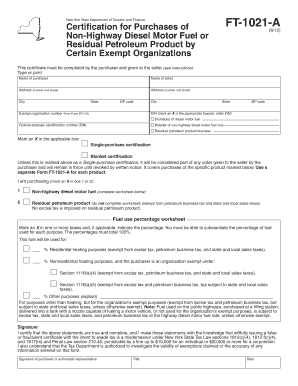

Ft 1021 Form

What is the Ft 1021

The Ft 1021 form is a specific document used primarily in the context of tax reporting and compliance within the United States. It serves as a declaration for certain financial transactions and is essential for individuals and businesses to accurately report their income or expenses to the Internal Revenue Service (IRS). Understanding the purpose of the Ft 1021 is crucial for ensuring compliance with federal tax regulations.

How to use the Ft 1021

Using the Ft 1021 form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents that pertain to the transactions you need to report. Next, carefully fill out the form, ensuring that all required fields are completed. After filling out the form, review it for accuracy before submission. The Ft 1021 can be submitted electronically or via traditional mail, depending on the specific requirements set by the IRS.

Steps to complete the Ft 1021

Completing the Ft 1021 form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather necessary financial documents, such as receipts and previous tax returns.

- Access the Ft 1021 form from the IRS website or through authorized providers.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Detail the specific financial transactions that the form addresses, ensuring all figures are accurate.

- Review the completed form for any errors or omissions.

- Submit the form according to IRS guidelines, either electronically or by mail.

Legal use of the Ft 1021

The Ft 1021 form holds legal significance as it is used to report financial information to the IRS. To ensure its legal validity, it must be completed accurately and submitted within the designated deadlines. Compliance with IRS regulations is essential; failure to do so may result in penalties or legal repercussions. Using a reliable electronic signature solution, like airSlate SignNow, can help ensure that the submitted form is legally binding and secure.

Filing Deadlines / Important Dates

Filing deadlines for the Ft 1021 form are crucial to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes in deadlines, as the IRS may announce extensions or modifications based on specific circumstances.

Required Documents

To accurately complete the Ft 1021 form, certain documents are required. These may include:

- Previous tax returns for reference.

- Receipts or invoices related to the financial transactions being reported.

- Bank statements that reflect the transactions.

- Any additional documentation that supports the figures reported on the form.

Having these documents readily available will facilitate a smoother completion process and help ensure accuracy.

Quick guide on how to complete ft 1021

Complete Ft 1021 effortlessly on any device

Online document administration has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow offers all the tools required to create, modify, and eSign your documents quickly without delays. Manage Ft 1021 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The simplest way to modify and eSign Ft 1021 with ease

- Find Ft 1021 and select Get Form to start.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Ft 1021 and assure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ft 1021

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ft 1021 in the context of airSlate SignNow?

The term 'ft 1021' refers to a specific document format supported by airSlate SignNow. This feature allows businesses to easily manage and eSign documents while maintaining compliance with industry standards. By using ft 1021, users can ensure their documents are both legally binding and efficiently processed.

-

How does airSlate SignNow support the ft 1021 document format?

airSlate SignNow seamlessly integrates the ft 1021 format into its platform, enabling users to upload, edit, and send documents easily. This compatibility ensures that all features of the airSlate SignNow platform, including eSignature capabilities, are fully functional with ft 1021 documents. Businesses can leverage this for improved workflow efficiency.

-

What are the pricing options for using ft 1021 with airSlate SignNow?

Pricing for airSlate SignNow that includes the capability to eSign ft 1021 documents is flexible and tailored to different business needs. The platform offers various plans, allowing organizations to choose one that fits their budget and feature requirements. You can access a free trial to evaluate how well it meets your needs.

-

Can I integrate airSlate SignNow with other software while using ft 1021?

Yes, airSlate SignNow supports multiple integrations with popular software solutions while managing ft 1021 documents. This allows businesses to connect their existing tools for enhanced productivity. Integrations with CRM systems, document management systems, and other apps simplify the eSigning process for ft 1021 files.

-

What are the key benefits of using airSlate SignNow for ft 1021 documents?

The key benefits of using airSlate SignNow for ft 1021 documents include increased efficiency in document handling, enhanced security with advanced encryption, and user-friendly eSigning features. This platform empowers businesses to streamline their signing processes while ensuring compliance with legal standards associated with ft 1021 documents.

-

Is it easy to get started with airSlate SignNow for ft 1021?

Getting started with airSlate SignNow for managing ft 1021 documents is straightforward. New users can sign up for an account and receive guided support to help them navigate the platform. The intuitive interface ensures that even those unfamiliar with electronic signatures can quickly learn how to send and eSign ft 1021 documents.

-

Are there any limitations when using ft 1021 with airSlate SignNow?

While airSlate SignNow offers robust support for ft 1021 documents, there may be limitations based on specific features included in your pricing plan. It's important to review the chosen plan to ensure it aligns with your needs regarding document processing and signing capabilities. Generally, most essential features are covered.

Get more for Ft 1021

- Macquarie bank deceased estates form

- Psychological testing nevada medicaid and nevada check up medicaid nv form

- Allied health professional provider certification application form

- Shell merchandise form

- Srs declaration form

- Sample 42 cfr part 2 31 consent form medfusion medfusion

- Minnesota energy certificate form

- Application and permit to hold game in captivity michigan form

Find out other Ft 1021

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online