Dr 1316 Instructions Form

What is the DR 1316 Instructions

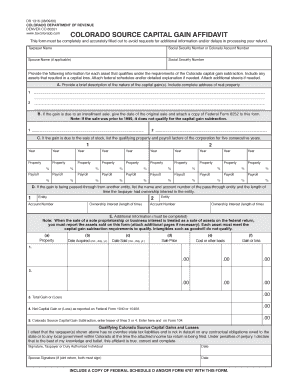

The DR 1316 instructions pertain to the Colorado source capital gain affidavit. This form is essential for individuals who need to report capital gains on property sales or other transactions within Colorado. The instructions provide detailed guidance on how to accurately complete the affidavit, ensuring compliance with state tax regulations. Understanding these instructions is crucial for taxpayers to avoid penalties and ensure that their filings are processed correctly.

Steps to Complete the DR 1316 Instructions

Completing the DR 1316 instructions involves several key steps:

- Gather necessary documents: Collect all relevant documents, including proof of the transaction and any supporting financial records.

- Fill out the form: Carefully complete each section of the DR 1316, ensuring that all information is accurate and complete.

- Review for accuracy: Double-check all entries for errors or omissions before submission.

- Submit the form: Follow the specified submission methods, whether online, by mail, or in person, to ensure timely processing.

Legal Use of the DR 1316 Instructions

The legal use of the DR 1316 instructions is governed by Colorado tax law. This affidavit must be completed accurately to ensure that the reported capital gains are recognized by the state. Failure to comply with the legal requirements can result in penalties or audits. It is important to adhere strictly to the guidelines provided in the instructions to maintain compliance and protect against legal issues.

Key Elements of the DR 1316 Instructions

Several key elements are essential when working with the DR 1316 instructions:

- Identification of the taxpayer: Accurate identification is crucial for processing.

- Details of the transaction: Clear documentation of the transaction, including dates and amounts, is necessary.

- Signature requirements: Proper signatures must be included to validate the affidavit.

- Submission guidelines: Follow the specific instructions for submitting the form to ensure it is accepted by the state.

Who Issues the Form

The DR 1316 form is issued by the Colorado Department of Revenue. This department is responsible for overseeing tax compliance and ensuring that all forms are correctly utilized by taxpayers. Understanding the issuing authority helps clarify the importance of adhering to the guidelines set forth in the DR 1316 instructions.

Required Documents

When completing the DR 1316 instructions, several documents are typically required:

- Proof of sale: Documentation that verifies the sale of the property or asset.

- Financial records: Any relevant financial statements that support the reported capital gains.

- Identification: A valid form of identification may be necessary to verify the taxpayer's identity.

Quick guide on how to complete dr 1316 instructions

Complete Dr 1316 Instructions seamlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any hold-ups. Handle Dr 1316 Instructions on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and eSign Dr 1316 Instructions effortlessly

- Locate Dr 1316 Instructions and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that aim.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Dr 1316 Instructions and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 1316 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Colorado source capital gain and how does it apply to my business?

Colorado source capital gain refers to the profits from the sale of assets that are sourced from Colorado. For businesses, understanding this concept is crucial for tax purposes and financial planning, especially if you are dealing with investments or asset sales. Properly managing these gains can signNowly affect your overall tax obligations.

-

How can airSlate SignNow help in managing documents related to Colorado source capital gain?

airSlate SignNow offers an efficient platform for managing documents that involve Colorado source capital gain. With features like eSigning and document storage, you can easily handle contracts, tax documents, and other paperwork without hassle. This streamlines your workflow and ensures that you remain compliant with local regulations.

-

Is there a cost to using airSlate SignNow for document transactions concerning Colorado source capital gain?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While the costs may vary depending on features and the number of users, it remains a cost-effective solution for managing document transactions related to Colorado source capital gain. You can choose a plan that best fits your volume of document handling.

-

What features does airSlate SignNow provide for handling Colorado source capital gain transactions?

airSlate SignNow provides several features tailored for handling Colorado source capital gain transactions, including customizable templates, automated workflows, and secure eSignature capabilities. These features simplify the document generation process, ensuring accuracy and compliance with state regulations. Additionally, you can track document status and receive notifications in real-time.

-

Can airSlate SignNow integrate with other software for managing Colorado source capital gain?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including CRM systems and accounting tools. This integration can help you manage your Colorado source capital gain documentation more effectively by automating processes and reducing data entry errors. This connection provides a holistic approach to your capital gain management.

-

What are the key benefits of using airSlate SignNow for Colorado source capital gain documentation?

The key benefits of using airSlate SignNow for Colorado source capital gain documentation include increased efficiency, enhanced security, and improved compliance. The platform allows for quick document processing and reduces the need for physical paperwork. Additionally, encrypted eSignatures provide a secure method for signing important financial documents.

-

How do I get started with airSlate SignNow for my Colorado source capital gain needs?

Getting started with airSlate SignNow for Colorado source capital gain needs is easy. Simply sign up on our website, choose a plan that suits your business, and begin exploring the features available. Our intuitive interface will guide you through the document creation and signing process in no time.

Get more for Dr 1316 Instructions

- Statement in lieu of actual receipts form

- Form for your transcript request skyline college skylinecollege

- Samples of retirement budgets form

- Aluminum glass order form fillable

- Maryland college investment plan distribution form

- Genworth required minimum distribution authorization form

- Wildomar building and safety form

- Notice to law enforcement agencies instructions form

Find out other Dr 1316 Instructions

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document