213 AdjustmentVoid Form and Instructions

What is the 213 AdjustmentVoid Form and Instructions

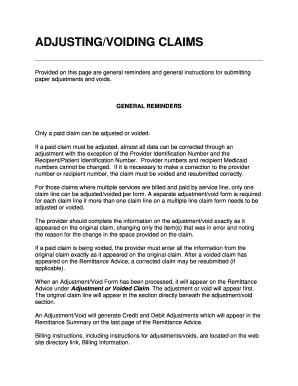

The 213 AdjustmentVoid Form and Instructions is a specific document used in the United States to address adjustments related to previous submissions. This form is essential for individuals and businesses seeking to correct or void prior filings, ensuring that their records are accurate and compliant with tax regulations. Understanding the purpose and function of this form is crucial for maintaining proper documentation and avoiding potential penalties.

How to use the 213 AdjustmentVoid Form and Instructions

Using the 213 AdjustmentVoid Form and Instructions involves several steps to ensure accurate completion. First, gather all necessary information related to the original submission that requires adjustment. This may include previous forms, supporting documents, and any relevant correspondence. Next, carefully fill out the 213 form, ensuring that all fields are completed accurately. Finally, submit the form according to the specified guidelines, which may include electronic submission or mailing it to the appropriate tax authority.

Steps to complete the 213 AdjustmentVoid Form and Instructions

Completing the 213 AdjustmentVoid Form involves a systematic approach:

- Review the original submission to identify the necessary adjustments.

- Obtain the 213 AdjustmentVoid Form from a reliable source.

- Fill in your personal or business information accurately.

- Clearly state the reasons for the adjustment or voiding of the previous submission.

- Attach any supporting documentation that substantiates your request.

- Review the completed form for accuracy and completeness.

- Submit the form as instructed, keeping a copy for your records.

Legal use of the 213 AdjustmentVoid Form and Instructions

The legal use of the 213 AdjustmentVoid Form and Instructions is governed by U.S. tax laws and regulations. It is essential to ensure that the form is filled out correctly to maintain compliance with legal standards. Failure to use the form appropriately can lead to complications, including penalties or delays in processing. The form serves as an official record of adjustments, making it vital for both individuals and businesses to adhere to the established guidelines.

Key elements of the 213 AdjustmentVoid Form and Instructions

Key elements of the 213 AdjustmentVoid Form include:

- Personal or business information: Accurate identification of the filer.

- Details of the original submission: Information pertaining to the prior filing that is being adjusted or voided.

- Reason for adjustment: A clear explanation of why the adjustment is necessary.

- Supporting documentation: Any additional documents that support the request for adjustment.

- Signature: A signature is often required to validate the form.

Form Submission Methods

The 213 AdjustmentVoid Form can typically be submitted through various methods, depending on the requirements of the relevant tax authority. Common submission methods include:

- Online submission: Many tax authorities offer electronic filing options for convenience.

- Mail: The form can be printed and mailed to the designated address provided in the instructions.

- In-person submission: For certain situations, submitting the form in person may be an option.

Quick guide on how to complete 213 adjustmentvoid form and instructions

Complete 213 AdjustmentVoid Form And Instructions effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without hindrances. Manage 213 AdjustmentVoid Form And Instructions on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign 213 AdjustmentVoid Form And Instructions effortlessly

- Obtain 213 AdjustmentVoid Form And Instructions and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or hide sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes requiring the reprinting of new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Alter and eSign 213 AdjustmentVoid Form And Instructions and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 213 adjustmentvoid form and instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 213 AdjustmentVoid Form And Instructions?

The 213 AdjustmentVoid Form And Instructions is a critical document used for adjusting or voiding previous transactions in specific contexts. This form provides detailed instructions on how to accurately complete the adjustment process, ensuring compliance with relevant regulations.

-

How can I access the 213 AdjustmentVoid Form And Instructions?

You can easily access the 213 AdjustmentVoid Form And Instructions through the airSlate SignNow platform. Our user-friendly interface allows you to download or fill out the form online, simplifying the process for your business.

-

Are there any costs associated with the 213 AdjustmentVoid Form And Instructions?

Using the 213 AdjustmentVoid Form And Instructions on airSlate SignNow is part of our overall service package. Our pricing is transparent and competitive, providing excellent value for all your document signing needs while including access to this essential form.

-

What features does airSlate SignNow offer for the 213 AdjustmentVoid Form And Instructions?

With airSlate SignNow, you get a suite of features that enhance your experience with the 213 AdjustmentVoid Form And Instructions. These features include easy document sharing, eSignature capabilities, and automated workflows that save time and improve efficiency.

-

Can I integrate the 213 AdjustmentVoid Form And Instructions with other software?

Yes, airSlate SignNow offers integrations with various software solutions, allowing seamless use of the 213 AdjustmentVoid Form And Instructions within your existing systems. This flexibility can enhance your workflow and streamline your document management processes.

-

What are the benefits of using airSlate SignNow for the 213 AdjustmentVoid Form And Instructions?

Using airSlate SignNow for the 213 AdjustmentVoid Form And Instructions provides several benefits, including time savings, reduced errors, and enhanced security. Our platform ensures that your documents are handled with care, maintaining compliance while facilitating smooth operations.

-

Is the 213 AdjustmentVoid Form And Instructions suitable for all business sizes?

Absolutely! The 213 AdjustmentVoid Form And Instructions is designed to meet the needs of businesses of all sizes. Whether you're a small startup or a large corporation, airSlate SignNow can accommodate your requirements effectively.

Get more for 213 AdjustmentVoid Form And Instructions

Find out other 213 AdjustmentVoid Form And Instructions

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now