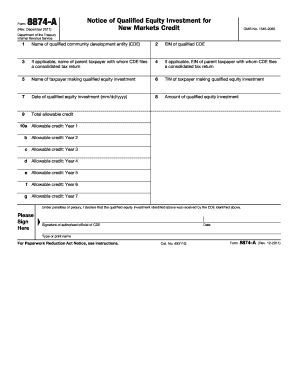

8874 a Form

What is the 8874 A Form

The 8874 A Form is a tax document used primarily for claiming the American Opportunity Tax Credit (AOTC). This form is essential for eligible taxpayers who wish to receive a credit for qualified education expenses incurred during the tax year. The AOTC can significantly reduce the amount of tax owed, making it a valuable resource for students and their families.

How to use the 8874 A Form

To effectively use the 8874 A Form, taxpayers must first ensure they meet the eligibility criteria for the American Opportunity Tax Credit. Once eligibility is confirmed, the form should be filled out with accurate information regarding qualified education expenses. This includes tuition, fees, and course materials. After completing the form, it must be submitted along with the tax return to the IRS to claim the credit.

Steps to complete the 8874 A Form

Completing the 8874 A Form involves several key steps:

- Gather necessary documentation, including receipts for qualified expenses.

- Fill out personal information, such as your name, Social Security number, and filing status.

- Detail your qualified education expenses in the appropriate sections of the form.

- Calculate the total credit amount based on the expenses reported.

- Review the completed form for accuracy before submission.

Legal use of the 8874 A Form

The 8874 A Form is legally recognized by the IRS as a valid means to claim the American Opportunity Tax Credit. To ensure compliance, taxpayers must adhere to IRS guidelines regarding eligibility and documentation. Proper use of the form can help avoid penalties and ensure that the credit is applied correctly to reduce tax liability.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the 8874 A Form. Typically, taxpayers must submit their tax returns, including the 8874 A Form, by April 15 of the following year. Extensions may be available, but it is important to check the IRS guidelines for specific dates and requirements to avoid late penalties.

Required Documents

When completing the 8874 A Form, certain documents are required to substantiate the claim for the American Opportunity Tax Credit. These documents include:

- Form 1098-T from the educational institution, detailing tuition expenses.

- Receipts for any additional qualified expenses, such as books and supplies.

- Proof of enrollment, if necessary.

Eligibility Criteria

To qualify for the American Opportunity Tax Credit using the 8874 A Form, taxpayers must meet specific eligibility criteria. These include:

- Being enrolled at least half-time in a qualified educational institution.

- Having a modified adjusted gross income (MAGI) below certain thresholds.

- Not having completed four years of post-secondary education before the tax year.

Quick guide on how to complete 8874 a form

Effortlessly Prepare 8874 A Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 8874 A Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest way to update and electronically sign 8874 A Form effortlessly

- Find 8874 A Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant portions of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from any device at your disposal. Modify and electronically sign 8874 A Form to maintain excellent communication during every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8874 a form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8874 A Form, and why is it important?

The 8874 A Form is a crucial document used for IRS tax reporting purposes. It allows businesses to provide necessary information for tax compliance and ensures they stay within regulatory guidelines. Understanding its significance can save you from potential penalties related to incorrect filings.

-

How can airSlate SignNow help me with the 8874 A Form?

airSlate SignNow simplifies the process of completing and signing the 8874 A Form. With our electronic signature solution, you can easily fill out, send, and eSign this important form quickly and securely, streamlining your filing process.

-

Is there a cost associated with using airSlate SignNow for the 8874 A Form?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs, including features designed specifically for managing the 8874 A Form. You can choose a plan that fits your budget and utilize powerful tools without overspending.

-

What features of airSlate SignNow can assist in managing the 8874 A Form?

Our platform offers features like templates, real-time collaboration, and secure storage, all of which make managing the 8874 A Form easier. Additionally, automated reminders ensure that your form is completed on time, keeping your business compliant with tax regulations.

-

Can I integrate airSlate SignNow with other applications for my 8874 A Form needs?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage the 8874 A Form. Whether you use accounting software or CRM tools, our integrations help streamline your workflow, ensuring all your documents are in one place.

-

What are the benefits of using airSlate SignNow for the 8874 A Form?

Using airSlate SignNow for the 8874 A Form offers numerous benefits, including enhanced efficiency, reduced errors, and improved security. Our platform ensures that your forms are filled out correctly and securely stored, giving you peace of mind during tax season.

-

Is airSlate SignNow compliant with regulations for the 8874 A Form?

Absolutely! AirSlate SignNow meets all necessary compliance standards, making it a reliable choice for managing the 8874 A Form. We prioritize data security and regulatory adherence, ensuring that your information remains safe and compliant.

Get more for 8874 A Form

- Therapeutic waiver form

- Yes aliens probably exist quiz scope scholastic form

- United kingdom city glasgow form

- Sample photo release form form child care aware of virginia

- Visa debit card fraud form barkansasb best fcu abfcu

- The number grid 1 100 form

- Law society train contract template form

- Lawn care and landscape maintenance contract template form

Find out other 8874 A Form

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy