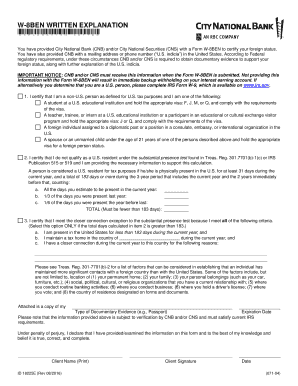

W 8BEN WRITTEN EXPLANATION Form

What is the W-8BEN Written Explanation

The W-8BEN Written Explanation is a form used by foreign individuals and entities to certify their foreign status for U.S. tax purposes. It helps establish eligibility for reduced withholding tax rates under U.S. tax treaties. This form is crucial for non-resident aliens receiving income from U.S. sources, as it provides the necessary documentation to avoid higher withholding rates. The written explanation typically accompanies the W-8BEN form to clarify the reasons for claiming treaty benefits or to provide additional context regarding the foreign status of the individual or entity.

Steps to Complete the W-8BEN Written Explanation

Completing the W-8BEN Written Explanation involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant information, including your name, address, and taxpayer identification number. Clearly state your country of residence and any applicable tax treaty benefits. Provide a concise explanation of your eligibility for these benefits, referencing specific articles of the tax treaty if necessary. Ensure that your explanation is straightforward and free from jargon, as clarity is essential for IRS review. Finally, sign and date the document, confirming its authenticity.

Legal Use of the W-8BEN Written Explanation

The legal use of the W-8BEN Written Explanation is governed by IRS regulations, which require accurate and truthful representation of foreign status and treaty eligibility. This form must be submitted to U.S. payers to avoid excessive withholding taxes. Misrepresentation or failure to provide a valid explanation can lead to penalties or increased withholding rates. It is essential to keep a copy of the completed form for your records, as it may be required for future reference or audits. Understanding the legal implications ensures compliance and protects against potential tax liabilities.

IRS Guidelines for the W-8BEN Written Explanation

The IRS provides specific guidelines regarding the completion and submission of the W-8BEN Written Explanation. It is important to follow these guidelines closely to ensure that the form is accepted. The IRS requires that the explanation be clear and detailed enough to support the claims made on the W-8BEN form. This includes referencing the appropriate tax treaty articles and providing sufficient justification for any claims of reduced withholding rates. Adhering to these guidelines helps prevent delays in processing and potential issues with tax compliance.

Examples of Using the W-8BEN Written Explanation

Examples of using the W-8BEN Written Explanation can help clarify its application. For instance, a foreign artist receiving royalties from a U.S. company may use the form to explain their eligibility for a reduced withholding rate under a tax treaty. Another example could involve a foreign investor earning dividends from U.S. stocks, where the explanation outlines the relevant treaty provisions that justify a lower withholding rate. These examples illustrate the importance of providing a well-structured explanation to support claims for treaty benefits.

Required Documents for the W-8BEN Written Explanation

When preparing the W-8BEN Written Explanation, certain documents may be required to support your claims. These typically include identification documents, such as a passport or national ID, to verify your foreign status. Additionally, any documentation related to the specific income being received, such as contracts or agreements, may be necessary. If applicable, copies of tax treaties or official correspondence with the IRS can also strengthen your explanation. Ensuring that all required documents are included helps facilitate the review process and supports your claims effectively.

Quick guide on how to complete w 8ben written explanation

Finish W 8BEN WRITTEN EXPLANATION effortlessly on any gadget

Online document management has surged in popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without hold-ups. Manage W 8BEN WRITTEN EXPLANATION on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign W 8BEN WRITTEN EXPLANATION with ease

- Locate W 8BEN WRITTEN EXPLANATION and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically available through airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to store your changes.

- Choose how you prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign W 8BEN WRITTEN EXPLANATION and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 8ben written explanation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W 8BEN WRITTEN EXPLANATION?

The W 8BEN WRITTEN EXPLANATION is a document used by foreign individuals to signNow their non-U.S. status for tax purposes. It helps in claiming tax treaty benefits and avoiding withholding taxes on U.S. source income. Understanding this explanation is crucial for accurate tax reporting.

-

How can airSlate SignNow assist with the W 8BEN WRITTEN EXPLANATION?

airSlate SignNow provides a streamlined process for completing and eSigning the W 8BEN WRITTEN EXPLANATION. Its user-friendly interface allows users to fill out the form and send it securely, making compliance easier and faster. This functionality is essential for global businesses engaged in international transactions.

-

Are there any costs associated with using airSlate SignNow for W 8BEN WRITTEN EXPLANATION?

airSlate SignNow offers various pricing plans to suit different business needs. Basic features are available at an affordable monthly rate, while advanced functionalities may require a subscription to premium plans. Evaluating the pricing will help you find the best option for managing your W 8BEN WRITTEN EXPLANATION documents.

-

What features does airSlate SignNow offer for managing W 8BEN WRITTEN EXPLANATION documents?

airSlate SignNow includes features such as template creation, bulk sending, and real-time tracking for W 8BEN WRITTEN EXPLANATION documents. These tools enhance efficiency and ensure that all parties can sign the necessary documents promptly. Moreover, the platform's secure storage keeps your documents safe.

-

Can I integrate airSlate SignNow with other applications for W 8BEN WRITTEN EXPLANATION management?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Workspace, Microsoft Office, and CRM systems. This integration facilitates effortless management of W 8BEN WRITTEN EXPLANATION documents alongside your existing workflows. Streamlining your processes is essential for improved productivity.

-

What are the benefits of using airSlate SignNow for W 8BEN WRITTEN EXPLANATION?

Using airSlate SignNow for your W 8BEN WRITTEN EXPLANATION improves efficiency, reduces errors, and speeds up the signing process. It allows businesses to manage international tax documents with ease and maintain compliance with tax regulations. The platform’s user-friendly interface enhances the experience for both senders and signers.

-

Is airSlate SignNow secure for handling W 8BEN WRITTEN EXPLANATION documents?

Absolutely, airSlate SignNow prioritizes security and compliance with industry standards. It uses advanced encryption to protect your W 8BEN WRITTEN EXPLANATION documents during transmission and storage. Trusting a secure platform is crucial when dealing with sensitive information.

Get more for W 8BEN WRITTEN EXPLANATION

- Confidential personal inventory form

- Reading comprehension worksheet sun grade 1 and printable reading comprehension worksheet for grade 1 form

- Emdr pain protocol pdf form

- Convert javelin to pdf form

- Hawaiian airlines oxygen form

- Jasinc form

- Marathon petroleum vip matching program form

- Janitorial service contract template form

Find out other W 8BEN WRITTEN EXPLANATION

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe