472s Form

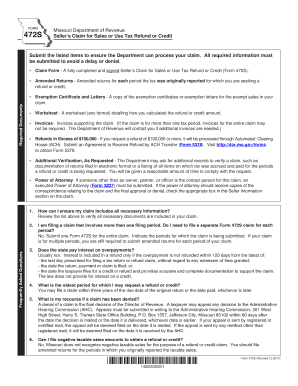

What is the 472s?

The 472s form, also known as the Missouri Form 472s, is a tax form used in the state of Missouri. It is primarily utilized by businesses and individuals to report certain tax-related information to the Missouri Department of Revenue. This form is essential for ensuring compliance with state tax regulations and is often required for various tax filings, including income tax returns and business tax obligations. Understanding the purpose and requirements of the 472s is crucial for accurate tax reporting and avoiding potential penalties.

How to use the 472s

Using the 472s form involves several key steps. First, ensure that you have the correct version of the form, as there may be updates or revisions. Next, gather all necessary information, including your business details, income, and any deductions or credits applicable to your situation. Carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission. Finally, submit the form according to the instructions provided, whether online, by mail, or in person.

Steps to complete the 472s

Completing the 472s form requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Obtain the latest version of the 472s form from the Missouri Department of Revenue website.

- Gather all relevant financial documents, including income statements and prior tax returns.

- Fill out the form, ensuring to include your name, address, and tax identification number.

- Report all income and applicable deductions accurately.

- Double-check all entries for errors or omissions.

- Submit the completed form by the designated deadline.

Legal use of the 472s

The legal use of the 472s form is governed by Missouri state tax laws. It is crucial to ensure that the form is filled out correctly and submitted on time to avoid penalties. The form must be signed and dated by the appropriate party, confirming that the information provided is accurate to the best of their knowledge. Failure to comply with the legal requirements associated with the 472s can result in fines or other legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the 472s form are critical to ensure compliance with Missouri tax regulations. Typically, the form must be submitted by the tax filing deadline, which coincides with the federal tax return due date. It is important to stay informed about any changes to these deadlines, as they can vary from year to year. Mark your calendar with important dates to avoid late submissions and potential penalties.

Required Documents

To complete the 472s form accurately, certain documents are required. These may include:

- Previous tax returns for reference.

- Income statements, such as W-2s or 1099s.

- Documentation for any deductions or credits claimed.

- Proof of business expenses, if applicable.

Having these documents readily available will facilitate a smoother filing process.

Quick guide on how to complete 472s

Easily Prepare 472s on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage 472s on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Simplest Way to Modify and eSign 472s Effortlessly

- Obtain 472s and click on Get Form to begin.

- Utilize our tools to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically available from airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Decide how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, tiresome document searches, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs with just a few clicks from any preferred device. Modify and eSign 472s while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 472s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 472s and how can airSlate SignNow help?

Form 472s is a document used for various business processes, and airSlate SignNow simplifies its management. With our platform, you can easily create, send, and eSign form 472s, ensuring efficient and secure transactions. This user-friendly tool streamlines workflows and saves time.

-

What features does airSlate SignNow offer for form 472s?

airSlate SignNow offers a range of features specifically tailored for form 472s, including customizable templates, bulk sending, and real-time status tracking. Our platform allows you to add fields for signatures, dates, and other necessary information, making the process seamless. This ensures that all stakeholders can easily complete and submit form 472s.

-

How much does it cost to use airSlate SignNow for form 472s?

airSlate SignNow provides flexible pricing plans suitable for businesses of all sizes to manage form 472s efficiently. We offer a free trial, so you can explore our features before committing. Our subscription plans are designed to be cost-effective while providing robust capabilities.

-

Can I integrate airSlate SignNow with other applications for form 472s?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your workflow with form 472s. You can connect with tools like Google Drive, Salesforce, and others to automate and streamline your document management process. This integration ensures you can handle form 472s from one centralized location.

-

Is it secure to use airSlate SignNow for form 472s?

Absolutely! airSlate SignNow prioritizes the security of your documents, including form 472s, by using top-notch encryption and compliance with industry standards. Our platform guarantees that your information remains confidential and protected throughout the signing process. Rest assured, your data is in safe hands.

-

What are the benefits of using airSlate SignNow for form 472s?

Using airSlate SignNow for form 472s offers multiple benefits, including improved efficiency, reduced turnaround times, and cost savings. Our platform's intuitive interface makes it easy to manage documents, ensuring quick access and processing. Furthermore, eSigning eliminates the need for paper, contributing to environmental sustainability.

-

Can I track the status of my form 472s with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your form 472s, allowing you to monitor document status at any time. You will receive notifications when recipients view or sign the document, keeping you informed throughout the process. This feature helps you stay organized and proactive.

Get more for 472s

- Imm 892es spanish form

- 20 essential tools for real estate investors form

- Midwest special needs trust form

- Inequality word problems worksheet form

- 2 uppgifter om anstllning form

- Interactive hud 1 settlement statement prestige title agency form

- Wws broward form

- Ttbizlink registration form a individual

Find out other 472s

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship