Understanding Your Mortgage Statement Form

What is the Understanding Your Mortgage Statement

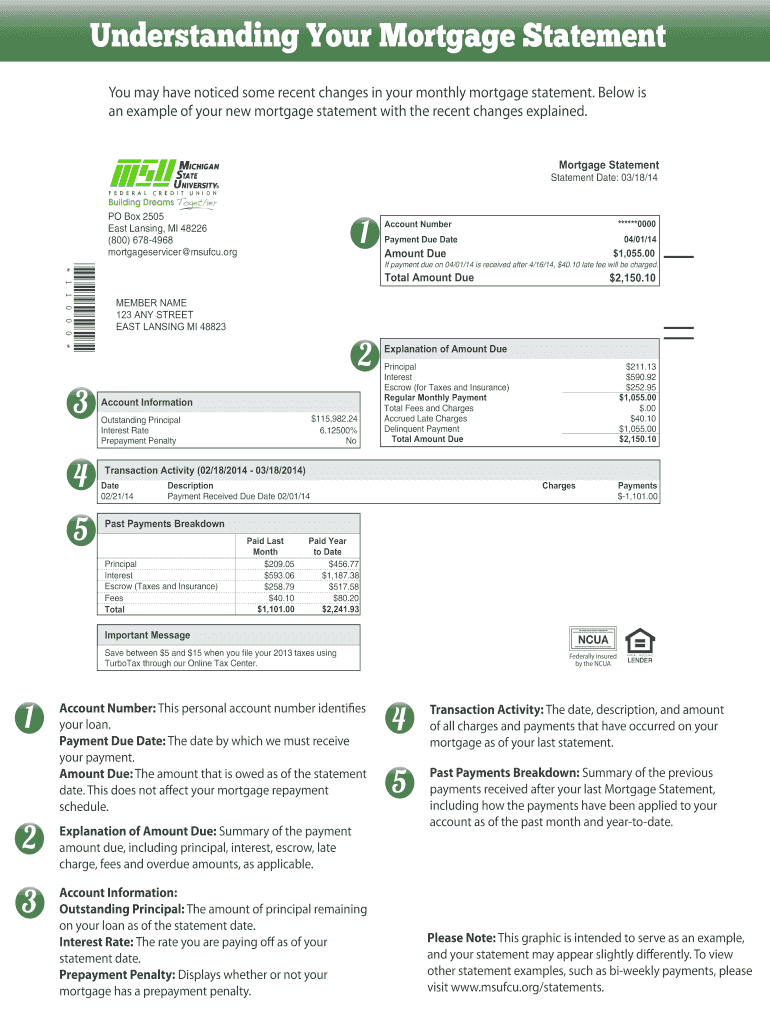

The Understanding Your Mortgage Statement form is a document that provides homeowners with a clear breakdown of their mortgage details. It typically includes information such as the loan balance, payment history, interest rates, and any fees associated with the mortgage. This statement is essential for borrowers to track their payments, understand their financial obligations, and manage their mortgage effectively. By reviewing this statement, homeowners can also identify any discrepancies and ensure they are on track with their repayment schedule.

Key elements of the Understanding Your Mortgage Statement

Several key elements are crucial in the Understanding Your Mortgage Statement. These include:

- Loan balance: The total amount owed on the mortgage.

- Payment history: A record of all payments made, including dates and amounts.

- Interest rate: The percentage charged on the outstanding balance.

- Payment due date: The date by which the next payment must be made.

- Fees and charges: Any additional costs that may apply, such as late fees or service charges.

Understanding these elements helps borrowers maintain awareness of their mortgage status and make informed decisions regarding their finances.

Steps to complete the Understanding Your Mortgage Statement

Completing the Understanding Your Mortgage Statement involves several straightforward steps:

- Gather necessary documents: Collect any previous mortgage statements, payment records, and related financial documents.

- Review the statement: Carefully examine each section of the mortgage statement, noting key details such as payment amounts and due dates.

- Identify discrepancies: Look for any errors or inconsistencies in the statement, such as incorrect payment amounts or missing transactions.

- Contact your lender: If you find any discrepancies, reach out to your mortgage lender for clarification or correction.

- Keep records: Maintain a copy of the statement and any correspondence with your lender for future reference.

How to use the Understanding Your Mortgage Statement

The Understanding Your Mortgage Statement can be used in various ways to manage your mortgage effectively:

- Budgeting: Use the statement to plan your monthly budget by factoring in your mortgage payment.

- Tracking progress: Monitor your loan balance and payment history to see how much equity you have built over time.

- Refinancing decisions: Evaluate your current interest rate and payment terms to determine if refinancing may be beneficial.

- Tax preparation: Use the statement to gather necessary information for tax deductions related to mortgage interest.

Legal use of the Understanding Your Mortgage Statement

The Understanding Your Mortgage Statement is legally significant as it serves as an official record of your mortgage obligations. It can be used in various legal contexts, such as:

- Dispute resolution: Provides documentation in case of disputes with lenders regarding payment terms or balances.

- Loan modifications: Essential for negotiating changes to your loan terms with your lender.

- Foreclosure proceedings: May be required in legal proceedings related to foreclosure or default.

Understanding the legal implications of your mortgage statement ensures that you are aware of your rights and responsibilities as a borrower.

How to obtain the Understanding Your Mortgage Statement

Obtaining the Understanding Your Mortgage Statement is typically a straightforward process. Homeowners can follow these steps:

- Contact your lender: Reach out to your mortgage lender directly, either by phone or through their website.

- Access online accounts: Many lenders provide online portals where borrowers can view and download their mortgage statements.

- Request by mail: If preferred, you can request a physical copy of your statement to be sent to your home address.

By ensuring you have access to this important document, you can stay informed about your mortgage status and financial obligations.

Quick guide on how to complete understanding your mortgage statement

Accomplish Understanding Your Mortgage Statement seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as a superb eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without holdups. Manage Understanding Your Mortgage Statement on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to amend and electronically sign Understanding Your Mortgage Statement effortlessly

- Locate Understanding Your Mortgage Statement and click Get Form to commence.

- Utilize the tools we offer to finalize your document.

- Emphasize key sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Craft your signature using the Sign tool, which takes only seconds and possesses the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Understanding Your Mortgage Statement and ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the understanding your mortgage statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Understanding Your Mortgage Statement?

Understanding Your Mortgage Statement refers to the process of interpreting the various components of your mortgage bill. It provides insights into principal, interest, taxes, and insurance payments, which are crucial for managing your mortgage effectively.

-

Why is it important to understand my mortgage statement?

Understanding Your Mortgage Statement is vital for tracking payments and identifying any discrepancies. It also helps you plan for future payments and understand how your mortgage balance changes over time, giving you better financial control.

-

How can airSlate SignNow help with mortgage documentation?

With airSlate SignNow, you can easily eSign and send mortgage documents efficiently. This streamlines the process of managing your mortgage statement, making it more accessible and understandable without the hassle of paperwork.

-

Does airSlate SignNow offer integrations with mortgage management tools?

Yes, airSlate SignNow integrates seamlessly with various mortgage management tools. This feature enhances your experience in Understanding Your Mortgage Statement, allowing for smooth document flow and easier record-keeping.

-

What features does airSlate SignNow offer for mortgage document management?

airSlate SignNow provides features such as customizable templates, secure digital signatures, and automated workflows. These features help in Understanding Your Mortgage Statement and simplifying the overall mortgage document process.

-

Is airSlate SignNow cost-effective for small businesses managing mortgages?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses. By using this platform, companies can save time and resources that are typically spent on traditional paperwork, assisting them in Understanding Your Mortgage Statement more clearly.

-

Can I track the status of my mortgage documents with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your mortgage documents in real-time. This feature is particularly useful in Understanding Your Mortgage Statement, as it ensures you stay updated on necessary actions and deadlines.

Get more for Understanding Your Mortgage Statement

Find out other Understanding Your Mortgage Statement

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT