Nj Form O 71

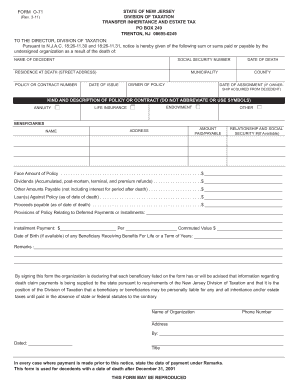

What is the NJ Form O 71

The NJ Form O 71, also known as the New Jersey Form O 71, is a document used primarily for tax purposes within the state of New Jersey. This form is essential for individuals and businesses to report specific financial information to the state tax authorities. Understanding the purpose and requirements of the NJ Form O 71 is crucial for compliance with state regulations and ensuring accurate tax filings.

How to Use the NJ Form O 71

Using the NJ Form O 71 involves several key steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements and expense reports. Next, carefully fill out the form, ensuring that all sections are completed with accurate data. After completing the form, review it for any errors or omissions before submission. This attention to detail helps avoid potential issues with state tax authorities.

Steps to Complete the NJ Form O 71

Completing the NJ Form O 71 requires a systematic approach:

- Collect all necessary financial documents, such as W-2s, 1099s, and other income records.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income and any deductions accurately in the designated sections.

- Double-check all entries for accuracy and completeness.

- Sign and date the form to validate your submission.

Legal Use of the NJ Form O 71

The NJ Form O 71 is legally binding when filled out correctly and submitted in accordance with state laws. It is important to understand that providing false information or failing to submit the form can lead to penalties. Compliance with the legal requirements surrounding this form ensures that individuals and businesses meet their tax obligations and avoid legal repercussions.

Key Elements of the NJ Form O 71

Several key elements must be included in the NJ Form O 71 to ensure its validity:

- Personal Information: Accurate identification details of the filer.

- Income Reporting: Detailed reporting of all sources of income.

- Deductions: Any applicable deductions that reduce taxable income.

- Signature: The form must be signed and dated by the filer to confirm its authenticity.

Form Submission Methods

The NJ Form O 71 can be submitted through various methods, allowing flexibility for filers. Options include:

- Online Submission: Many users prefer to file electronically through the New Jersey Division of Taxation's online portal.

- Mail: The completed form can be printed and mailed to the appropriate tax office.

- In-Person: Filers may also choose to submit the form in person at designated tax offices.

Quick guide on how to complete nj form o 71

Effortlessly Prepare Nj Form O 71 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a superb environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Nj Form O 71 on any device with the airSlate SignNow Android or iOS applications and simplify any document-focused task today.

Efficiently Edit and Electronically Sign Nj Form O 71 with Ease

- Locate Nj Form O 71 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize essential sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you wish to distribute your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Nj Form O 71 to guarantee outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj form o 71

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nj form o 71 and how can airSlate SignNow help?

The nj form o 71 is a form used for specific document submissions in New Jersey. With airSlate SignNow, you can easily fill, sign, and send the nj form o 71 electronically, streamlining your paperwork and reducing physical document handling.

-

What features does airSlate SignNow offer for completing the nj form o 71?

airSlate SignNow provides features such as customizable templates, electronic signatures, and secure document storage that simplify the process of completing the nj form o 71. These tools ensure you can fill out necessary details accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for the nj form o 71?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, making it a cost-effective solution for managing the nj form o 71. You can choose a plan that suits your document handling volume and business requirements.

-

Can I integrate airSlate SignNow with other applications for processing the nj form o 71?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and Salesforce, allowing you to streamline your workflow when managing the nj form o 71. This enhances efficiency by connecting your favorite tools.

-

How secure is the electronic signing process for the nj form o 71 on airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform encrypts your data and complies with industry standards, ensuring that your nj form o 71 and other documents are safe during transmission and storage.

-

Can I track the status of my nj form o 71 after sending it with airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your nj form o 71. You will receive notifications when the document is viewed and completed, providing you with peace of mind and transparency.

-

What benefits does airSlate SignNow provide for businesses using the nj form o 71?

Using airSlate SignNow for the nj form o 71 benefits businesses by speeding up the document signing process, reducing paper usage, and minimizing delays. This leads to improved productivity and efficiency in your operations.

Get more for Nj Form O 71

- Truckers occupational acident application form

- Proof of school dental examination form

- Arrowhead credit union direct deposit form

- It 711 partnership income tax general instructions form

- 10 3567 state home inspection staffing profile form

- Sponsor name rank form

- This is a web optimized version of this form down

- Bus stop observation form pupil transportation safety institute

Find out other Nj Form O 71

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation