AV 9 Department of Revenue Form

What is the AV 9 Department Of Revenue

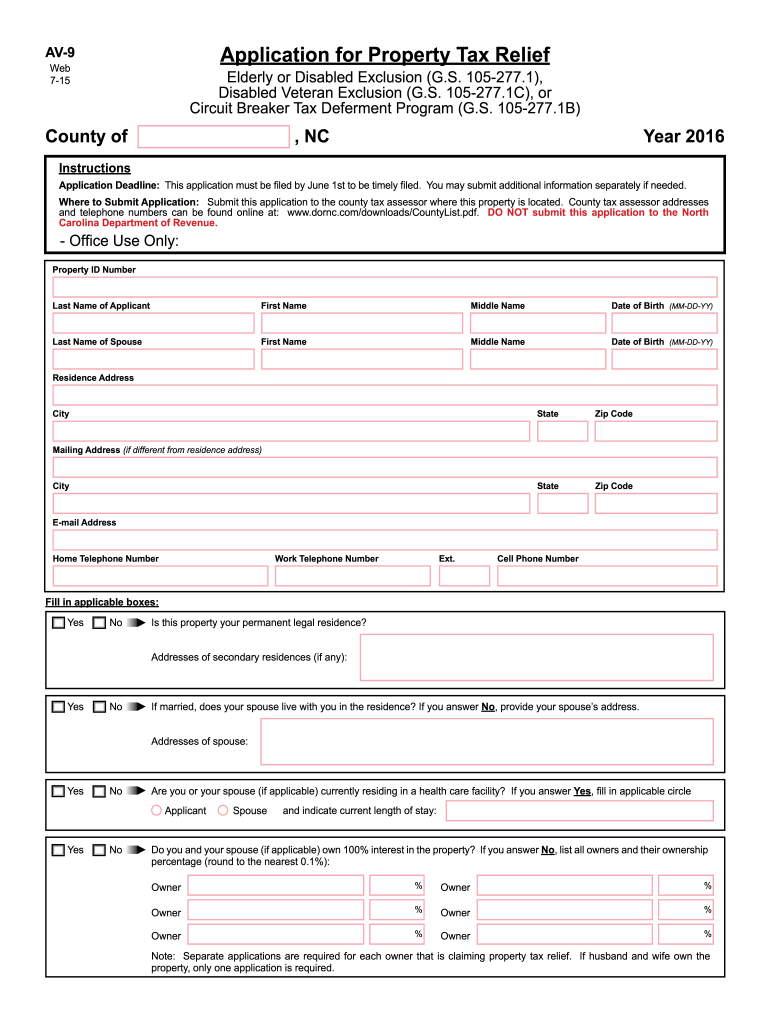

The AV 9 Department Of Revenue form is a crucial document used for various tax-related purposes within the United States. This form is typically associated with property tax assessments and is utilized by taxpayers to report changes in property ownership, value, or use. Understanding the AV 9 form is essential for ensuring compliance with state tax regulations and for accurately reporting property-related information to the appropriate revenue department.

Steps to complete the AV 9 Department Of Revenue

Completing the AV 9 Department Of Revenue form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information regarding the property, including its current value, ownership details, and any relevant changes since the last assessment. Once you have this information, follow these steps:

- Fill out the form with accurate details about the property.

- Provide any supporting documentation that may be required, such as previous assessment notices or proof of ownership.

- Review the completed form for accuracy to avoid potential penalties.

- Submit the form by the specified deadline, ensuring it reaches the appropriate department.

Legal use of the AV 9 Department Of Revenue

The AV 9 Department Of Revenue form is legally binding when completed and submitted according to state regulations. It serves as an official declaration of property-related information and must be filled out truthfully. Misrepresentation or failure to file can lead to penalties, including fines or increased assessments. It is important to understand the legal implications of this form to maintain compliance with property tax laws.

Form Submission Methods

The AV 9 Department Of Revenue form can typically be submitted through various methods, ensuring convenience for taxpayers. Common submission options include:

- Online: Many states offer an online portal for submitting the AV 9 form, allowing for quick and efficient processing.

- Mail: Taxpayers can print the completed form and send it via postal service to the appropriate revenue department.

- In-Person: Some taxpayers may prefer to deliver the form in person at their local revenue office, where they can receive immediate assistance if needed.

Required Documents

When completing the AV 9 Department Of Revenue form, certain documents may be required to support the information provided. These documents can include:

- Proof of property ownership, such as a deed or title.

- Previous property tax assessments or notices.

- Any relevant documentation that supports changes in property value or use.

Eligibility Criteria

Eligibility to use the AV 9 Department Of Revenue form typically depends on the ownership and type of property being reported. Generally, property owners, including individuals and businesses, can file this form to report changes affecting their property assessments. It is important to verify specific eligibility criteria set by the state’s revenue department, as these can vary by jurisdiction.

Quick guide on how to complete av 9 department of revenue

Effortlessly Prepare AV 9 Department Of Revenue on Any Device

Managing documents online has gained immense popularity among both businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed materials, as you can easily access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to swiftly create, modify, and electronically sign your documents without any delays. Handle AV 9 Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign AV 9 Department Of Revenue with Ease

- Locate AV 9 Department Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Adjust and electronically sign AV 9 Department Of Revenue to guarantee excellent communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the av 9 department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is AV 9 Department Of Revenue, and how can airSlate SignNow assist with it?

AV 9 Department Of Revenue is a form used for reporting property tax assessments. airSlate SignNow provides an efficient way to complete, send, and eSign your AV 9 documents, ensuring faster submission and compliance with the department's requirements.

-

How does pricing work for airSlate SignNow in relation to AV 9 Department Of Revenue forms?

The pricing for airSlate SignNow is designed to be cost-effective, allowing you to manage documents like the AV 9 Department Of Revenue form without breaking the bank. We offer different plans tailored for businesses of all sizes, ensuring you get the features you need at a competitive price.

-

What features of airSlate SignNow are beneficial for handling AV 9 Department Of Revenue documents?

airSlate SignNow includes features such as template creation, bulk sending, and secure eSigning that streamline the process of managing AV 9 Department Of Revenue forms. These tools help ensure accuracy and speed, allowing timely submissions to the department.

-

Can I integrate airSlate SignNow with other applications to manage my AV 9 Department Of Revenue submissions better?

Yes, airSlate SignNow offers integrations with various applications, including CRM systems and project management tools. This allows you to seamlessly manage your AV 9 Department Of Revenue submissions and keep all related operations in one place.

-

How secure is airSlate SignNow when dealing with sensitive AV 9 Department Of Revenue documents?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards, ensuring your AV 9 Department Of Revenue documents are protected. You can trust that your sensitive information remains confidential and secure throughout the eSigning process.

-

What benefits do I gain by using airSlate SignNow for my AV 9 Department Of Revenue paperwork?

Using airSlate SignNow for your AV 9 Department Of Revenue paperwork enhances efficiency, reduces processing time, and improves accuracy. The platform simplifies document management, allowing you to focus on your core business activities.

-

Is there customer support available for issues related to AV 9 Department Of Revenue forms on airSlate SignNow?

Absolutely! airSlate SignNow offers robust customer support to assist you with any questions or issues related to your AV 9 Department Of Revenue documents. Our team is dedicated to providing timely help to ensure your experience is smooth and satisfactory.

Get more for AV 9 Department Of Revenue

- Bmcc affidavit of support form

- Printable certificate for alarm form

- Last will and testament florida form

- Vt78 application for nominated tester training vt78 application for nominated tester training form

- Apply for mmc form

- Request for personnel action brigham young universityhawaii form

- Application for physical therapy california state university long csulb form

- Utd degree plans form

Find out other AV 9 Department Of Revenue

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement