Ftb Head of Household Audit Letter Form

What is the FTB Head of Household Audit Letter

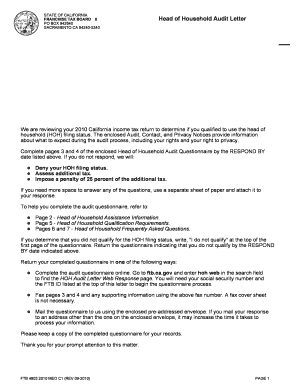

The FTB Head of Household Audit Letter is a formal communication issued by the State of California Franchise Tax Board (FTB). It typically indicates that the FTB is reviewing a taxpayer's claim for head of household status. This letter may request additional documentation or clarification regarding the taxpayer's eligibility for this filing status, which can significantly affect tax liabilities and potential refunds.

Key Elements of the FTB Head of Household Audit Letter

An FTB Head of Household Audit Letter generally includes several critical components:

- Taxpayer Information: This section identifies the taxpayer, including their name, address, and taxpayer identification number.

- Reason for Audit: The letter outlines the specific reasons for the audit, often related to discrepancies in the head of household claim.

- Requested Documentation: The FTB will specify the documents required to support the head of household status, such as proof of residency and dependent information.

- Response Instructions: Clear guidelines on how to respond to the letter, including deadlines and acceptable methods of submission.

Steps to Complete the FTB Head of Household Audit Letter

To effectively address the FTB Head of Household Audit Letter, taxpayers should follow these steps:

- Review the Letter: Understand the details and requirements outlined in the letter.

- Gather Documentation: Collect all necessary documents that validate your head of household status.

- Prepare a Response: Draft a response letter addressing the FTB's concerns and include copies of the requested documents.

- Submit Your Response: Send your response by the specified deadline using the recommended submission method, whether online, by mail, or in person.

Legal Use of the FTB Head of Household Audit Letter

The FTB Head of Household Audit Letter serves as a legal document in the context of tax compliance. Taxpayers are legally obligated to respond to the letter and provide the requested information. Failure to do so can lead to penalties, adjustments to tax returns, or denial of the head of household status, which may result in increased tax liability. It is crucial to understand that the information provided in response to the letter must be accurate and complete to maintain compliance with California tax laws.

Form Submission Methods

Taxpayers can submit their responses to the FTB Head of Household Audit Letter through various methods:

- Online Submission: Using the FTB’s online portal, if available, allows for quick and secure document submission.

- Mail: Taxpayers can send their responses via postal mail, ensuring that they keep copies of all documents for their records.

- In-Person: For those who prefer face-to-face interactions, visiting a local FTB office is an option, though it may require an appointment.

Required Documents

When responding to the FTB Head of Household Audit Letter, taxpayers should be prepared to provide several key documents, including:

- Proof of Residency: Documents such as utility bills, lease agreements, or mortgage statements that confirm the taxpayer's primary residence.

- Dependent Information: Birth certificates or legal documents that verify the taxpayer's claim of dependents.

- Income Documentation: Pay stubs or tax returns that support the taxpayer's financial situation.

Quick guide on how to complete ftb head of household audit letter

Complete Ftb Head Of Household Audit Letter effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools essential to create, modify, and eSign your documents quickly and without delays. Manage Ftb Head Of Household Audit Letter on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Ftb Head Of Household Audit Letter seamlessly

- Obtain Ftb Head Of Household Audit Letter and then select Get Form to initiate.

- Make use of the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Form your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your updates.

- Select how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Ftb Head Of Household Audit Letter and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb head of household audit letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a state of California franchise tax board letter?

A state of California franchise tax board letter is a formal correspondence sent by the California Franchise Tax Board (FTB) regarding tax obligations. This letter may include information about your business's tax filings, payment deadlines, or any discrepancies that need to be addressed. Understanding this letter is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help me manage state of California franchise tax board letters?

airSlate SignNow provides an efficient way to send and eSign documents, including important state of California franchise tax board letters. By streamlining the signing process, businesses can ensure timely responses and maintain compliance with tax regulations. This helps in managing correspondence effectively and securely.

-

Are there any costs associated with receiving a state of California franchise tax board letter?

Generally, there are no costs to receive a state of California franchise tax board letter, as it is a form of official communication from the FTB. However, responding to issues or penalties mentioned in the letter may incur costs, particularly if legal or accounting assistance is needed for clarification. It's essential to review the letter thoroughly and act timely.

-

What features does airSlate SignNow offer for dealing with state of California franchise tax board letters?

airSlate SignNow offers features such as electronic signatures, document templates, and an organized dashboard to manage your documents, including state of California franchise tax board letters. The platform ensures that documents are securely signed and stored, making it easier to retrieve and track your correspondence with the FTB.

-

Can I integrate airSlate SignNow with accounting software to handle state of California franchise tax board letters?

Yes, airSlate SignNow can easily integrate with various accounting software to help manage state of California franchise tax board letters. This integration allows users to streamline document sharing and ensure that financial records are updated promptly. Linking these platforms eliminates the hassle of manual data entry and enhances overall efficiency.

-

What benefits does airSlate SignNow provide for businesses dealing with state of California franchise tax board letters?

Using airSlate SignNow for handling state of California franchise tax board letters can signNowly reduce turnaround times for document signing and submissions. The platform is user-friendly and cost-effective, making it accessible for businesses of all sizes. Additionally, it helps maintain compliance with tax regulations by ensuring timely responses.

-

How secure is the airSlate SignNow platform for sending state of California franchise tax board letters?

The airSlate SignNow platform prioritizes security, utilizing encryption and compliance with industry standards to protect sensitive documents, including state of California franchise tax board letters. This ensures that your correspondence with the FTB remains confidential and secure from unauthorized access. User data is also protected to maintain trust and integrity.

Get more for Ftb Head Of Household Audit Letter

Find out other Ftb Head Of Household Audit Letter

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form