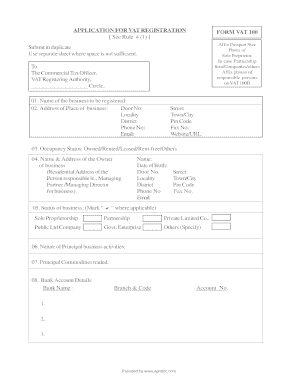

Blank Vat 100 Form

What is the Blank Vat 100 Form

The blank VAT 100 form is a tax document used in the United States for reporting value-added tax (VAT) obligations. It is essential for businesses that engage in transactions subject to VAT, allowing them to report their sales and purchases accurately. This form plays a critical role in ensuring compliance with tax regulations and helps businesses track their VAT liabilities and entitlements.

How to Use the Blank Vat 100 Form

Using the blank VAT 100 form involves several key steps. First, gather all necessary financial records, including sales invoices and purchase receipts. Next, accurately fill in the form with details of your taxable sales, exempt sales, and any VAT you have paid on purchases. Ensure that all calculations are correct to avoid discrepancies. Once completed, the form must be submitted to the appropriate tax authority, either electronically or by mail, depending on local regulations.

Steps to Complete the Blank Vat 100 Form

Completing the blank VAT 100 form requires attention to detail. Follow these steps for accurate submission:

- Gather all relevant documents, including sales and purchase records.

- Enter your business information, including name, address, and tax identification number.

- Report total sales and purchases in the designated sections.

- Calculate the VAT owed or refundable based on your transactions.

- Review the form for accuracy and completeness.

- Submit the form by the specified deadline.

Legal Use of the Blank Vat 100 Form

The blank VAT 100 form is legally binding when filled out correctly and submitted on time. Compliance with tax laws is crucial to avoid penalties. The form must be completed in accordance with IRS guidelines and local regulations to ensure that it is accepted by tax authorities. Proper use of this form helps maintain transparency in business operations and fosters trust with regulatory bodies.

Filing Deadlines / Important Dates

Filing deadlines for the blank VAT 100 form can vary based on your business's tax reporting period. Typically, businesses must submit the form quarterly or annually. It is essential to keep track of these deadlines to avoid late fees or penalties. Mark your calendar with important dates to ensure timely submission and compliance with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The blank VAT 100 form can be submitted through various methods, depending on the requirements of your local tax authority. Common submission methods include:

- Online: Many jurisdictions allow electronic filing through their tax websites, offering a faster and more efficient process.

- Mail: You can print the completed form and send it via postal service to the designated tax office.

- In-Person: Some businesses may choose to deliver the form directly to their local tax office for immediate processing.

Quick guide on how to complete blank vat 100 form

Complete Blank Vat 100 Form effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Blank Vat 100 Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Blank Vat 100 Form with ease

- Obtain Blank Vat 100 Form and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Blank Vat 100 Form and guarantee outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the blank vat 100 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the blank vat 100 form?

The blank vat 100 form is a standardized document used for VAT reporting in various jurisdictions. It allows businesses to declare their VAT liability and recover VAT on eligible expenses. Understanding this form is crucial for compliance and accurate financial reporting.

-

How do I fill out a blank vat 100 form using airSlate SignNow?

Filling out a blank vat 100 form with airSlate SignNow is simple and intuitive. You can upload your document, add necessary fields for information, and easily sign it electronically. Our platform guides you through the process to ensure all required data is included.

-

Is there a cost associated with using airSlate SignNow for the blank vat 100 form?

airSlate SignNow offers competitive pricing plans, which include the ability to fill out and eSign documents like the blank vat 100 form. Depending on the plan you choose, you may have access to advanced features such as integrations and customizable templates, enhancing your experience.

-

What are the benefits of using airSlate SignNow for VAT forms?

Using airSlate SignNow for filling out VAT forms like the blank vat 100 form streamlines the process, reduces manual errors, and ensures a faster turnaround time. The platform also provides secure cloud storage, making it easy to access your documents anytime, anywhere.

-

Can I integrate airSlate SignNow with other software for VAT reporting?

Yes, airSlate SignNow offers various integrations with popular software solutions, allowing seamless data transfer for VAT reporting. This means you can easily sync data from your accounting software to fill out your blank vat 100 form efficiently. Check our integrations page for more details.

-

What features does airSlate SignNow offer for the blank vat 100 form?

airSlate SignNow provides features such as customizable templates, electronic signatures, and real-time collaboration for your blank vat 100 form. Our platform also offers the ability to track document status and send reminders, ensuring timely submission of your VAT forms.

-

Is airSlate SignNow secure for handling sensitive VAT documents?

Absolutely! AirSlate SignNow prioritizes security by employing industry-standard encryption and compliance measures. When handling sensitive documents like the blank vat 100 form, you can trust that your information is protected during the entire signing process.

Get more for Blank Vat 100 Form

- Proof of dc residency application department of motor vehicles dmv dc form

- Rental property worksheet form

- Inwood animal clinic patient history form

- Bexar county meo toxicology laboratory analysis request form gov bexar

- Minnesota uniform conveyancing blanks form 50 1 1 justia

- Exposure indicent investigation form

- Wholesale food trade contract template form

- Wholesale house contract template form

Find out other Blank Vat 100 Form

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template