De1p Form

What is the De1p

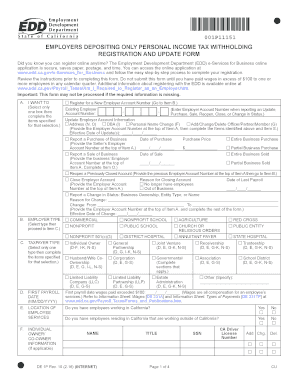

The De1p form is a crucial document used primarily in California for reporting specific employment-related information to the Employment Development Department (EDD). This form is essential for individuals who are applying for unemployment benefits, disability insurance, or paid family leave. It serves to collect necessary data that helps determine eligibility for these benefits. Understanding the purpose and requirements of the De1p is vital for applicants to ensure they provide accurate information, which can influence the outcome of their claims.

How to use the De1p

Using the De1p form involves several straightforward steps. First, gather all required personal and employment information, including Social Security numbers, employment history, and details about your claim. Next, access the form through the EDD website or a trusted digital platform like signNow. Once you have the form, fill it out carefully, ensuring all information is accurate and complete. After completing the form, you can submit it electronically or print it for mailing, depending on your preference and the submission guidelines provided by the EDD.

Steps to complete the De1p

Completing the De1p form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Step 1: Download the form from the EDD website or access it through a digital signing platform.

- Step 2: Fill in your personal information, including your name, address, and Social Security number.

- Step 3: Provide detailed employment history, including dates of employment and job titles.

- Step 4: Review the form for accuracy and completeness.

- Step 5: Submit the form electronically or print it for mailing, following the EDD's submission guidelines.

Legal use of the De1p

The legal use of the De1p form is governed by various regulations that ensure its validity in the context of employment and benefits. To be considered legally binding, the form must be filled out accurately and submitted in accordance with EDD guidelines. Additionally, electronic submissions must comply with the ESIGN Act, which recognizes electronic signatures as valid. Using a trusted platform like signNow can help ensure that the electronic submission meets all legal requirements, providing a secure and compliant way to handle your documents.

Key elements of the De1p

Several key elements are essential to the De1p form, which include:

- Personal Information: Full name, address, and Social Security number.

- Employment History: Details of previous employers, job titles, and dates of employment.

- Claim Information: Specific details regarding the type of benefits being applied for.

- Signature: A signature or electronic signature confirming the accuracy of the information provided.

Who Issues the Form

The De1p form is issued by the California Employment Development Department (EDD). This state agency is responsible for administering unemployment insurance, disability insurance, and paid family leave programs. The EDD provides the necessary resources and guidelines for individuals to properly complete and submit the De1p form, ensuring that applicants understand their rights and responsibilities in the benefits application process.

Quick guide on how to complete de1p

Prepare De1p effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to obtain the suitable form and safely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly without delays. Handle De1p on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign De1p with ease

- Locate De1p and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your edits.

- Choose how you wish to share your form, either via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Adjust and eSign De1p and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the de1p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is de1p in airSlate SignNow?

De1p is a comprehensive feature within airSlate SignNow that streamlines the document signing process. It allows users to easily create, send, and manage documents for eSigning, ensuring a more efficient workflow tailored for businesses of all sizes.

-

How much does airSlate SignNow's de1p cost?

The pricing for airSlate SignNow's de1p feature is designed to be cost-effective for all users. There are various subscription plans available that scale with your business needs, making it easy to choose a plan that fits your budget.

-

What are the main features of de1p?

De1p in airSlate SignNow offers functionalities such as document templates, automated reminders, and real-time tracking of the signing process. These features enhance the user experience by minimizing delays and improving overall productivity.

-

Can I integrate de1p with other software?

Yes, airSlate SignNow's de1p is designed for seamless integration with various third-party applications. This flexibility allows businesses to incorporate de1p into their existing workflows, enhancing efficiency and user satisfaction.

-

What benefits does de1p provide for businesses?

Using de1p in airSlate SignNow helps businesses save time and reduce paper usage. Its digital solutions not only streamline processes but also improve compliance and security, making it a transformative tool for business operations.

-

Is de1p secure for sensitive documents?

Absolutely, de1p in airSlate SignNow ensures top-notch security for all your documents. With advanced encryption and compliance with industry standards, your sensitive information is protected throughout the signing process.

-

How user-friendly is de1p for new users?

De1p is designed with an intuitive interface that makes it easy for new users to adopt airSlate SignNow swiftly. The platform offers tutorials and customer support, ensuring that everyone can efficiently utilize its features right from the start.

Get more for De1p

- Obrazec za povrailo vinjete form

- Indian river county tourist development tax return clerk indian river form

- Return form bavarian autosport

- Mediation request form fcps

- Kentucky department for public health instructions for the chfs ky form

- Kyc form askari investment management limited

- Medical information and liability release form thi

- Attn account services dept form

Find out other De1p

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation