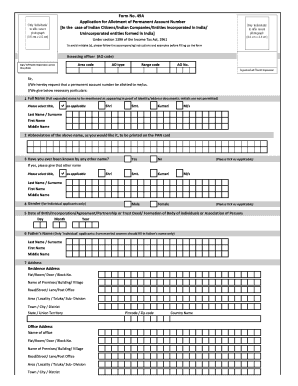

Form No 49a

What is the Form No 49a

The Form No 49a is a crucial document used primarily for tax purposes in the United States. It serves as a request for a taxpayer identification number (TIN) for various entities, including individuals, businesses, and organizations. This form is essential for ensuring compliance with IRS regulations and is often required when opening bank accounts, applying for loans, or filing tax returns. Understanding the purpose and requirements of Form No 49a is vital for anyone needing to establish their tax identity in a formal capacity.

How to obtain the Form No 49a

Obtaining Form No 49a is straightforward. It can be accessed directly from the IRS website or through authorized tax professionals. Individuals can also request a physical copy by contacting the IRS directly. It is important to ensure that you are using the most current version of the form to avoid any complications during submission. Having the correct form is essential for accurate processing and compliance.

Steps to complete the Form No 49a

Completing Form No 49a involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number or Employer Identification Number (EIN).

- Indicate the type of entity you are representing, such as an individual, corporation, or partnership.

- Provide any additional information requested, ensuring accuracy to prevent delays.

- Review the completed form for any errors or omissions before submission.

- Sign and date the form to validate it.

Legal use of the Form No 49a

The legal use of Form No 49a is governed by IRS regulations. It must be filled out accurately to ensure compliance with tax laws. This form is legally binding and can be used to establish a taxpayer's identity for various financial transactions. Misuse or incorrect completion of the form can lead to penalties or delays in processing. Therefore, it is crucial to understand the legal implications of submitting this form and to ensure that it is completed in accordance with the law.

Key elements of the Form No 49a

Key elements of Form No 49a include:

- Taxpayer Information: This section requires detailed personal or business information.

- Entity Type: Identifying whether the form is for an individual, corporation, or other entity.

- Signature: A signature is required to validate the form.

- Date: The date of signing must be included to establish the timeline of the request.

Form Submission Methods

Form No 49a can be submitted through various methods, including:

- Online Submission: Many users prefer to submit the form electronically through the IRS website or authorized e-filing services.

- Mail: The form can be printed and mailed to the appropriate IRS address.

- In-Person: Individuals may also choose to submit the form in person at designated IRS offices.

Quick guide on how to complete form no 49a 80050802

Conveniently prepare Form No 49a on any gadget

Digital document management has gained traction among companies and individuals. It serves as an optimal eco-friendly alternative to traditional printed and signed paperwork, allowing you to acquire the necessary format and securely store it online. airSlate SignNow offers all the resources needed to create, edit, and electronically sign your documents swiftly and without hindrances. Manage Form No 49a on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The simplest method to edit and electronically sign Form No 49a effortlessly

- Locate Form No 49a and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form No 49a and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 49a 80050802

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form no 49a and how can airSlate SignNow help with it?

Form no 49a is a document used for various purposes, such as registration of companies. airSlate SignNow allows you to easily create, send, and eSign form no 49a digitally, ensuring quick and efficient processing. Our platform simplifies compliance by providing secure and traceable electronic signatures.

-

Is there a cost associated with using airSlate SignNow for form no 49a?

Yes, airSlate SignNow offers various pricing plans suitable for different business needs, including plans that cater specifically to handling documents like form no 49a. You can choose a plan that fits your budget and take advantage of our 30-day free trial to explore our features before committing.

-

What features does airSlate SignNow offer for managing form no 49a?

airSlate SignNow provides a range of features designed for efficiently managing form no 49a, such as customizable templates, eSignature capabilities, and document tracking. Additionally, you can collaborate with team members in real-time, making the entire signing process seamless and efficient.

-

Can I integrate airSlate SignNow with other tools for form no 49a?

Absolutely! airSlate SignNow seamlessly integrates with many popular tools and platforms, such as Google Drive, Dropbox, and CRM systems. This allows you to manage form no 49a alongside your other business processes, enhancing productivity and ensuring everything is in one place.

-

What are the benefits of using airSlate SignNow for form no 49a?

Using airSlate SignNow for form no 49a comes with multiple benefits, including increased efficiency, reduced paper waste, and simplified tracking of document status. Additionally, it ensures that your signed form no 49a is stored securely in the cloud, making it accessible anytime, anywhere.

-

How secure is the signing process for form no 49a with airSlate SignNow?

Security is our priority at airSlate SignNow. The signing process for form no 49a is protected with encryption and complies with global eSignature laws, ensuring your documents are safe from unauthorized access. You'll have peace of mind knowing that your sensitive information is handled with the utmost security.

-

Can I use airSlate SignNow for international transactions involving form no 49a?

Yes, airSlate SignNow supports international transactions, making it an ideal choice for businesses dealing with form no 49a globally. By using our platform, you can ensure that your documents are compliant with local regulations and can be signed by parties regardless of their location.

Get more for Form No 49a

- Sbar report to a physician form

- Parts order form veseys equipment

- Attestation regarding withdrawal based on financial hardship form

- Rn refresher course online form

- Divisions bp forms

- Hr reviewer users guide office of human resourcesoregon form

- Stillwater mining company internal job application stillwaterfamily form

- Employee uniform requisition

Find out other Form No 49a

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online