Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs

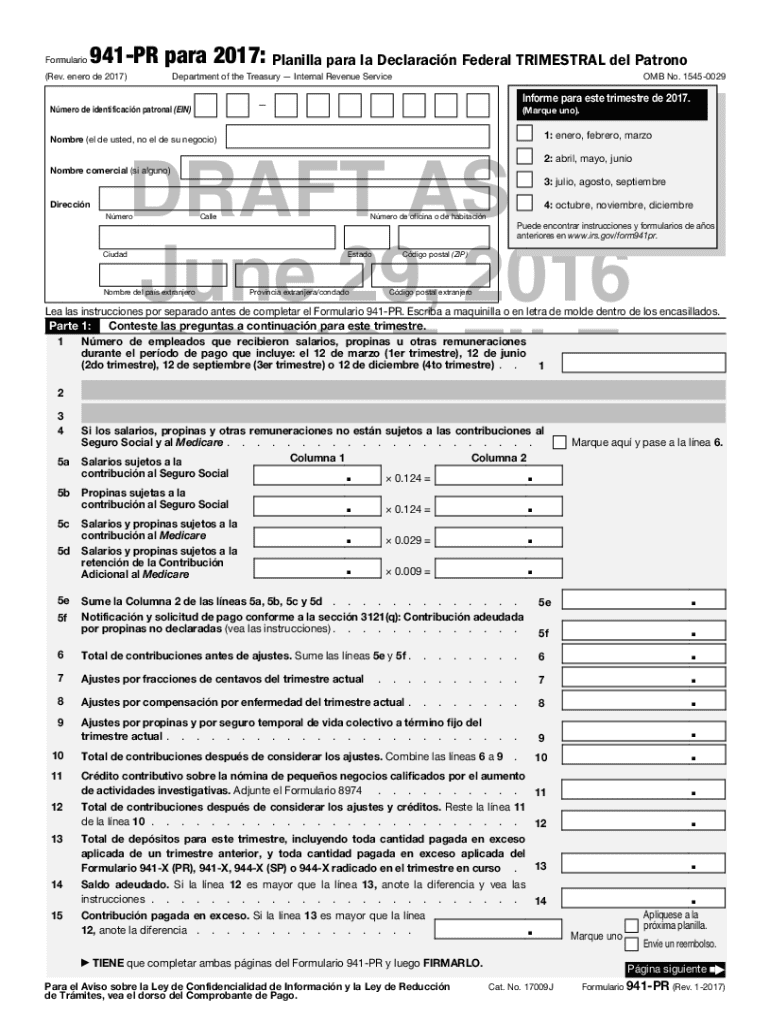

What is the Form 941 PR Rev January?

The Form 941 PR Rev January is the Employer's Quarterly Federal Tax Return specifically designed for employers in Puerto Rico. This form is essential for reporting income taxes withheld from employee wages, as well as the employer's and employee's share of Social Security and Medicare taxes. It is crucial for compliance with federal tax regulations and ensures that employers fulfill their tax obligations accurately.

Steps to Complete the Form 941 PR Rev January

Completing the Form 941 PR Rev January involves several key steps:

- Gather Required Information: Collect employee wage data, tax withholding amounts, and any adjustments for the quarter.

- Fill Out the Form: Enter the necessary information in the designated fields, ensuring accuracy to avoid penalties.

- Calculate Taxes: Determine the total taxes owed based on the wages and withholdings reported.

- Review for Errors: Double-check all entries for accuracy before submission.

- Submit the Form: File the completed form by the deadline, either electronically or by mail.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the Form 941 PR Rev January. Generally, the form is due on the last day of the month following the end of each quarter. For example, for the first quarter (January to March), the due date is April 30. Timely submission is essential to avoid penalties and interest on late payments.

Form Submission Methods

The Form 941 PR Rev January can be submitted through various methods:

- Online: Many employers choose to file electronically through authorized e-file providers, which can streamline the process and reduce errors.

- Mail: Employers can also print the form and mail it to the appropriate IRS address for submission.

- In-Person: Some employers may opt to deliver the form directly to their local IRS office.

Penalties for Non-Compliance

Failure to file the Form 941 PR Rev January on time or inaccuracies in reporting can lead to significant penalties. The IRS may impose fines based on the amount of tax owed and the duration of the delay. It is essential for employers to understand these penalties to ensure compliance and avoid unnecessary financial burdens.

Legal Use of the Form 941 PR Rev January

The Form 941 PR Rev January is legally binding when completed accurately and submitted on time. Employers must ensure that all information is truthful and complies with IRS regulations. This form serves as a critical document in maintaining compliance with federal tax laws, and any fraudulent information can lead to severe consequences.

Quick guide on how to complete form 941 pr rev january 2017 employers quarterly federal tax return puerto rican version ftp irs

Effortlessly prepare Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs on any device

The management of online documents has gained traction among companies and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs on any device using the airSlate SignNow Android or iOS applications and streamline any document-focused process today.

The easiest way to modify and electronically sign Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs effortlessly

- Locate Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 941 pr rev january 2017 employers quarterly federal tax return puerto rican version ftp irs

How to make an electronic signature for your Form 941 Pr Rev January 2017 Employers Quarterly Federal Tax Return Puerto Rican Version Ftp Irs in the online mode

How to generate an eSignature for your Form 941 Pr Rev January 2017 Employers Quarterly Federal Tax Return Puerto Rican Version Ftp Irs in Google Chrome

How to create an electronic signature for signing the Form 941 Pr Rev January 2017 Employers Quarterly Federal Tax Return Puerto Rican Version Ftp Irs in Gmail

How to make an eSignature for the Form 941 Pr Rev January 2017 Employers Quarterly Federal Tax Return Puerto Rican Version Ftp Irs right from your mobile device

How to create an electronic signature for the Form 941 Pr Rev January 2017 Employers Quarterly Federal Tax Return Puerto Rican Version Ftp Irs on iOS devices

How to create an electronic signature for the Form 941 Pr Rev January 2017 Employers Quarterly Federal Tax Return Puerto Rican Version Ftp Irs on Android

People also ask

-

What is the Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs?

The Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs is a tax form specifically designed for employers in Puerto Rico to report their quarterly federal tax liabilities. This version is tailored to meet the unique tax requirements of Puerto Rican employers, ensuring compliance with IRS regulations. Using the correct form helps businesses avoid penalties and streamline their tax reporting process.

-

How can airSlate SignNow help me with the Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs?

airSlate SignNow simplifies the process of completing and eSigning the Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs. Our intuitive platform allows you to easily fill out the form, gather necessary signatures, and submit it electronically. This not only saves time but also enhances accuracy and compliance with IRS standards.

-

Is there a cost associated with using airSlate SignNow for the Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs when handling the Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs. Our plans include features like unlimited document signing, advanced templates, and integrations, providing great value for businesses looking to streamline their tax processes. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs?

airSlate SignNow provides a range of features to assist with the Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs. Key features include customizable templates, secure cloud storage, real-time tracking of document status, and integration with other business tools. These features enhance efficiency and ensure that your tax documents are managed effectively.

-

Can I integrate airSlate SignNow with other software for handling the Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and business management software, making it easier to handle the Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs. Whether you use popular platforms like QuickBooks or other payroll systems, our integrations help streamline your workflows and keep your documents organized.

-

What benefits will I gain by using airSlate SignNow for the Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs?

Using airSlate SignNow for the Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs provides signNow benefits, including time savings, reduced paperwork, and improved compliance. Our platform ensures that your tax documents are completed accurately and filed on time, minimizing the risk of errors and penalties. Additionally, the eSigning feature speeds up the approval process, helping you stay organized.

-

Is airSlate SignNow secure for submitting the Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs?

Yes, airSlate SignNow prioritizes security, especially when it comes to sensitive documents like the Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs. Our platform uses advanced encryption and security protocols to protect your information during transmission and storage. You can confidently submit your tax documents knowing they are safeguarded.

Get more for Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs

Find out other Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto Rican Version Ftp Irs

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple