T2220 Completed Example Form

What is the T2220 Completed Example

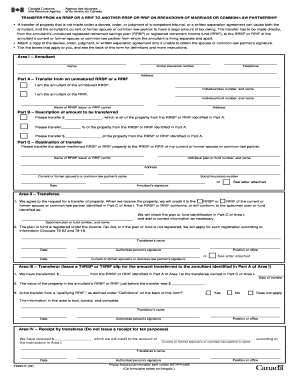

The T2220 form is a crucial document used for tax purposes in the United States. It is primarily utilized to report certain tax credits and deductions. A completed example of the T2220 form illustrates how to accurately fill out the required fields, ensuring that all necessary information is included. This example serves as a valuable reference for individuals and businesses looking to understand the structure and requirements of the form.

Steps to Complete the T2220 Completed Example

Completing the T2220 form involves several key steps. First, gather all necessary documentation, including income statements and any relevant tax credit information. Next, carefully fill in your personal details, such as your name, address, and Social Security number. Ensure that you accurately report your income and any deductions you are claiming. Review the completed form for accuracy before submission. Finally, sign and date the form as required.

Legal Use of the T2220 Completed Example

The T2220 form must be filled out correctly to ensure its legal validity. This means adhering to IRS guidelines and ensuring that all information provided is truthful and complete. The completed example can help users understand the legal implications of each section of the form, reinforcing the importance of accuracy in tax reporting. Misrepresentation or errors can lead to penalties or audits, making it essential to follow the example closely.

IRS Guidelines

The IRS provides specific guidelines for completing the T2220 form. These guidelines outline the required information, acceptable formats, and submission methods. It is important to familiarize yourself with these guidelines to avoid common mistakes that could delay processing or result in penalties. The completed example aligns with these guidelines, serving as a reliable template for users.

Filing Deadlines / Important Dates

Filing deadlines for the T2220 form are critical to ensure compliance with tax regulations. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for most taxpayers. However, extensions may be available under certain circumstances. Being aware of these important dates helps individuals and businesses plan their tax submissions effectively and avoid late fees.

Required Documents

To accurately complete the T2220 form, certain documents are required. These may include W-2 forms, 1099 forms, and documentation supporting any deductions or credits claimed. Having these documents on hand simplifies the completion process and ensures that all necessary information is included in the T2220 form. The completed example can guide users on how to reference these documents appropriately.

Quick guide on how to complete t2220 completed example

Easily Set Up T2220 Completed Example on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without delays. Manage T2220 Completed Example on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The Simplest Method to Alter and eSign T2220 Completed Example Effortlessly

- Locate T2220 Completed Example and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Mark important sections of your documents or conceal sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and has the same legal validity as a conventional ink signature.

- Review the information, then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign T2220 Completed Example and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t2220 completed example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a T2220 form and why is it important?

The T2220 form is a crucial document for businesses in Canada to declare and manage the use of certain tax credits. Understanding how to fill out a T2220 form correctly can ensure compliance with tax regulations and help you avoid potential penalties. This form plays an essential role in documenting tax obligations, making it vital for business operations.

-

How can airSlate SignNow help me fill out a T2220 form?

airSlate SignNow offers an intuitive platform to create, edit, and eSign documents, including the T2220 form. Our tools guide you through the process of how to fill out a T2220 form by allowing you to input data easily and securely share completed forms for electronic signatures. This streamlines your workflow and saves you time.

-

What features does airSlate SignNow provide for filling out forms?

airSlate SignNow includes features such as customizable templates, drag-and-drop form fields, and automated workflows that simplify the process of filling out forms like the T2220. With these tools, you can quickly learn how to fill out a T2220 form efficiently, ensuring that your documents are ready for submission and review.

-

Is there a cost associated with using airSlate SignNow for the T2220 form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. By subscribing, you gain access to a full suite of features that simplify how to fill out a T2220 form and manage other important documents. Explore our plans to find the one that suits your budget and requirements best.

-

Can I integrate airSlate SignNow with other software I use?

Absolutely! airSlate SignNow supports integrations with popular tools such as Google Drive, Salesforce, and more, allowing for seamless document management. This capability makes it easier for you to gather and input information on how to fill out a T2220 form within the systems you already use.

-

What benefits will I gain from using airSlate SignNow to fill out my T2220 form?

Using airSlate SignNow to fill out your T2220 form means enhanced accuracy, security, and efficiency in document processing. Our platform helps reduce errors and ensures timely submissions, providing peace of mind while you focus on your business. By optimizing your workflow, you can save both time and resources.

-

Is training available to help me use airSlate SignNow for T2220 form?

Yes, airSlate SignNow provides comprehensive training resources and customer support to help you understand how to fill out a T2220 form. Our tutorials and guided sessions will walk you through each step, ensuring you can confidently use our platform to meet your document management needs.

Get more for T2220 Completed Example

- Nihb oxygen and respiratory medical supplies and equipment form

- Form 590 38154432

- Geha therapy fax request form

- 3300 066 wdnr form

- Waubonsee community college transcripts form

- Journeyman psep monthly sign off sheet form

- Form mi 1040cr 7 michigan home heating credit claim

- Instruction contract template form

Find out other T2220 Completed Example

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors