Form 535 PDF

What is the Form 535 PDF

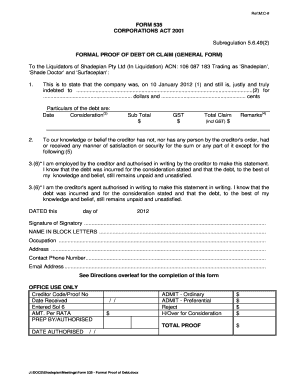

The Form 535 PDF, also known as the PWGSC 535, is a document used primarily for proof of debt in various contexts, including financial and legal scenarios. This form is essential for individuals and businesses seeking to formally establish a claim regarding outstanding debts. It serves as a standardized format that ensures all necessary information is captured clearly and concisely, facilitating the debt verification process.

How to Obtain the Form 535 PDF

Obtaining the Form 535 PDF is a straightforward process. It can typically be downloaded from official government websites or financial institutions that provide the necessary documentation for debt claims. Users should ensure they are accessing the most current version of the form to comply with any updated regulations or requirements. Additionally, local offices may provide physical copies upon request.

Steps to Complete the Form 535 PDF

Completing the Form 535 PDF involves several key steps to ensure accuracy and compliance. First, gather all relevant information regarding the debt, including the debtor's details, the amount owed, and any supporting documentation. Next, carefully fill out each section of the form, ensuring that all fields are completed accurately. Once the form is filled out, review it for any errors before signing and dating the document. Finally, submit the completed form according to the specified submission methods.

Legal Use of the Form 535 PDF

The Form 535 PDF is legally recognized when completed in accordance with applicable laws and regulations. To ensure its validity, it must be signed by the appropriate parties, and any claims made within the form should be substantiated with supporting evidence. Compliance with local and federal guidelines is crucial for the form to be accepted in legal proceedings or by financial institutions.

Key Elements of the Form 535 PDF

Key elements of the Form 535 PDF include the debtor's name and contact information, the creditor's details, the amount of debt, and a detailed description of the debt. Additionally, there may be sections for signatures, dates, and any relevant case numbers or identifiers. These elements are essential for establishing a clear and comprehensive record of the debt claim.

Form Submission Methods

The Form 535 PDF can typically be submitted through various methods, including online submission, mailing a hard copy, or delivering it in person to the relevant authority. Each method may have specific requirements regarding documentation and deadlines, so it is important to choose the most appropriate submission method based on the situation and to ensure compliance with all necessary protocols.

Quick guide on how to complete form 535 pdf

Complete Form 535 Pdf effortlessly on any gadget

Online document management has become popular among companies and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, enabling you to access the correct format and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Form 535 Pdf on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Form 535 Pdf with ease

- Obtain Form 535 Pdf and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Verify the information and click the Done button to save your changes.

- Select your preferred method to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that require you to print new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Form 535 Pdf and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 535 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 535 cra pdf and why is it important?

The form 535 cra pdf is a crucial document used for corporate tax filings in Canada. It ensures compliance with the Canada Revenue Agency's requirements and simplifies the process of submitting corporate taxes. By utilizing the form 535 cra pdf, businesses can avoid penalties and maintain good standing.

-

How can airSlate SignNow help me with the form 535 cra pdf?

airSlate SignNow allows you to easily upload, fill out, and eSign the form 535 cra pdf. Our platform provides a seamless experience for managing your documents, ensuring that your submissions are timely and accurate. Let airSlate SignNow simplify your document workflow when dealing with the form 535 cra pdf.

-

Is there any cost associated with using airSlate SignNow for the form 535 cra pdf?

airSlate SignNow offers a cost-effective solution for handling the form 535 cra pdf with competitive pricing plans. Depending on your needs, you can choose from various subscription options that provide excellent value for businesses of all sizes. Start your free trial today to explore our features without any upfront costs.

-

What features does airSlate SignNow offer for the form 535 cra pdf?

airSlate SignNow offers a range of features for the form 535 cra pdf. These include customizable templates, electronic signatures, secure cloud storage, and document tracking. With these features, you can manage your forms efficiently and stay organized.

-

Can I integrate airSlate SignNow with other applications while handling the form 535 cra pdf?

Yes, airSlate SignNow can easily integrate with various applications to streamline your process for the form 535 cra pdf. Whether you use CRM systems, cloud storage, or productivity tools, our integrations enhance your document management experience. This ensures all related activities are coordinated seamlessly.

-

What are the benefits of using airSlate SignNow for the form 535 cra pdf?

Using airSlate SignNow for the form 535 cra pdf offers numerous benefits, including enhanced efficiency and reduced turnaround time. It allows for easy collaboration among team members, ensuring smoother document workflows. By choosing airSlate SignNow, you also increase security and compliance in your document management.

-

Is it safe to eSign the form 535 cra pdf with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security when it comes to eSigning the form 535 cra pdf. Our platform uses advanced encryption and authentication measures to protect your sensitive information and ensure the integrity of your documents.

Get more for Form 535 Pdf

Find out other Form 535 Pdf

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms