North Dakota Form 500

What is the North Dakota Form 500

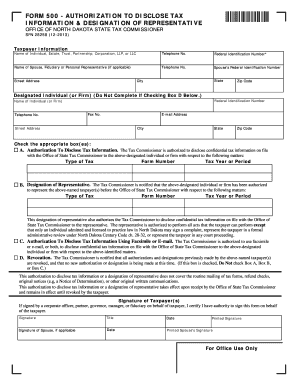

The North Dakota Form 500 is a crucial document used for corporate income tax purposes in the state of North Dakota. This form is primarily utilized by corporations to report their income, deductions, and tax liabilities to the North Dakota Office of State Tax Commissioner. It ensures that businesses comply with state tax regulations and contribute appropriately to state revenue.

How to obtain the North Dakota Form 500

To obtain the North Dakota Form 500, businesses can visit the official website of the North Dakota Office of State Tax Commissioner. The form is available for download in a PDF format, making it easy for users to print and fill out. Additionally, businesses may also request a physical copy by contacting the tax office directly.

Steps to complete the North Dakota Form 500

Completing the North Dakota Form 500 involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the form with accurate information regarding your corporation's income, deductions, and credits.

- Ensure all calculations are correct to avoid errors that could lead to penalties.

- Sign and date the form, certifying that the information provided is true and complete.

- Submit the completed form to the North Dakota Office of State Tax Commissioner by the specified deadline.

Legal use of the North Dakota Form 500

The North Dakota Form 500 is legally binding and must be filed in accordance with state tax laws. Proper completion and submission of this form are essential for maintaining compliance with tax obligations. Failure to file or inaccuracies in the form can result in penalties, interest on unpaid taxes, and potential legal repercussions.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the North Dakota Form 500. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. It is important to check for any changes to these dates annually, as they may vary.

Form Submission Methods (Online / Mail / In-Person)

The North Dakota Form 500 can be submitted through various methods to accommodate different preferences. Corporations may choose to file the form online through the North Dakota Office of State Tax Commissioner's e-filing system, which offers a streamlined process. Alternatively, businesses can mail the completed form to the appropriate address or submit it in person at the tax office. Each method has its own requirements and processing times, so it is advisable to choose the one that best suits your needs.

Quick guide on how to complete north dakota form 500

Manage North Dakota Form 500 seamlessly on any gadget

Online document management has gained signNow traction among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct format and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly without interruptions. Address North Dakota Form 500 on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

The easiest method to edit and eSign North Dakota Form 500 effortlessly

- Find North Dakota Form 500 and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that aim.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you prefer to share your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management with just a few clicks from any device you choose. Edit and eSign North Dakota Form 500 to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the north dakota form 500

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the north dakota form 500?

The north dakota form 500 is a tax form used by businesses to report income and sales in North Dakota. Understanding how to accurately fill out this form is crucial for compliance and tax filing. By utilizing airSlate SignNow, you can easily eSign and submit the north dakota form 500 electronically, streamlining your workflow.

-

How can airSlate SignNow help with the north dakota form 500?

airSlate SignNow provides an intuitive platform to prepare, eSign, and manage documents such as the north dakota form 500. With features like templates and customizable fields, you can ensure all necessary information is included. This helps businesses save time and reduce errors when submitting the north dakota form 500.

-

Is there a cost associated with using airSlate SignNow for the north dakota form 500?

Yes, airSlate SignNow operates on a subscription-based pricing model, offering plans to fit various business needs. The cost is often offset by the efficiency gained in processing documents like the north dakota form 500. You can choose a plan that suits your organization and start simplifying your form submissions.

-

What features does airSlate SignNow offer for the north dakota form 500?

airSlate SignNow includes various features that enhance the submission process for the north dakota form 500, such as customizable templates, secure eSignature options, and document tracking. These features ensure that your form is filled out correctly and delivered on time. Additionally, you can collaborate with team members directly within the platform.

-

Can airSlate SignNow integrate with other software for managing the north dakota form 500?

Absolutely! airSlate SignNow offers seamless integrations with many popular software tools, enhancing the experience of managing the north dakota form 500. Whether you're using accounting software or CRM systems, integration ensures that your data is synchronized and up to date, allowing for a more efficient workflow.

-

Is the north dakota form 500 eSigning process secure with airSlate SignNow?

Yes, airSlate SignNow prioritizes security, providing bank-level encryption and secure data storage for documents like the north dakota form 500. This ensures that all your information remains confidential and protected throughout the eSigning process. You can confidently rely on the platform to handle sensitive documentation.

-

How does airSlate SignNow improve the efficiency of filing the north dakota form 500?

By using airSlate SignNow, you can optimize the entire process of filling out and submitting the north dakota form 500. The ability to create templates allows for quick access, and eSigning speeds up the approval process. This means you can file your form faster and reduce the risk of late submissions.

Get more for North Dakota Form 500

Find out other North Dakota Form 500

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure