Form it 605 Claim for EZ Investment Tax Credit and EZ Employment Incentive Credit for the Financial Services Industry Tax Year 2024-2026

Understanding the Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year

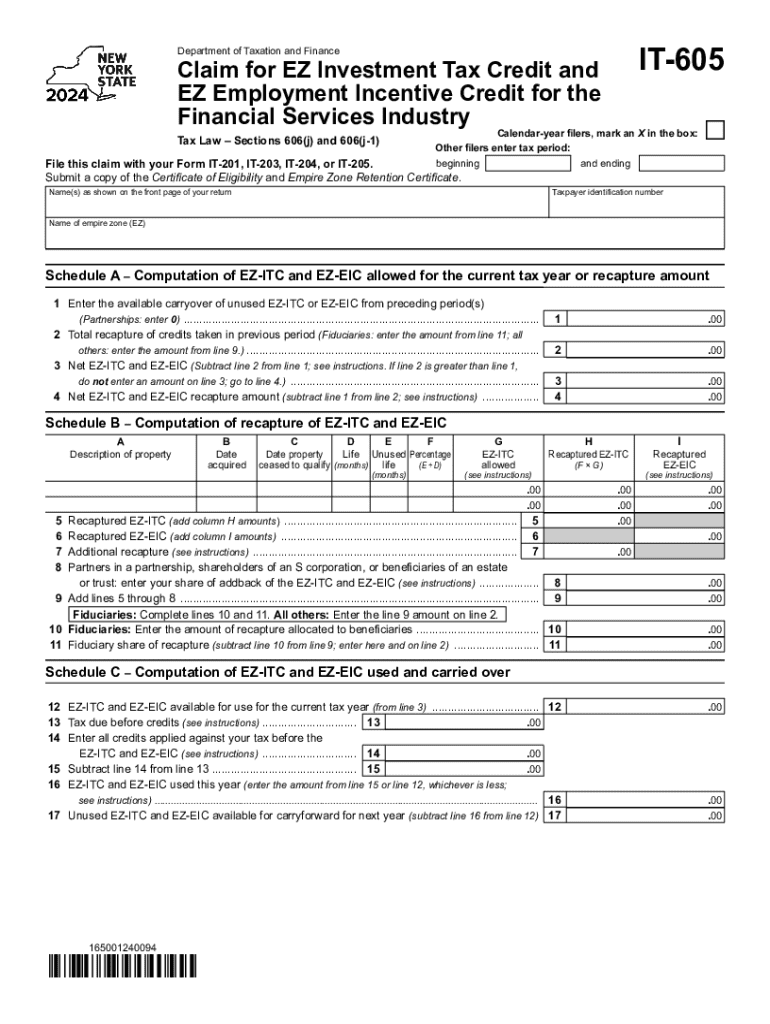

The Form IT 605 is a crucial document for businesses in the financial services industry seeking to claim the EZ Investment Tax Credit and the EZ Employment Incentive Credit. This form is designed to assist eligible businesses in receiving tax benefits that can significantly reduce their tax liabilities. The EZ Investment Tax Credit aims to encourage investment in certain qualified property, while the EZ Employment Incentive Credit provides a tax incentive for businesses that hire employees from specific target groups. Understanding the purpose and benefits of this form is essential for businesses looking to maximize their tax advantages.

Steps to Complete the Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year

Completing the Form IT 605 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents and records related to your investments and employment practices. Next, fill out the form with precise information regarding your business, including identification details, the nature of your investments, and the number of employees hired from eligible groups. It is important to double-check all entries for accuracy before submission. After completing the form, review the instructions for filing to ensure you meet all requirements.

Eligibility Criteria for the Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year

To qualify for the EZ Investment Tax Credit and the EZ Employment Incentive Credit, businesses must meet specific eligibility criteria. Generally, businesses must operate within the financial services industry and demonstrate that they have made qualifying investments or hired eligible employees. Additionally, businesses must maintain accurate records to substantiate their claims. Understanding these criteria is vital to avoid potential rejections or penalties during the review process.

Required Documents for the Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year

When filing the Form IT 605, certain documents are required to support your claim. These typically include financial statements, records of investment purchases, and documentation of employee hiring practices. It is essential to keep all supporting materials organized and accessible, as they may be requested for review by tax authorities. Having these documents ready can streamline the filing process and enhance the credibility of your claim.

Filing Deadlines for the Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year

Timely filing of the Form IT 605 is crucial to ensure that your claims are processed without delay. The deadlines for submitting this form typically align with the annual tax filing deadlines for businesses. It is advisable to check the specific dates for the current tax year, as they may vary. Missing the deadline can result in forfeiting potential tax credits, so staying informed about these dates is essential for all businesses.

Form Submission Methods for the Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year

The Form IT 605 can be submitted through various methods, including online, by mail, or in person. Each submission method has its own set of guidelines and requirements. Online submission is often the quickest and most efficient way to file, allowing for immediate processing. However, businesses may also choose to submit the form by mail or in person if they prefer those methods. Understanding the available options can help businesses select the most suitable method for their needs.

Create this form in 5 minutes or less

Find and fill out the correct form it 605 claim for ez investment tax credit and ez employment incentive credit for the financial services industry tax year 772089041

Create this form in 5 minutes!

How to create an eSignature for the form it 605 claim for ez investment tax credit and ez employment incentive credit for the financial services industry tax year 772089041

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year?

The Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year is a tax form used by businesses in the financial services sector to claim specific tax credits. These credits are designed to incentivize investment and employment within the industry, providing signNow financial benefits.

-

How can airSlate SignNow help with the Form IT 605 Claim process?

airSlate SignNow streamlines the process of completing and submitting the Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year. Our platform allows you to easily fill out, eSign, and send documents securely, ensuring compliance and efficiency in your tax credit claims.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you can efficiently manage the Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year.

-

What features does airSlate SignNow provide for managing tax documents?

airSlate SignNow provides a range of features including document templates, eSignature capabilities, and secure cloud storage. These features are particularly useful for managing the Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year, making the process faster and more organized.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. This allows you to easily access and manage your documents, including the Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year, from your preferred platforms.

-

What are the benefits of using airSlate SignNow for tax credit claims?

Using airSlate SignNow for your tax credit claims, including the Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year, offers numerous benefits. These include increased efficiency, reduced paperwork, and enhanced security, ensuring that your sensitive information is protected.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with eSigning. Our intuitive interface simplifies the process of completing the Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year, allowing anyone to navigate it with ease.

Get more for Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year

Find out other Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe