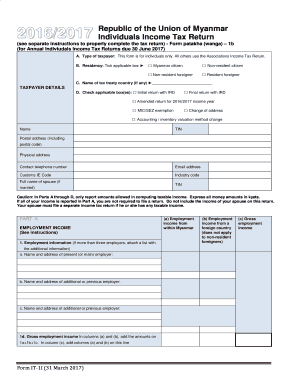

Republic of the Union of Myanmar Individuals Income Tax Return IRD Form

What is the Republic Of The Union Of Myanmar Individuals Income Tax Return IRD

The Republic Of The Union Of Myanmar Individuals Income Tax Return IRD is a formal document used by residents of Myanmar to report their income and calculate their tax obligations. This return is essential for ensuring compliance with Myanmar's tax laws and regulations. It encompasses various sources of income, including salaries, business profits, and other earnings. Individuals must accurately complete this return to determine their tax liabilities and any potential refunds.

Steps to complete the Republic Of The Union Of Myanmar Individuals Income Tax Return IRD

Completing the Republic Of The Union Of Myanmar Individuals Income Tax Return IRD involves several key steps:

- Gather all necessary financial documents, including income statements, receipts, and previous tax returns.

- Identify all sources of income to be reported on the return.

- Complete the form by entering personal information and income details accurately.

- Calculate the total tax liability based on the provided income and applicable deductions.

- Review the completed return for accuracy and completeness.

- Submit the return by the designated deadline to avoid penalties.

How to obtain the Republic Of The Union Of Myanmar Individuals Income Tax Return IRD

The Republic Of The Union Of Myanmar Individuals Income Tax Return IRD can be obtained through several channels. Individuals may visit the official website of the Internal Revenue Department (IRD) of Myanmar to download the form. Additionally, physical copies are often available at local tax offices. It is advisable to ensure that you are using the most current version of the form to comply with the latest tax regulations.

Required Documents

To successfully complete the Republic Of The Union Of Myanmar Individuals Income Tax Return IRD, individuals must prepare several documents:

- Income statements from employers or businesses.

- Bank statements reflecting interest and dividends.

- Receipts for deductible expenses, such as medical or educational costs.

- Previous year’s tax return for reference.

Filing Deadlines / Important Dates

Filing deadlines for the Republic Of The Union Of Myanmar Individuals Income Tax Return IRD are critical to avoid penalties. Typically, the tax return must be submitted by the end of March following the end of the tax year. It is important for individuals to stay informed about any changes to these dates, as they can vary annually or due to specific circumstances.

Penalties for Non-Compliance

Failure to file the Republic Of The Union Of Myanmar Individuals Income Tax Return IRD by the deadline can result in significant penalties. These may include fines based on the amount of tax owed and interest on unpaid taxes. Additionally, repeated non-compliance can lead to more severe consequences, including legal action or restrictions on financial activities.

Quick guide on how to complete republic of the union of myanmar individuals income tax return ird

Effortlessly prepare Republic Of The Union Of Myanmar Individuals Income Tax Return IRD on any device

The management of documents online has gained popularity among both companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you require to create, alter, and eSign your documents quickly without hindrances. Manage Republic Of The Union Of Myanmar Individuals Income Tax Return IRD on any platform using airSlate SignNow apps for Android or iOS and streamline any document-centric process today.

How to modify and eSign Republic Of The Union Of Myanmar Individuals Income Tax Return IRD easily

- Locate Republic Of The Union Of Myanmar Individuals Income Tax Return IRD and click on Get Form to begin.

- Employ the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Alter and eSign Republic Of The Union Of Myanmar Individuals Income Tax Return IRD to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the republic of the union of myanmar individuals income tax return ird

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Republic Of The Union Of Myanmar Individuals Income Tax Return IRD?

The Republic Of The Union Of Myanmar Individuals Income Tax Return IRD is the official document that individuals must file to report their earnings and determine their tax liabilities in Myanmar. It's essential for complying with local tax regulations and avoiding penalties. Properly filing this return ensures you remain in good standing with the IRD.

-

How can airSlate SignNow assist in filing the Republic Of The Union Of Myanmar Individuals Income Tax Return IRD?

airSlate SignNow simplifies the process by allowing users to electronically sign and send their Republic Of The Union Of Myanmar Individuals Income Tax Return IRD documents securely. With our platform, you can easily manage, track, and store your tax documents, making compliance easier and more efficient.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for managing your Republic Of The Union Of Myanmar Individuals Income Tax Return IRD offers numerous benefits, including enhanced security, faster processing times, and improved organization of important documents. Our solution allows you to streamline the signing process, reducing time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for the Republic Of The Union Of Myanmar Individuals Income Tax Return IRD?

Yes, airSlate SignNow offers cost-effective pricing plans tailored to businesses and individuals who need to manage various documents, including the Republic Of The Union Of Myanmar Individuals Income Tax Return IRD. We provide a variety of subscription options to meet your specific needs, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other accounting software for tax purposes?

Absolutely! airSlate SignNow can be integrated with popular accounting software, making it easy to manage your Republic Of The Union Of Myanmar Individuals Income Tax Return IRD alongside your financial records. These integrations streamline your workflow, enabling seamless data transfer and improved accuracy.

-

What features does airSlate SignNow offer that would help with tax filing?

airSlate SignNow offers several features that facilitate the tax filing process, including customizable templates for the Republic Of The Union Of Myanmar Individuals Income Tax Return IRD, automated reminders, and in-app communication tools. These features help ensure timely submissions and enhance collaboration among stakeholders.

-

How secure is airSlate SignNow for handling tax documents like the Republic Of The Union Of Myanmar Individuals Income Tax Return IRD?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your sensitive information, such as your Republic Of The Union Of Myanmar Individuals Income Tax Return IRD documents. Our platform complies with international security standards, ensuring your data is safe.

Get more for Republic Of The Union Of Myanmar Individuals Income Tax Return IRD

- Sample written warning letters including employee policies form

- Request a default judgment by court homesaclaworg form

- Board of directors resolution changing officers salaries form

- License agreement allowing search on property for antique bottles form

- State v davis 1954 supreme court of appeals of west form

- Sample memorandum of agreement montana form

- United states of america plaintiff appellee v brian form

- Howerton v tri state salvage no 29640 form

Find out other Republic Of The Union Of Myanmar Individuals Income Tax Return IRD

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy