Gift Aid Form

What is the Gift Aid Form

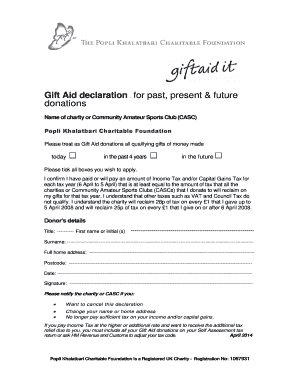

The gift aid form is a document used by U.S. taxpayers to allow charitable organizations to reclaim tax on donations made by them. This form enables organizations to maximize the value of donations, as they can claim back a percentage of the donation from the government. By completing this form, donors can ensure that their contributions have a greater impact, helping charities to fund their activities and support their missions.

How to use the Gift Aid Form

Using the gift aid form involves a few straightforward steps. First, donors must fill out the form with their personal information, including name, address, and taxpayer identification number. Next, they indicate the amount of their donation and confirm that they are a taxpayer. Once completed, the form should be submitted to the charity, which will use it to claim back the tax. It’s important for donors to keep a copy of the form for their records.

Steps to complete the Gift Aid Form

Completing the gift aid form requires careful attention to detail. Here are the essential steps:

- Provide your full name and address.

- Include your taxpayer identification number, such as your Social Security number.

- State the amount of your donation.

- Confirm that you are a taxpayer and eligible to make the claim.

- Sign and date the form to validate it.

After filling out the form, ensure it is submitted according to the charity's instructions, either online or by mail.

Legal use of the Gift Aid Form

The legal use of the gift aid form is governed by specific regulations that ensure compliance with tax laws. For the form to be valid, donors must confirm that they have paid enough tax to cover the amount that the charity will reclaim. This is crucial, as charities are only allowed to reclaim tax on donations made by individuals who have paid sufficient tax. Misuse or incorrect completion of the form can lead to penalties for both the donor and the organization.

Key elements of the Gift Aid Form

Several key elements must be included in the gift aid form to ensure its validity. These include:

- Donor's full name and address.

- Taxpayer identification number.

- Details of the donation amount.

- Confirmation of taxpayer status.

- Signature and date.

Each of these elements plays a critical role in the form's acceptance by the charity and the tax authorities.

Eligibility Criteria

To be eligible to use the gift aid form, donors must meet specific criteria. They must be individuals who pay income tax or capital gains tax in the United States. The total amount of tax paid must be at least equal to the amount the charity will reclaim on the donations. Additionally, donors must not receive any benefit in return for their contributions, as this could invalidate the claim.

Quick guide on how to complete gift aid form 79242861

Complete Gift Aid Form seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Gift Aid Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The most efficient way to edit and eSign Gift Aid Form effortlessly

- Locate Gift Aid Form and then click Get Form to begin.

- Utilize the features we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or mishandled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Modify and eSign Gift Aid Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gift aid form 79242861

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a gift aid form and why is it important?

A gift aid form is a document that allows UK charities to claim back tax on donations made by individuals. This means that for every £1 you donate, the charity can claim an extra 25p from the government, maximizing your contribution without additional cost to you. Understanding the importance of a gift aid form helps charities increase their funding efficiently.

-

How can I create a gift aid form with airSlate SignNow?

Creating a gift aid form with airSlate SignNow is simple. You can start by selecting a template or customizing your own document using our user-friendly editor. Once your gift aid form is ready, you can easily send it out for electronic signatures, streamlining your donation process.

-

Is there a cost associated with using airSlate SignNow for gift aid forms?

airSlate SignNow offers a cost-effective solution for managing gift aid forms. Pricing plans vary based on features and the number of users, but the platform is designed to accommodate various budgets. Investing in this service can lead to increased efficiency in processing donations and enhancing donor engagement.

-

What features does airSlate SignNow offer for processing gift aid forms?

airSlate SignNow provides features like customizable templates, secure electronic signatures, and the ability to track document status. These features make it easy for charities to manage gift aid forms and ensure that all necessary information is collected efficiently. This enhances the overall donation experience for both organizations and donors.

-

Can I integrate airSlate SignNow with other donation platforms for gift aid forms?

Yes, airSlate SignNow can integrate with various donation platforms and CRM systems. This allows for seamless data sharing and management of gift aid forms. By integrating these tools, charities can automate workflows and improve the efficiency of their fundraising efforts.

-

How secure are the gift aid forms created with airSlate SignNow?

Security is a top priority for airSlate SignNow. All gift aid forms you create are protected with encryption and safe data storage. Additionally, the platform complies with industry standards to ensure that sensitive information contained in gift aid forms remains confidential and secure.

-

What benefits can charities expect from using digital gift aid forms?

Using digital gift aid forms offers numerous benefits for charities, including reduced paperwork, faster processing times, and enhanced accuracy in data collection. With airSlate SignNow, charities can also streamline the signing process for donors, encouraging more contributions while maximizing the potential for Gift Aid claims.

Get more for Gift Aid Form

Find out other Gift Aid Form

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple