CRA Form T2125 Statement of Business or Professional Activities

What is the CRA Form T2125 Statement Of Business Or Professional Activities

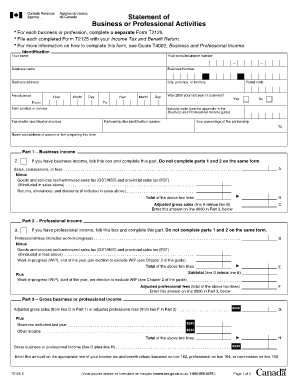

The CRA Form T2125, known as the Statement of Business or Professional Activities, is a crucial document for self-employed individuals and business owners in Canada. This form is used to report income earned from business activities and to claim expenses related to those activities. It provides a comprehensive overview of the financial performance of a business, detailing revenue, costs, and net income. The T2125 form is essential for ensuring compliance with tax regulations and for accurately calculating taxable income.

How to use the CRA Form T2125 Statement Of Business Or Professional Activities

Using the CRA Form T2125 involves several steps. First, gather all necessary financial records, including income statements and receipts for business expenses. Next, complete the form by entering your business income, which includes sales, commissions, and other earnings. After documenting your income, list all allowable expenses, such as office supplies, travel costs, and professional fees. It is important to ensure that all figures are accurate and supported by documentation. Finally, submit the completed form along with your tax return to the Canada Revenue Agency (CRA) by the designated deadline.

Steps to complete the CRA Form T2125 Statement Of Business Or Professional Activities

Completing the CRA Form T2125 involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather Documentation: Collect all relevant financial documents, including invoices, receipts, and bank statements.

- Report Income: Enter all sources of income from your business activities in the designated section of the form.

- List Expenses: Document all business-related expenses, ensuring they are categorized correctly (e.g., vehicle expenses, home office deductions).

- Calculate Net Income: Subtract total expenses from total income to determine your net income for the year.

- Review and Submit: Double-check all entries for accuracy before submitting the form with your tax return.

Legal use of the CRA Form T2125 Statement Of Business Or Professional Activities

The CRA Form T2125 is legally binding when completed accurately and submitted in accordance with tax laws. It serves as an official record of your business activities and financial performance. Proper use of the form ensures compliance with the Income Tax Act and protects against potential audits by the CRA. It is essential to maintain accurate records and to report all income and expenses truthfully to avoid penalties and legal issues.

Key elements of the CRA Form T2125 Statement Of Business Or Professional Activities

The T2125 form comprises several key elements that must be accurately filled out to ensure compliance and proper reporting. These include:

- Identification Information: Your name, business name, and contact details.

- Business Income: Total income generated from business activities.

- Expenses: Detailed listing of all allowable business expenses.

- Net Income Calculation: The difference between total income and total expenses, which determines taxable income.

Filing Deadlines / Important Dates

Filing deadlines for the CRA Form T2125 are crucial for compliance. Generally, self-employed individuals must file their tax returns by June 15 of each year. However, any taxes owed are due by April 30 to avoid interest charges. It is important to keep these dates in mind to ensure timely submission and to avoid penalties.

Quick guide on how to complete cra form t2125 statement of business or professional activities

Complete CRA Form T2125 Statement Of Business Or Professional Activities effortlessly on any device

Online document management has gained prominence among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle CRA Form T2125 Statement Of Business Or Professional Activities on any platform using airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The most efficient way to modify and eSign CRA Form T2125 Statement Of Business Or Professional Activities with ease

- Locate CRA Form T2125 Statement Of Business Or Professional Activities and then click Get Form to begin.

- Use the tools we provide to submit your form.

- Emphasize relevant sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Select how you want to distribute your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and eSign CRA Form T2125 Statement Of Business Or Professional Activities to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cra form t2125 statement of business or professional activities

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t2125 form and why do I need it?

The t2125 form is a crucial document for self-employed individuals in Canada, outlining your business income and expenses. Understanding how to accurately complete this form can help you maintain compliance with tax regulations while also maximizing potential deductions. Utilizing tools like airSlate SignNow can streamline the eSignature process for the t2125 form, making it easier to handle your business finances efficiently.

-

How can airSlate SignNow help me manage the t2125 form?

airSlate SignNow provides a user-friendly platform that allows you to easily send, sign, and store the t2125 form securely online. With its intuitive interface, you can complete and submit the necessary documents quickly, reducing the time spent on administrative tasks. This digital solution not only saves you time but also enhances the accuracy of your submissions.

-

What features does airSlate SignNow offer for eSigning the t2125 form?

airSlate SignNow offers a range of features for eSigning the t2125 form, including easy document uploads, customizable signing workflows, and real-time tracking. The platform ensures that all signatures and data are secure, compliant with legal standards, and easily accessible. Additionally, you can manage multiple signers seamlessly, making it effortless to finalize your documents.

-

Is there a cost associated with using airSlate SignNow for the t2125 form?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, including options for teams and individual users. These plans provide flexibility based on your document signing and volume requirements. Additionally, considering the time and cost savings that digital signing solutions offer, investing in airSlate SignNow can be a cost-effective choice for managing your t2125 form.

-

Can I integrate airSlate SignNow with other software for the t2125 form?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow for managing the t2125 form. Popular integrations include accounting software, CRMs, and cloud storage solutions, allowing you to streamline your processes and keep all your business documents organized. This flexibility ensures that you can work efficiently using the tools you already use.

-

What are the benefits of using airSlate SignNow for my business documents, including the t2125 form?

Using airSlate SignNow for the t2125 form and other business documents offers numerous benefits, including enhanced efficiency, improved accuracy, and reduced turnaround time. The platform's digital tools eliminate the need for paper, making your business more eco-friendly while ensuring all signatures are legally binding. Additionally, the ability to access and manage documents from anywhere provides greater flexibility and convenience.

-

Is airSlate SignNow secure for signing the t2125 form?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and secure access protocols to safeguard your documents, including the t2125 form. Your sensitive business information is protected throughout the signing process, and the platform is compliant with industry standards for digital signatures. This commitment to security ensures peace of mind when handling your essential documents.

Get more for CRA Form T2125 Statement Of Business Or Professional Activities

Find out other CRA Form T2125 Statement Of Business Or Professional Activities

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form