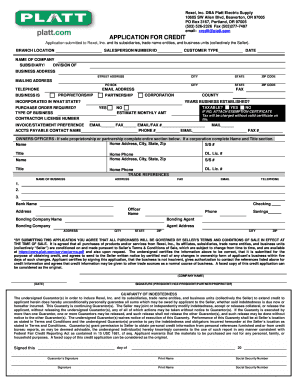

Platt Business Credit Form

What is the Platt Business Credit

The Platt Business Credit is a financial tool designed to assist businesses in establishing and managing credit. It provides an avenue for companies to access funds, which can be essential for growth, operational expenses, and other financial needs. This form is particularly relevant for small to medium-sized enterprises looking to enhance their credit profile and secure better financing options.

How to Obtain the Platt Business Credit

To obtain the Platt Business Credit, businesses typically need to follow a structured application process. This involves gathering necessary documentation, such as business financial statements, tax returns, and identification information. Once the required documents are prepared, businesses can submit their application to the relevant financial institution or credit provider that issues the Platt Business Credit.

Steps to Complete the Platt Business Credit

Completing the Platt Business Credit form involves several key steps:

- Gather necessary documents, including identification and financial statements.

- Fill out the form accurately, ensuring all information is current and truthful.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, depending on the requirements of the issuing organization.

Legal Use of the Platt Business Credit

The legal use of the Platt Business Credit is governed by various regulations that ensure compliance and protect both the issuer and the borrower. It is important for businesses to understand these legal frameworks to avoid penalties and ensure that their credit application is valid. Compliance with federal and state laws is crucial in maintaining the legitimacy of the credit obtained.

Eligibility Criteria

Eligibility for the Platt Business Credit typically depends on several factors, including the type of business entity, credit history, and financial stability. Businesses may need to demonstrate a certain level of revenue and profitability to qualify. Additionally, personal credit scores of the business owners may also be considered during the approval process.

Required Documents

When applying for the Platt Business Credit, businesses must prepare and submit specific documents. Commonly required documents include:

- Business financial statements (profit and loss statements, balance sheets).

- Tax returns for the previous two years.

- Business licenses and permits.

- Identification documents for business owners.

Examples of Using the Platt Business Credit

The Platt Business Credit can be utilized in various scenarios, such as:

- Funding inventory purchases to meet seasonal demand.

- Covering operational costs during cash flow shortages.

- Investing in marketing campaigns to promote business growth.

Quick guide on how to complete platt business credit

Complete Platt Business Credit effortlessly on any device

Digital document management has become popular among businesses and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools needed to generate, modify, and electronically sign your documents quickly without delays. Manage Platt Business Credit on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Platt Business Credit with ease

- Locate Platt Business Credit and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your edits.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow resolves all your document management needs in a few clicks from any device you prefer. Edit and eSign Platt Business Credit and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the platt business credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is platt business credit and how can airSlate SignNow help?

Platt business credit refers to credit options available for businesses to manage cash flow and finance operations. airSlate SignNow can streamline the process of signing and managing documents related to your business credit applications, ensuring quick and secure access to necessary financial agreements.

-

How does pricing for airSlate SignNow compare for businesses seeking platt business credit?

airSlate SignNow offers competitive pricing plans that cater to businesses seeking platt business credit solutions. Our pricing is transparent, allowing you to choose a plan that aligns with your business size and eSigning needs, while providing exceptional value for managing your credit documents.

-

What features does airSlate SignNow offer for managing platt business credit documentation?

Key features of airSlate SignNow include customizable templates, automated workflows, and secure cloud storage, all essential for managing platt business credit documentation. These features simplify the creation, sending, and tracking of eSigned documents, ensuring compliance and reducing the chance of errors.

-

Are there integrations available for airSlate SignNow to help with platt business credit applications?

Yes, airSlate SignNow integrates seamlessly with popular applications like Salesforce and Google Workspace, optimizing your workflow with platt business credit applications. These integrations allow you to easily access and manage documents, reducing the time spent on administrative tasks and enhancing productivity.

-

What are the benefits of using airSlate SignNow for platt business credit documentation?

Utilizing airSlate SignNow for your platt business credit documentation provides a host of benefits, including enhanced security and faster turnaround times. Implementing our solution means you can complete credit-related agreements quickly, helping your business stay agile and responsive in a competitive market.

-

Can airSlate SignNow help with international platt business credit processes?

Absolutely! airSlate SignNow supports international agreements and transactions, making it an ideal choice for businesses navigating global platt business credit processes. Our multilingual support and compliance with international eSigning standards ensure your documents remain valid across borders.

-

Is airSlate SignNow suitable for small businesses seeking platt business credit?

Yes, airSlate SignNow is particularly beneficial for small businesses looking to manage platt business credit. Our user-friendly platform and affordable pricing make it a perfect fit for small enterprises aiming to simplify their document management and elevate their business operations.

Get more for Platt Business Credit

- Mysterysuspense book report form 1 chutrav com

- Design review application 7 22 09 pinehillsnet pinehills form

- Homeless declaration form

- Disposition letter form

- Purchase and sale contract for lots and vacant land mcba form

- How candy conquered america 299814409 form

- Easy equities confirmation of address form

- Atlantic records pdf contract download form

Find out other Platt Business Credit

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure