Ct 706nt Form

What is the Ct 706nt Form

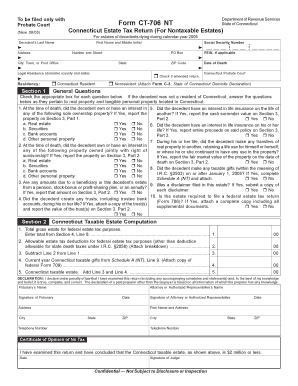

The Ct 706nt Form is a crucial document used in the state of Connecticut for estate tax purposes. This form is specifically designed for estates that exceed a certain value threshold, requiring the executor or administrator to report the estate's assets, liabilities, and any applicable deductions. The information provided on this form helps the state determine the estate tax owed, ensuring compliance with Connecticut tax laws.

How to use the Ct 706nt Form

Using the Ct 706nt Form involves several steps to ensure accurate completion. First, gather all necessary information regarding the deceased's assets, liabilities, and any deductions that may apply. Next, carefully fill out the form, providing detailed information as required. Once completed, the form must be filed with the Connecticut Department of Revenue Services. It is essential to review the form for accuracy before submission to avoid any potential issues.

Steps to complete the Ct 706nt Form

Completing the Ct 706nt Form requires a systematic approach:

- Collect all relevant financial documents related to the estate.

- Fill in the decedent's information, including name, date of death, and Social Security number.

- List all assets, including real estate, bank accounts, and investments, along with their fair market values.

- Document any liabilities and debts that the estate owes.

- Apply any deductions, such as funeral expenses or debts, as permitted by Connecticut law.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate state authority.

Legal use of the Ct 706nt Form

The Ct 706nt Form must be used in accordance with Connecticut state law to ensure its legal validity. It is essential to comply with the specific regulations governing estate taxation in Connecticut. This includes adhering to deadlines for submission and providing accurate information to avoid penalties. The form serves as a legal declaration of the estate's value and tax obligations, making it a critical component in the estate settlement process.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 706nt Form are essential to ensure compliance with state regulations. The form must typically be filed within six months of the decedent's date of death. Failure to meet this deadline may result in penalties or interest on unpaid taxes. It is advisable to check for any updates or changes to filing deadlines as they may vary based on specific circumstances or legislative changes.

Required Documents

To complete the Ct 706nt Form, certain documents are required:

- Death certificate of the decedent.

- Financial statements detailing the estate's assets and liabilities.

- Documentation for any deductions claimed, such as funeral expenses.

- Legal documents establishing the executor's authority, if applicable.

Who Issues the Form

The Ct 706nt Form is issued by the Connecticut Department of Revenue Services. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. Executors or administrators of estates must obtain this form directly from the department to ensure they are using the most current version and following the correct procedures for filing.

Quick guide on how to complete ct 706nt form

Effortlessly Prepare Ct 706nt Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents promptly and without delays. Manage Ct 706nt Form seamlessly on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Ct 706nt Form with Ease

- Locate Ct 706nt Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form—via email, SMS, or invite link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, laborious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign Ct 706nt Form and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 706nt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ct 706nt Form?

The Ct 706nt Form is a tax form used in Connecticut for reporting the estate of a deceased individual. It is essential for submitting information to the state concerning the estate’s value and tax obligations. Understanding how to complete the Ct 706nt Form accurately can help ensure compliance with state tax laws.

-

How can airSlate SignNow assist in completing the Ct 706nt Form?

airSlate SignNow offers an intuitive platform that allows users to easily complete, sign, and send the Ct 706nt Form. With its electronic signature feature, you can quickly gather required approvals from relevant parties. This streamlines the process and helps avoid delays in filing your tax documents.

-

Is there a cost associated with using airSlate SignNow for the Ct 706nt Form?

Yes, airSlate SignNow provides various pricing plans tailored to different business needs. Each plan includes features that facilitate the completion of documents like the Ct 706nt Form, ensuring a cost-effective solution for electronic document management. Visit our pricing page for detailed information on the plans available.

-

What features does airSlate SignNow offer for the Ct 706nt Form?

airSlate SignNow includes features such as document templates, electronic signatures, and real-time tracking, all of which are beneficial when dealing with the Ct 706nt Form. These features enhance efficiency and ensure that all necessary documentation is in order before submission. The easy-to-navigate interface also makes form completion straightforward.

-

Can I integrate airSlate SignNow with other applications for filing the Ct 706nt Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications that help in managing your business paperwork, making it easier to file the Ct 706nt Form. This allows you to directly import data from other platforms or export your completed forms without hassle, enhancing your workflow.

-

What are the benefits of using airSlate SignNow for the Ct 706nt Form?

Using airSlate SignNow for the Ct 706nt Form brings benefits such as increased efficiency, reduced processing time, and enhanced accessibility. The platform allows users to complete and sign documents from anywhere, at any time, making it convenient for busy professionals. Additionally, compliance with legal standards is maintained through our secure signatures.

-

How secure is airSlate SignNow when handling the Ct 706nt Form?

airSlate SignNow prioritizes security by implementing multiple layers of protection for your documents, including the Ct 706nt Form. We utilize encryption and secure cloud storage to safeguard your data. You can trust that your sensitive information is handled with the utmost care and in compliance with legal regulations.

Get more for Ct 706nt Form

- Lesson 3 skills practice adding linear expressions answer key form

- Ladbs inspection card form

- 8288 b fillable form

- Bronx naturalization form italiangen

- Fillable online form f31 rule 10 63 fax email print fill online

- Denuncia di smarrimento o di furto del form

- Sample letter of direction 1 docx form

- Poa 0831a form 4 replacement of missing offence form

Find out other Ct 706nt Form

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple