Areas of Financial Planning Form

What are the areas of financial planning?

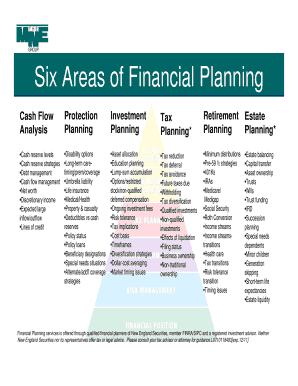

The areas of financial planning encompass essential components that help individuals and businesses manage their finances effectively. These areas include:

- Cash flow management: Understanding income and expenses to maintain a healthy financial balance.

- Investment planning: Strategizing to grow wealth through various investment vehicles.

- Retirement planning: Preparing financially for retirement to ensure a comfortable lifestyle.

- Tax planning: Structuring finances to minimize tax liabilities legally.

- Estate planning: Arranging for the distribution of assets after death to minimize taxes and ensure wishes are honored.

- Risk management: Identifying and mitigating potential financial risks through insurance and other means.

Steps to complete the areas of financial planning

Completing the areas of financial planning involves several structured steps to ensure thoroughness and effectiveness:

- Assess your current financial situation: Review income, expenses, assets, and liabilities.

- Set clear financial goals: Define short-term and long-term objectives based on personal or business aspirations.

- Create a budget: Develop a budget that aligns with your financial goals and tracks spending.

- Choose investment strategies: Select appropriate investment options based on risk tolerance and time horizon.

- Implement risk management solutions: Evaluate and purchase necessary insurance to protect against unforeseen events.

- Review and adjust regularly: Periodically revisit and adjust your financial plan to reflect changes in circumstances or goals.

Legal use of the areas of financial planning

Understanding the legal aspects of the areas of financial planning is crucial for compliance and protection. Key legal considerations include:

- Compliance with tax laws: Ensure all financial strategies adhere to IRS regulations and state laws.

- Proper documentation: Maintain accurate records of financial transactions and planning documents.

- Estate laws: Be aware of state-specific estate laws that affect asset distribution.

- Insurance regulations: Understand the legal requirements for obtaining and maintaining insurance policies.

Examples of using the areas of financial planning

Real-world applications of the areas of financial planning can vary widely. Here are a few examples:

- Retirement planning: A 30-year-old begins contributing to a 401(k) to secure retirement savings.

- Investment planning: A small business owner diversifies investments in stocks and bonds to grow capital.

- Tax planning: An individual uses tax-advantaged accounts to reduce taxable income.

- Estate planning: A family creates a trust to manage assets for minor children after a parent's passing.

Who issues the form?

The areas of financial planning forms are typically issued by financial institutions, government agencies, or financial advisors. These entities provide the necessary documentation to help individuals and businesses outline their financial strategies. It is essential to obtain forms from reputable sources to ensure compliance and accuracy.

Required documents

To effectively complete the areas of financial planning, several documents may be required. These include:

- Income statements: Pay stubs, tax returns, or profit and loss statements for businesses.

- Asset documentation: Bank statements, investment account statements, and property deeds.

- Liability records: Loan agreements, credit card statements, and mortgage documents.

- Insurance policies: Copies of life, health, property, and liability insurance policies.

Quick guide on how to complete areas of financial planning

Effortlessly Prepare areas of financial planning on Any Device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the needed form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without delays. Manage 6 areas of financial planning on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to Modify and eSign areas of financial planning with Ease

- Obtain six areas of financial planning and click Get Form to initiate the process.

- Utilize the tools available to fill out your form.

- Select important sections of your documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information carefully and click on the Done button to save your changes.

- Decide how you want to send your form, whether via email, text message (SMS), or sharing link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with a few clicks from any chosen device. Modify and eSign 6 areas of financial planning to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to six areas of financial planning

Create this form in 5 minutes!

How to create an eSignature for the 6 areas of financial planning

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask six areas of financial planning

-

What are the 6 areas of financial planning covered by airSlate SignNow?

The 6 areas of financial planning include budgeting, saving, investing, insurance, retirement, and estate planning. With airSlate SignNow, you can easily manage documents related to each of these areas, ensuring a comprehensive approach to your financial management.

-

How can airSlate SignNow help streamline my financial planning process?

airSlate SignNow streamlines your financial planning process by allowing you to easily eSign and manage all necessary documents. By organizing paperwork for the 6 areas of financial planning in one secure location, you can save time and enhance efficiency in your financial dealings.

-

What features does airSlate SignNow offer for financial planning?

Key features of airSlate SignNow include document templates, secure eSigning, and integration with popular financial tools. These features can signNowly aid in managing the 6 areas of financial planning, driving greater accuracy and ease in your financial transactions.

-

Is airSlate SignNow a cost-effective solution for financial planning?

Yes, airSlate SignNow provides a cost-effective solution for businesses looking to streamline their financial planning. By reducing the costs associated with paper documents and enhancing workflows within the 6 areas of financial planning, you can maximize your returns on investment.

-

Can I integrate airSlate SignNow with other financial tools?

Absolutely! airSlate SignNow offers integrations with various financial tools and platforms, making it easier to manage documents related to the 6 areas of financial planning. This interoperability ensures you maintain a cohesive system that works seamlessly with your existing processes.

-

What benefits does eSigning bring to financial planning?

eSigning provides a quick and legally binding way to finalize documents related to the 6 areas of financial planning. This not only speeds up the approval process but also enhances security and reduces the likelihood of lost documents in traditional paper-based systems.

-

How does airSlate SignNow support compliance in financial planning?

airSlate SignNow supports compliance by providing secure, encrypted storage and audit trails for all signed documents. This is particularly important in the 6 areas of financial planning, where adherence to regulations and safeguarding sensitive information are crucial.

Get more for 6 areas of financial planning

- F 1009 wisconsin medicaid notification of hospice benefit election form

- Printable fuel record 2005 form

- Probate f form

- Ambulance pcr from form

- License application family child care centers dcf f 67 dcf wisconsin form

- Wkc 12 form

- Soswystatewyuselectioneth formhtm

- Assignment of trade name registration wyoming secretary of state vote wyoming form

Find out other areas of financial planning

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document