Nab Home Loan Application Form

What is the Nab Home Loan Application Form

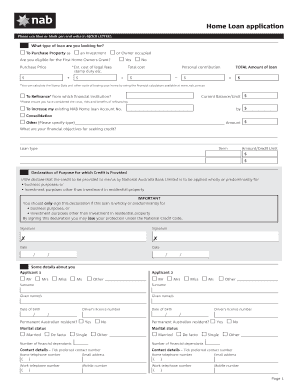

The Nab home loan application form is a crucial document for individuals seeking to secure a mortgage for purchasing a home. This form collects essential information about the applicant's financial status, employment history, and personal details. It serves as the foundation for assessing the applicant's eligibility for a home loan and determining the terms of the loan. Completing this form accurately is vital for a smooth application process.

How to use the Nab Home Loan Application Form

Using the Nab home loan application form involves several steps to ensure that all required information is provided. Applicants should first gather necessary documents, such as proof of income, identification, and details about existing debts. Once the form is obtained, applicants can fill it out either digitally or on paper. It is important to review the completed form carefully to avoid any errors or omissions that could delay the approval process.

Steps to complete the Nab Home Loan Application Form

Completing the Nab home loan application form requires attention to detail. Here are the key steps:

- Gather documents: Collect all necessary financial documents, including pay stubs, tax returns, and bank statements.

- Fill out personal information: Provide your full name, address, and contact information.

- Detail financial status: Include information about income, expenses, and assets.

- Review the form: Double-check all entries for accuracy and completeness.

- Submit the form: Send the completed application to the lender through the preferred submission method.

Legal use of the Nab Home Loan Application Form

The Nab home loan application form is legally binding once submitted. It must comply with relevant laws and regulations governing mortgage applications in the United States. This includes ensuring that all information provided is truthful and accurate. Misrepresentation or fraud can lead to severe penalties, including denial of the loan application or legal action.

Required Documents

When filling out the Nab home loan application form, certain documents are typically required to verify the information provided. Commonly required documents include:

- Proof of identity (e.g., driver's license or passport)

- Proof of income (e.g., pay stubs, tax returns)

- Bank statements for the last two to three months

- Details of existing debts (e.g., credit card statements, loan agreements)

- Property information (if applicable, such as purchase agreement)

Eligibility Criteria

Eligibility for a home loan through the Nab home loan application form depends on several factors. Lenders typically evaluate the applicant's credit score, income level, employment history, and debt-to-income ratio. Meeting the minimum requirements for these criteria increases the likelihood of loan approval. It is advisable for applicants to check their credit reports and address any issues before applying.

Quick guide on how to complete nab home loan application form

Finalize Nab Home Loan Application Form effortlessly on any device

Online document management has gained traction among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the proper form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Nab Home Loan Application Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric task today.

How to modify and eSign Nab Home Loan Application Form with ease

- Locate Nab Home Loan Application Form and then click Get Form to commence.

- Use the tools available to finish your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your updates.

- Select your preferred method to submit your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Nab Home Loan Application Form and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nab home loan application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the application process for a house loan using airSlate SignNow?

The application for a house loan using airSlate SignNow is straightforward. Start by completing the required forms and uploading essential documents. Once you submit your application, you can eSign your documents securely, ensuring a smooth and efficient process.

-

Are there any costs associated with the application for a house loan using airSlate SignNow?

AirSlate SignNow offers a cost-effective solution for your application for a house loan. The pricing depends on the plan you choose, but it typically includes features like unlimited document signing and streamlined workflows. Check our pricing page for detailed information on each plan.

-

What features does airSlate SignNow offer for house loan applications?

The application for a house loan through airSlate SignNow includes features such as customizable templates, document tracking, and eSigning functionality. These tools enhance the user experience by making the application process faster and more efficient. You'll also benefit from advanced security measures to protect your sensitive information.

-

How does airSlate SignNow benefit users applying for house loans?

Using airSlate SignNow for your application for a house loan greatly benefits users by simplifying the documentation process. Our platform allows for real-time collaboration and quick access to important documents, making it easier to manage your loan application effectively. Additionally, the eSigning feature accelerates approval times.

-

Can I integrate airSlate SignNow with other applications for my house loan?

Yes, you can easily integrate airSlate SignNow with various applications to enhance your application for a house loan. Our platform supports integrations with CRM systems, document storage solutions, and more, providing you with a seamless workflow. This flexibility allows you to consolidate your tools for better efficiency.

-

Is airSlate SignNow compliant with legal regulations for house loan applications?

Absolutely! The application for a house loan via airSlate SignNow complies with all necessary legal regulations, ensuring your documents are legally binding. Our platform adheres to industry-standard security protocols, protecting your information and ensuring compliance with eSignature laws.

-

How does eSigning work for the application for a house loan?

eSigning for your application for a house loan using airSlate SignNow is both simple and secure. After filling out your forms, you can electronically sign documents with just a few clicks. This feature ensures that your application is authenticated and expedites the overall loan process.

Get more for Nab Home Loan Application Form

Find out other Nab Home Loan Application Form

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now