Form 8396

What is the Form 8396

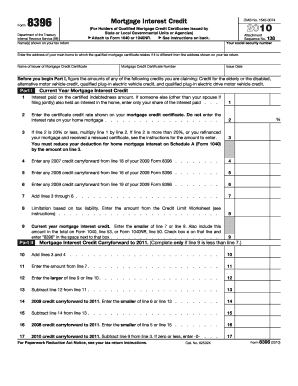

The Form 8396, also known as the Mortgage Interest Credit, is a tax form used by eligible homeowners in the United States to claim a credit for a portion of the mortgage interest paid on their home. This form is particularly beneficial for low-income individuals and families who may not have enough tax liability to fully utilize their mortgage interest deduction. By completing this form, taxpayers can potentially reduce their overall tax burden, making homeownership more affordable.

How to use the Form 8396

To use the Form 8396 effectively, taxpayers must first determine their eligibility based on specific criteria set by the IRS. This includes having a qualified mortgage and meeting income limits. Once eligibility is confirmed, the taxpayer can fill out the form, providing necessary information such as the amount of mortgage interest paid and personal identification details. The completed form is then submitted with the taxpayer's annual tax return, allowing for the credit to be applied against their tax liability.

Steps to complete the Form 8396

Completing the Form 8396 involves several important steps:

- Gather necessary documents: Collect your mortgage statement and any other relevant financial documents.

- Determine eligibility: Check if your mortgage qualifies for the credit and if your income meets IRS guidelines.

- Fill out the form: Provide accurate information regarding your mortgage interest and personal details.

- Calculate the credit: Follow the instructions on the form to determine the amount of credit you can claim.

- Submit with your tax return: Include the completed Form 8396 when filing your annual tax return.

Legal use of the Form 8396

The legal use of the Form 8396 is governed by IRS regulations. To ensure compliance, taxpayers must accurately report their mortgage interest and adhere to eligibility criteria. Misrepresentation or errors in completing the form can lead to penalties or disqualification from claiming the credit. It is advisable to consult IRS guidelines or a tax professional if there are uncertainties regarding the form's requirements.

Eligibility Criteria

To qualify for the Mortgage Interest Credit using Form 8396, taxpayers must meet specific eligibility criteria, which include:

- Having a qualified mortgage for the purchase of a primary residence.

- Meeting income limits set by the IRS, which may vary based on filing status and household size.

- Being a first-time homebuyer or having purchased a home after a certain date, as specified by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8396 align with the general tax return deadlines. Typically, individual tax returns are due by April fifteenth of each year. If additional time is needed, taxpayers may file for an extension, but the Form 8396 must still be submitted by the extended deadline to ensure the credit is claimed for the applicable tax year.

Quick guide on how to complete form 8396 1651966

Effortlessly Prepare Form 8396 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8396 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign Form 8396 with Ease

- Obtain Form 8396 and click on Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, frustrating form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8396 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8396 1651966

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8396 and why do I need it?

Form 8396 is the Mortgage Interest Credit form used for claiming a tax credit for eligible homeowners. Completing this form accurately can help you receive valuable tax benefits, ensuring you're not leaving money on the table when filing your taxes. Using airSlate SignNow can streamline the process of filling out and eSigning this form.

-

How can airSlate SignNow help me with form 8396?

airSlate SignNow provides an efficient platform to fill out and eSign form 8396. With its user-friendly interface, you can quickly input the necessary information, ensuring you meet all requirements without any hassle. Plus, it allows you to store and manage your documents securely, making the whole process easier.

-

Is there a cost associated with using airSlate SignNow for form 8396?

Yes, there are different pricing plans available for using airSlate SignNow, which cater to businesses of all sizes. Investing in this service provides you with a cost-effective solution for managing all your document signing needs, including form 8396. By opting for a plan, you gain access to advanced features that enhance productivity and compliance.

-

Can I integrate airSlate SignNow with other software for form 8396?

Absolutely! airSlate SignNow offers seamless integrations with many popular software applications, allowing you to work efficiently while completing form 8396. This means you can connect it directly with your existing tools and systems, streamlining your workflow and reducing the chances of errors.

-

What are the advantages of using airSlate SignNow for completing form 8396?

By using airSlate SignNow for form 8396, you benefit from a customizable and secure document management system. You can track the status of your document in real-time and ensure compliance with signing regulations. Additionally, its mobile accessibility means you can manage your forms on-the-go, providing flexibility and ease of use.

-

Is there customer support available for using airSlate SignNow with form 8396?

Yes, airSlate SignNow offers comprehensive customer support to assist you with any inquiries regarding form 8396. Their dedicated team is available to help you navigate the platform, solve issues, and maximize the benefits of their services. Users can access resources such as tutorials and FAQs for quick assistance.

-

What types of documents can I eSign besides form 8396?

In addition to form 8396, airSlate SignNow supports a wide variety of documents that you may need for personal or business purposes. You can eSign contracts, agreements, and other forms efficiently within the platform. This versatility helps streamline your overall document management process.

Get more for Form 8396

- Youth group waiver amp parental consent form milpitas ca parkvictoria

- Mvr request for public schools in ok form

- Form 12 register of contractors pdf

- New york lease termination letter form

- Lc690 3 doc michigan form

- Vehicle emission test due but car currently out of state form

- Writ contract template form

- Writer contract template form

Find out other Form 8396

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple