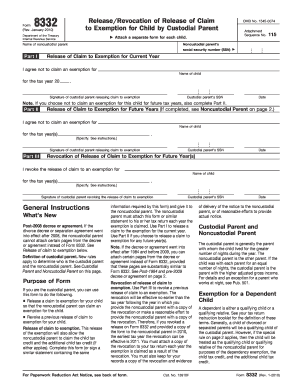

Form 8338

What is the Form 8338

The Form 8338 is an Internal Revenue Service (IRS) document used primarily for claiming a tax credit for certain qualified expenditures related to the purchase of a qualified electric vehicle. This form is essential for taxpayers who wish to benefit from available tax incentives while ensuring compliance with IRS regulations. The form helps the IRS track claims and verify eligibility for the associated credits.

How to use the Form 8338

To effectively use the Form 8338, taxpayers need to fill it out accurately and submit it with their annual tax return. The form requires detailed information about the vehicle, including its make, model, and year, as well as the taxpayer's personal information. Completing the form correctly ensures that the taxpayer can claim the appropriate tax credits and avoid potential issues with the IRS.

Steps to complete the Form 8338

Completing the Form 8338 involves several key steps:

- Gather necessary documents, including proof of purchase and vehicle specifications.

- Fill in personal information, such as name, address, and Social Security number.

- Provide details about the vehicle, including its make, model, and year of manufacture.

- Calculate the eligible tax credit based on the vehicle's specifications and IRS guidelines.

- Review the completed form for accuracy before submission.

Legal use of the Form 8338

The legal use of the Form 8338 is governed by IRS regulations. To ensure compliance, taxpayers must adhere to the guidelines set forth by the IRS regarding eligibility for tax credits. The form must be submitted in conjunction with the taxpayer's annual tax return, and any inaccuracies may lead to penalties or denial of the claimed credits. Understanding the legal framework surrounding the form is crucial for taxpayers seeking to maximize their benefits.

Filing Deadlines / Important Dates

Timely filing of the Form 8338 is essential to ensure that taxpayers receive their eligible credits. The form must be submitted with the annual tax return, which is typically due on April 15 of each year. If taxpayers require an extension, they should ensure that the Form 8338 is included in their extended filing. Keeping track of these deadlines helps avoid penalties and ensures compliance with IRS requirements.

Required Documents

To complete the Form 8338, taxpayers need to gather several important documents, including:

- Proof of purchase for the qualified vehicle, such as a bill of sale or purchase agreement.

- Vehicle specifications, including make, model, and year.

- Previous tax returns, if applicable, to reference any prior claims.

Eligibility Criteria

Eligibility for using the Form 8338 is determined by specific criteria outlined by the IRS. Taxpayers must own a qualified electric vehicle that meets the necessary specifications. Additionally, the vehicle must be purchased for personal use, and the taxpayer must not have claimed the credit for the same vehicle in previous tax years. Understanding these criteria is vital for ensuring that the claim is valid and compliant with IRS regulations.

Quick guide on how to complete form 8338

Effortlessly Prepare Form 8338 on Any Device

The management of online documents has become popular among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed paperwork, allowing you to acquire the appropriate format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Form 8338 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Modify and Electronically Sign Form 8338 with Ease

- Obtain Form 8338 and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for those tasks.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 8338 and ensure outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8338

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8338 and why is it important?

Form 8338 is a crucial document used for requesting the allocation of a specific asset to a business entity. Understanding and accurately filling out form 8338 ensures compliance with IRS regulations, making it vital for businesses. Using airSlate SignNow simplifies the process of eSigning and sending form 8338 securely, enhancing your workflow.

-

How can I complete form 8338 using airSlate SignNow?

Completing form 8338 is effortless with airSlate SignNow. Simply upload your document, fill in the required fields, and invite your team members to eSign. The platform's user-friendly interface guides you through the entire process, ensuring you can finalize form 8338 quickly and efficiently.

-

Is there a fee to use airSlate SignNow for form 8338?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. These plans provide access to features that streamline the eSigning process for important documents like form 8338. Check our pricing page for details and find the plan that best meets your requirements.

-

What features does airSlate SignNow offer for managing form 8338?

airSlate SignNow provides multiple features to enhance your management of form 8338, including customizable templates, eSigning capabilities, and real-time tracking. Additionally, users can store and organize their documents securely, making retrieval for future use easy. This ensures that all your form 8338 submissions are efficiently managed.

-

Can I integrate airSlate SignNow with other software for form 8338 processing?

Absolutely! airSlate SignNow integrates seamlessly with various applications that may assist in your form 8338 processing, such as CRMs, document management systems, and cloud storage solutions. This integration enhances productivity by allowing you to manage form 8338 alongside your existing workflows.

-

What are the benefits of using airSlate SignNow for form 8338?

Using airSlate SignNow for form 8338 offers numerous benefits, including time savings through automated workflows, increased security with encrypted eSignatures, and improved compliance with document management. These features streamline your processes while ensuring that form 8338 is handled correctly.

-

Is airSlate SignNow user-friendly for completing form 8338?

Yes, airSlate SignNow is designed with user-friendliness in mind. Users can easily navigate the platform, making it simple to complete and eSign form 8338, even for those who may not be tech-savvy. The intuitive design allows for efficient document handling from start to finish.

Get more for Form 8338

- Acls course roster form multi regional training center heartsmartcpr

- Independent savings redemption form

- D80e form

- Alg ii hauptantrag antrag auf leistungen zur sicherung des lebensunterhalts nach dem zweiten buch sozialgesetzbuch sgb ii 62143348 form

- Capital improvement form fillable

- Widerruf eines sepa lastschrift mandats sparkasse bamberg form

- Contact us greater dover chamber of commerce nh form

- Division of licensing and board administration form

Find out other Form 8338

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document