Stock Redemption Agreement PDF Form

What is the Stock Redemption Agreement PDF

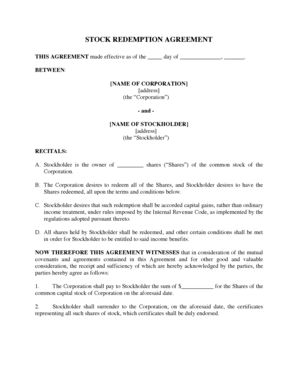

The stock redemption agreement PDF is a legal document that outlines the terms under which a corporation can buy back its own shares from shareholders. This agreement serves to protect both the corporation and the shareholders by clearly defining the conditions of the stock buyback, including the price, payment terms, and any relevant tax implications. It is essential for corporations to have a well-drafted stock redemption agreement to ensure compliance with state and federal regulations.

Key Elements of the Stock Redemption Agreement PDF

A comprehensive stock redemption agreement PDF typically includes several critical components:

- Parties Involved: Identification of the corporation and the shareholder(s) involved in the transaction.

- Redemption Price: The agreed-upon price at which the shares will be redeemed, often based on fair market value.

- Payment Terms: Details regarding how and when the payment will be made to the shareholder.

- Conditions of Redemption: Any specific conditions that must be met before the shares can be redeemed.

- Governing Law: Specification of the state law that will govern the agreement.

Steps to Complete the Stock Redemption Agreement PDF

Completing the stock redemption agreement PDF involves several important steps:

- Gather Information: Collect necessary details about the corporation and the shareholder, including share quantities and redemption price.

- Draft the Agreement: Use a template or legal software to create the stock redemption agreement, ensuring all key elements are included.

- Review and Revise: Have legal counsel review the document for compliance and clarity, making any necessary adjustments.

- Sign the Agreement: Both parties should sign the document, either physically or electronically, to make it legally binding.

- File and Store: Keep a copy of the signed agreement on file for corporate records and future reference.

Legal Use of the Stock Redemption Agreement PDF

The stock redemption agreement PDF must comply with various legal standards to be enforceable. It should adhere to the regulations outlined in the corporation's bylaws and state laws governing corporate actions. Additionally, it is crucial to ensure that the agreement does not violate any securities laws, which may require disclosures or filings with regulatory bodies. Proper legal use of this document helps prevent disputes and ensures that the redemption process is conducted fairly.

How to Obtain the Stock Redemption Agreement PDF

Obtaining a stock redemption agreement PDF can be accomplished through several methods:

- Legal Templates: Many legal websites offer templates that can be customized to fit specific needs.

- Legal Counsel: Consulting with an attorney can provide tailored guidance and ensure compliance with applicable laws.

- Corporate Software: Business management software often includes document generation features that allow for the creation of stock redemption agreements.

Examples of Using the Stock Redemption Agreement PDF

There are various scenarios in which a stock redemption agreement PDF may be utilized:

- Shareholder Exit: When a shareholder decides to leave the company, a stock redemption agreement can facilitate the buyback of their shares.

- Corporate Restructuring: During mergers or acquisitions, corporations may redeem shares to streamline ownership.

- Financial Strategy: Companies may redeem shares as part of a strategy to increase shareholder value or manage equity distribution.

Quick guide on how to complete stock redemption agreement pdf

Complete Stock Redemption Agreement Pdf effortlessly on any gadget

Digital document management has become widely embraced by businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, revise, and eSign your documents promptly without any holdups. Administer Stock Redemption Agreement Pdf on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

How to alter and eSign Stock Redemption Agreement Pdf with ease

- Find Stock Redemption Agreement Pdf and click Get Form to begin.

- Make use of the tools provided to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Decide how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunts, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign Stock Redemption Agreement Pdf and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the stock redemption agreement pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a stock redemption agreement corporation?

A stock redemption agreement corporation is a legal contract that allows a corporation to buy back its stock from shareholders. This type of agreement typically outlines the terms and conditions associated with the redemption process, ensuring that both the corporation and shareholders are protected.

-

Why is a stock redemption agreement important for corporations?

A stock redemption agreement is crucial for corporations as it provides clarity on the conditions under which shares can be bought back. This agreement helps manage shareholder expectations and can be a strategic tool for corporate finance, enabling companies to control ownership and maintain equity structure.

-

How can airSlate SignNow facilitate the creation of a stock redemption agreement corporation?

airSlate SignNow simplifies the process of creating a stock redemption agreement corporation by providing an easy-to-use interface to draft, edit, and finalize documents. Our platform allows for secure electronic signatures, ensuring that all parties can agree to terms quickly and efficiently.

-

What are the costs associated with eSigning a stock redemption agreement corporation using airSlate SignNow?

The costs for eSigning a stock redemption agreement corporation with airSlate SignNow vary based on your chosen plan. We offer flexible pricing tailored to businesses of all sizes, ensuring you get access to our document solutions without exceeding your budget.

-

What features does airSlate SignNow offer for managing stock redemption agreements?

airSlate SignNow offers a range of features for managing stock redemption agreements, including customizable templates, automated workflows, and secure cloud storage. These tools enhance collaboration between stakeholders and streamline the overall document management process.

-

Can I integrate airSlate SignNow with other platforms for stock redemption agreement management?

Yes, airSlate SignNow integrates seamlessly with various business applications, facilitating efficient management of stock redemption agreements. This integration allows your team to connect essential tools, ensuring a smoother workflow and better organizational efficiency.

-

What are the benefits of using airSlate SignNow for stock redemption agreement documentation?

Using airSlate SignNow for stock redemption agreement documentation provides signNow benefits, including saved time, reduced paper usage, and enhanced security. The platform's user-friendly design empowers businesses to easily manage agreements while maintaining compliance.

Get more for Stock Redemption Agreement Pdf

- Memorandum of judgement form

- User registration form busy accounting software busyaccountingsoftware

- Interchange and order off form afl barwon

- Maryland form wh ar 540052232

- Control and information device symbols

- Patients global impression of change pgic health mil form

- Informed consent for radiology procedures or intravenous contrast

- Syndication agreement template form

Find out other Stock Redemption Agreement Pdf

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed