Dr 841 2015-2026

What is the Dr 841

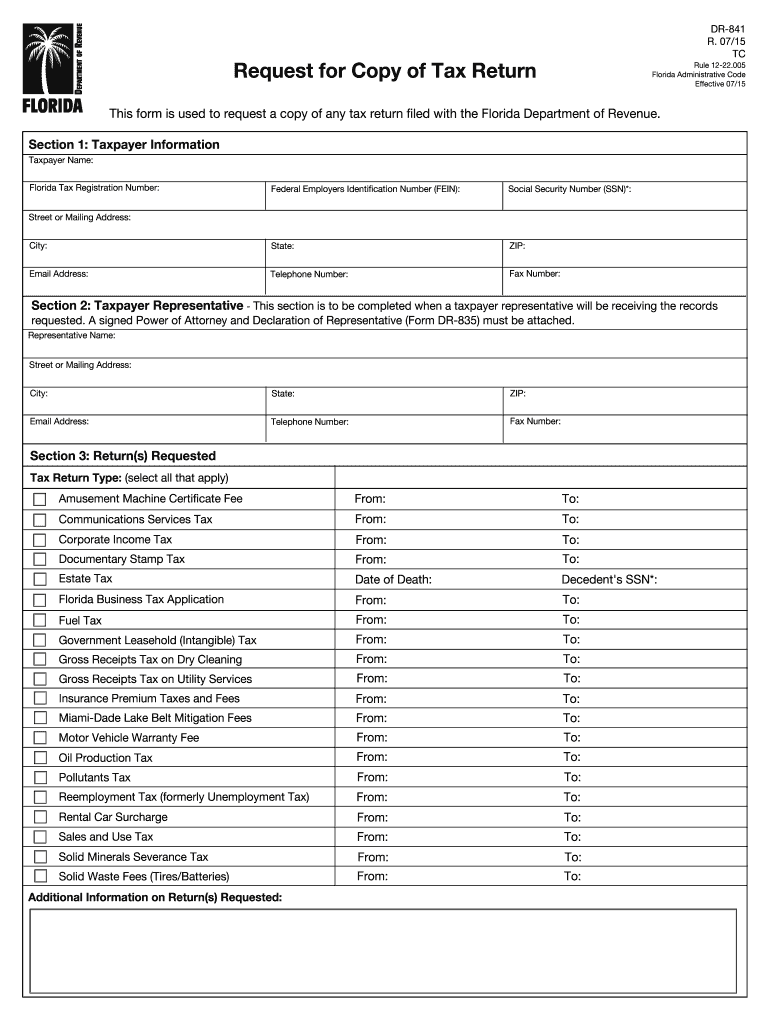

The Dr 841 is a specific tax form used in the state of Florida for requesting a copy of tax returns. This form serves as an official document that allows taxpayers to obtain copies of their filed tax returns, which may be necessary for various reasons, including loan applications, legal matters, or personal record-keeping. Understanding the purpose and function of the Dr 841 is essential for Florida residents who need to access their tax information efficiently.

How to use the Dr 841

Using the Dr 841 involves filling out the form accurately to ensure a smooth request process. Taxpayers must provide their personal information, including name, address, and Social Security number, along with details about the specific tax returns they wish to obtain. It is important to follow the instructions provided on the form carefully to avoid delays in processing. Once completed, the form can be submitted online or via mail, depending on the taxpayer's preference.

Steps to complete the Dr 841

Completing the Dr 841 requires several key steps:

- Gather necessary personal information, including your full name, address, and Social Security number.

- Determine which tax years you need copies of and include this information on the form.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form either online or by mailing it to the appropriate tax authority.

Legal use of the Dr 841

The Dr 841 is legally recognized as a valid method for requesting copies of tax returns in Florida. It complies with state regulations governing the retrieval of tax documents. Taxpayers should be aware that using this form correctly is crucial for ensuring that their requests are processed in accordance with the law. Additionally, the information obtained through the Dr 841 can be used for various legal and financial purposes, making it an important tool for individuals and businesses alike.

Filing Deadlines / Important Dates

When using the Dr 841, it is important to be aware of any relevant filing deadlines or important dates associated with tax return requests. While the Dr 841 itself does not have a specific deadline for submission, taxpayers should consider the deadlines for their tax filings and any associated legal or financial obligations. Being mindful of these dates can help ensure that requests for tax return copies are made in a timely manner, allowing for the necessary documentation to be available when needed.

Form Submission Methods (Online / Mail / In-Person)

The Dr 841 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Taxpayers can fill out and submit the form electronically through the Florida Department of Revenue's website.

- Mail Submission: The completed form can be printed and mailed to the appropriate tax authority for processing.

- In-Person Submission: Individuals may also choose to submit the form in person at designated tax offices, where assistance may be available.

Key elements of the Dr 841

Understanding the key elements of the Dr 841 is essential for effective use. Important components of the form include:

- Personal Information: Required fields for taxpayer identification.

- Tax Year Selection: Indication of which tax years the request pertains to.

- Signature: A signature is often required to validate the request.

- Submission Instructions: Clear guidance on how to submit the form effectively.

Quick guide on how to complete dr 841

Your assistance manual on how to prepare your Dr 841

If you’re looking to understand how to fill out and submit your Dr 841, here are some straightforward directions to simplify the tax filing process.

First, you will need to create your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an incredibly user-friendly and powerful document solution that enables you to edit, create, and finalize your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and digital signatures while being able to modify answers as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and easy sharing.

Follow the guidelines below to finalize your Dr 841 in just a few minutes:

- Establish your account and begin working on PDFs within moments.

- Utilize our library to obtain any IRS tax document; explore various forms and schedules.

- Select Get form to access your Dr 841 in our editor.

- Complete the necessary fillable sections with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-recognized digital signature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your intended recipient, and download it to your device.

Make use of this guide to electronically file your taxes with airSlate SignNow. Keep in mind that paper filing can lead to increased errors and delayed refunds. Certainly, before e-filing your taxes, check the IRS website for reporting requirements in your state.

Create this form in 5 minutes or less

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the dr 841

How to make an electronic signature for your Dr 841 in the online mode

How to make an eSignature for your Dr 841 in Google Chrome

How to generate an eSignature for putting it on the Dr 841 in Gmail

How to make an electronic signature for the Dr 841 straight from your smartphone

How to generate an eSignature for the Dr 841 on iOS

How to make an eSignature for the Dr 841 on Android devices

People also ask

-

What is Dr 841 in the context of airSlate SignNow?

Dr 841 refers to a specific feature or integration within the airSlate SignNow platform that enhances document signing capabilities. This functionality is designed to streamline the eSignature process, making it easier for businesses to manage their documents efficiently.

-

How much does airSlate SignNow cost for using Dr 841 features?

The pricing for airSlate SignNow varies based on the plan you choose, but Dr 841 features are included in all subscription tiers. This ensures that businesses of all sizes can access essential tools for document signing at a cost-effective rate.

-

What are the key benefits of using Dr 841 with airSlate SignNow?

Utilizing Dr 841 with airSlate SignNow offers several benefits, including improved workflow efficiency and enhanced document security. It simplifies the signing process, allowing users to execute contracts and agreements quickly and safely.

-

Can Dr 841 integrate with other software applications?

Yes, Dr 841 supports integration with various software applications, enhancing the overall functionality of airSlate SignNow. This compatibility allows businesses to connect their existing tools and streamline their document processes seamlessly.

-

Is there a mobile app for using Dr 841 on the go?

Absolutely! airSlate SignNow offers a mobile app that allows users to access Dr 841 features from anywhere. This flexibility ensures that you can send and eSign documents anytime, making it ideal for professionals on the move.

-

What types of documents can be signed using Dr 841?

Dr 841 supports a wide range of document types, including contracts, agreements, and forms. This versatility makes airSlate SignNow a powerful tool for businesses looking to manage all their document signing needs in one place.

-

How secure is the eSigning process with Dr 841?

The eSigning process with Dr 841 is highly secure, utilizing advanced encryption and authentication methods. airSlate SignNow prioritizes document security to ensure that all signed documents are protected against unauthorized access.

Get more for Dr 841

- Body disposition authorization affidavit form

- Chdp annual school report form

- Adult discharge instructions ambulatory surgery center of form

- Dss 8176 form

- D3 celebratory signing form pdf 486399516

- Hr form 382a

- Restaurant manager employment contract template form

- Revised employment contract template form

Find out other Dr 841

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template