Bank Power of Attorney 2002-2026

What is the Bank Power Of Attorney

The bank power of attorney is a legal document that grants an individual the authority to act on behalf of another person concerning banking matters. This authority can include managing bank accounts, making deposits, withdrawing funds, and handling other financial transactions. The person granting this power is known as the principal, while the individual receiving the authority is referred to as the agent or attorney-in-fact. This document is essential for individuals who may be unable to manage their financial affairs due to various reasons, such as illness or absence.

How to use the Bank Power Of Attorney

To effectively use a bank power of attorney, the agent must present the document to the bank where the principal holds accounts. The bank will typically require a copy of the power of attorney to verify the agent's authority. Once verified, the agent can perform transactions on behalf of the principal, including accessing account information, making withdrawals, and managing investments. It is important for the agent to act in the best interests of the principal and adhere to any specific instructions outlined in the document.

Steps to complete the Bank Power Of Attorney

Completing a bank power of attorney involves several key steps:

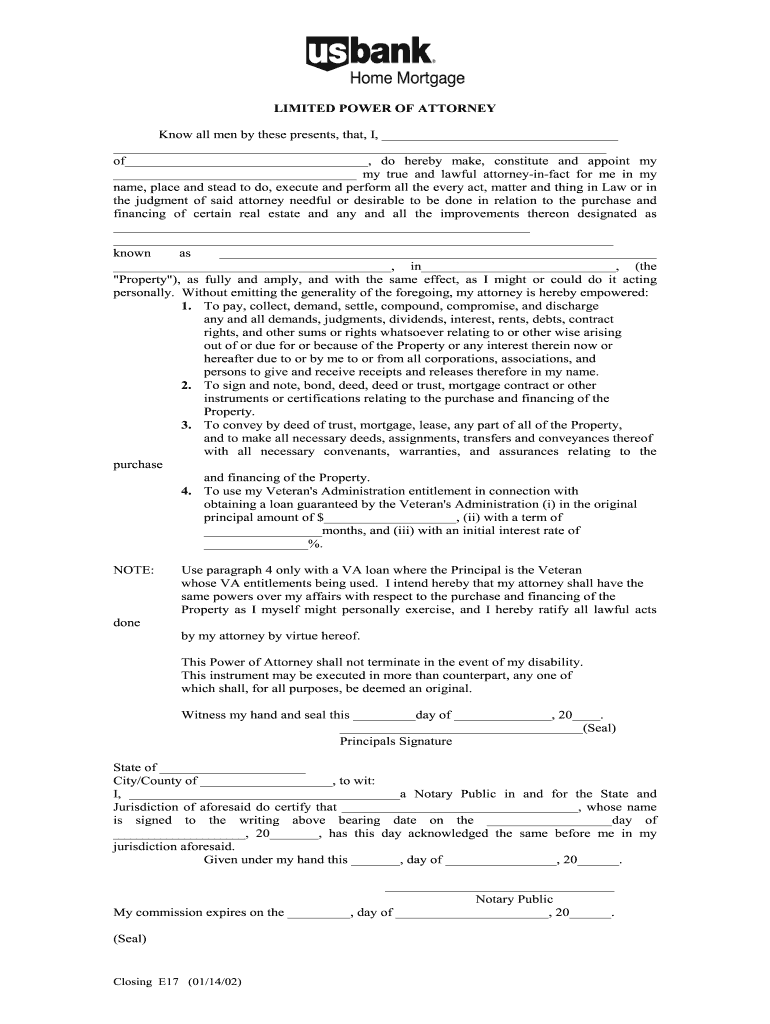

- Choose the right form: Obtain a bank power of attorney form that complies with state laws.

- Fill out the form: Provide necessary details, including the names of the principal and agent, and specify the powers granted.

- Sign the document: The principal must sign the form in the presence of a notary public to ensure its legality.

- Distribute copies: Provide copies of the signed document to the bank and keep one for personal records.

Legal use of the Bank Power Of Attorney

The bank power of attorney is legally binding as long as it is executed according to state laws. It is crucial that the document clearly outlines the powers granted to the agent and that it is signed and notarized properly. The agent must act within the scope of authority granted by the principal and must always prioritize the principal's best interests. Misuse of this power can lead to legal consequences, including potential criminal charges.

State-specific rules for the Bank Power Of Attorney

Each state in the U.S. has its own regulations regarding the creation and use of a bank power of attorney. These rules can dictate the necessary language, required signatures, and notarization processes. It is important for individuals to familiarize themselves with their state's specific requirements to ensure that the document is valid. Consulting with a legal professional can provide clarity on these state-specific rules and help avoid any potential issues.

Required Documents

To create a bank power of attorney, the following documents may be required:

- Identification: A valid government-issued ID of the principal.

- Bank power of attorney form: The completed and signed form.

- Notarization: Proof of notarization, if applicable in the state.

Quick guide on how to complete us bank power of attorney form

The optimal method to obtain and endorse Bank Power Of Attorney

On the scale of your entire organization, unproductive procedures concerning paper approvals can absorb substantial working hours. Signing documents such as Bank Power Of Attorney is an inherent aspect of operations in any organization, which is why the effectiveness of each agreement’s lifecycle holds signNow importance for the company’s overall success. With airSlate SignNow, endorsing your Bank Power Of Attorney can be as straightforward and swift as possible. You will discover on this platform the latest version of nearly any form. Even better, you can sign it instantly without the need for downloading external software on your computer or printing anything as physical copies.

Steps to obtain and endorse your Bank Power Of Attorney

- Browse our collection by category or utilize the search function to find the form you require.

- Examine the form preview by clicking on Learn more to confirm it’s the correct one.

- Press Get form to start editing immediately.

- Fill out your form and incorporate any necessary information using the toolbar.

- Once completed, click the Sign tool to endorse your Bank Power Of Attorney.

- Select the signature method that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Hit Done to finalize editing and move on to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to manage your documentation proficiently. You can locate, complete, edit, and even transmit your Bank Power Of Attorney in a single window with no complications. Enhance your procedures with one intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Can I convert my savings account into an NRO account?

Convert your bank savings account into an NRO accountWhy: Because the Reserve Bank of India says so in its circular: RBI/2007-2008/242 Master Circular No. 03 /2007- 08.What is an NRO account: An NRO account is like your regular bank savings account but has certain restrictions. In this account you can deposit your rupee earnings from India such as rent, interest, dividends etc. You can also deposit funds from abroad that are in the form of freely convertible foreign currency. You can issue cheques for all local payments, EMIs or investments through this account.Repatriation: You can repatriate (that is transfer to a bank account outside India) all current income such as rent, interest, dividends etc that you earned in India. Apart from that, if you made any capital account transactions like sale of property or investments, and if you got the sale proceeds in the NRO account, you can repatriate up to $1 million per calendar year. However, you would need to produce a certificate from your chartered accountant declaring that all taxes on the funds have been paid. Only then will the banker permit the repatriation.Interest rates and taxabilityInterest rates and taxability: The interest will be the similar to the interest on a regular savings bank account, that is, around 3%. The interest will be taxable and tax will be deducted at source at the rate of 30.9%.How to convert: Visit your bank branch and fill up the required forms. You would need to submit two photographs, a copy of your passport and copy of your visa.Already moved abroad? If you have already moved abroad without completing this formality, you can get copies of all your documents attested by the Indian Embassy or Notary and send them to the branch.2. Close your existing demat account, open an NRO demat account and open a new demat under PINSWhy: Sandeep Shanbhag, Director, Wonderland Investments and an expert on NRI matters explains, "An NRI has certain restrictions when it comes to investing in Indian equities. For instance, an NRI cannot invest more than 5% in the paid up capital of an Indian company. In order to keep track of these restrictions, the RBI requires you to make these changes in your demat accounts."For your existing shares: As an NRI you cannot continue to operate your regular demat account. Your existing demat account, which holds shares that you purchased while you were a resident Indian, will have to be closed and you would need to transfer the shares to an NRO demat account.You can continue to hold these shares or sell them. If you sell them, the proceeds are credited to the NRO savings account and there are restrictions on repatriation. That is, you can repatriate up to USD 1 million per calendar year (including all other capital account remittances) but you would need a certificate from your chartered accountant as mentioned earlier.For buying shares as an NRIFor buying shares as an NRI: If you want to buy shares as an NRI, you would need to open a demat account under the Portfolio Investment Scheme (PINS). In this demat, you can buy shares with funds in your NRE account and sale proceeds can be credited to NRE account for repatriation. If you choose to buy the shares on non-repatriable basis, then, the proceeds will be credited to the NRO account.You must maintain two separate demat accounts for repatriable and non-repatriable shares. Recently, the RBI also specified that an NRE must have a separate account linked to the PINS demat account. It cannot be the NRO or NRE account through which other routine transactions are conducted. Once you become a resident again, you must close the PINS account.How to do this: Your demat service provider will be able to help you with all of the above. You would need to submit documents such as passport and visa to do the same.3. Give power of attorney to someone in IndiaWhy: It is just operationally easier if you have someone you trust manage your bank accounts and other financial transactions for you.What transactions are covered: A power of attorney can be given to mange almost all your financial matters including operating bank accounts, buying and selling real estate, renting out your property, signing your tax forms, issuing cheques from your account etc.What is not covered: A POA holder cannot open bank accounts on your behalf. He can only operate bank accounts once they are opened. Further, according to RBI's circular RB/2004-05/394 A.P. (DIR Series) Circular No. 37 a resident holder of POA cannot repatriate funds outside of India. He can only repatriate funds to the foreign bank account of the account holder.How to make a power of attorneyHow to make a power of attorney: The operational word here is 'trust'. Remember that power of attorney is like giving someone the key to your locker. So only assign it to someone you trust completely. Having said that, there are two types of power of attorneys: a general POA and a specific POA. A generally power of attorney gives sweeping rights to the holder to conduct a broad number of transactions on your behalf, such as banking transactions, real estate transactions.The specific power of attorney is more restrictive in that each power of attorney defines a specific scope such as power to rent property, power to issue cheques on your behalf etc., thus implying greater safety. Make sure you contact a lawyer to do this the right way. Submit attested copies to the concerned service providers such as mutual fund house or bank.4. Open an NRE account if you may have substantial repatriation requirementsWhy: Because an NRE account can offer certain benefits over the NRO account for those who might have repatriation requirements. While it is possible to open an NRE account even from abroad, it is operationally difficult. So you may as well open it before you leave.What is an NRE Account: You can open an NRE savings account, current account or fixed deposit. You can deposit your funds from abroad into NRE savings accounts. You cannot deposit local earnings like rent, interest, dividends into this account but you can use NRE funds for making local rupee payments. You can also use these funds for investment purposes, the sale considerations of which you want to repatriate.RepatriationRepatriation: You can repatriate any amount of any kind from the NRE accounts. There is no restriction, ceiling or chartered accountant certificate needed.Interest rates and taxability: On your NRE savings account you can earn an interest of around 3% while on the NRE fixed deposit, you can earn between 2-4% depending on the tenure. Interest on NRE accounts, whether savings or fixed deposit, is tax free.How to open: The procedure is the same as with NRO accountAlready moved abroad: Again, follow the same procedure as with NRO account.For any Legal and Accounting support, Happy to help you, let us talk at Wazzeer.com

-

Can power of attorney in fact forms be filled out and authorized completely online?

Note: I am not an attorney. Even if I were an attorney, I am not your attorney. This is merely the opinion of a fairly savvy Citizen. It is not legal advice. If you want legal advice hire an actual attorney. In the U.S.A. "signing" something like a Power of Attorney electronically is generally not enforcable* because many (most?) Courts require that the authorizing of them usually requires a "wet" signature which has been signNowd. You could try it but, because they are such powerful documents, almost any court (or business for that matter) will require that the signature be signNowd before allowing them to be enforced and used.In fact many businesses simply have a policy of not recognizing them without a confirming court order as well. This is especially true in health care.This is mainly because the business wants to make damned sure that any liability for errors or misunderstandings lies with someone other than the business. *Note that "not enforcable" =/= "illegal" (or even sick hawk).There's no law preventing you from doing it. It's just completely pointless; because if you complete the Power of Attorney electronically anybody who knows anything about law or contracts or fiduciary duty will simply ignore it... along with any instructions you might try to give them under it.Do yourself a favor by getting an attorney and doing it right.

-

Can my attorney in fact deposit checks made out to me in his bank account using my Durable Power of Attorney?

First, it depends on what the terms of the Durable Power of Attorney state; if it's a general grant of financial authority, then the attorney-in-fact can do anything that you could do with a check written out to you, including depositing it in their own bank account. Such an act may or may not violate the fiduciary duty that an attorney-in-fact owes to the party they are representing; if you believe that a fraud has occurred under color of the Power of Attorney, you should seek competent legal advice from a licensed attorney in your jurisdiction.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

Can a power of attorney document be filled out with an online signature?

In California A Power of Attorney does not require notarization unless the document to be signed by the individual holding the power itself requires notarization, for example documents affecting a transfer or encumbrance of real property. As a small business attorney I routinely prepare Limited Powers of all accomplished through email which allow me to accomplish specific tasks on the half of a client. Granting of even Limited Powers of Attorney necessarily involve a great deal of trust, and a customer should be wary of signing such a document. Peter, Oakland, California small business attorney. Not offer or intended as legal advice.

-

How do I fill out the dd form for SBI bank?

Write the name of the beneficiary in the space after “in favour of “ and the branch name where the beneficiary would encash it in the space “payable at”.Fill in the amount in words and figures and the appropriate exchange .Fill up your name and address in “Applicant's name” and sign at “ applicant's signature”

-

How can I get an internet banking user ID for the Bank of India?

It’s simple!• You just have to visit the nearest branch.• Fill up a form for internet banking activation.(This is the form which clearly asks you form providing any three convenient user ids)• In that form there, you’ll provide the suitable user Id as you want.• Within a span of 10–15 days, you will receive the userId and the password by post.• Immediately after that you can visit the Bank of India website and then net banking.• Login with userId and password provided and then change your password to something of your choice.

Create this form in 5 minutes!

How to create an eSignature for the us bank power of attorney form

How to generate an eSignature for your Us Bank Power Of Attorney Form in the online mode

How to generate an eSignature for the Us Bank Power Of Attorney Form in Chrome

How to create an eSignature for putting it on the Us Bank Power Of Attorney Form in Gmail

How to generate an electronic signature for the Us Bank Power Of Attorney Form from your smart phone

How to create an eSignature for the Us Bank Power Of Attorney Form on iOS devices

How to generate an electronic signature for the Us Bank Power Of Attorney Form on Android

People also ask

-

What is a Bank Power Of Attorney and why do I need it?

A Bank Power Of Attorney (POA) is a legal document that allows you to designate someone to manage your banking transactions on your behalf. This is particularly useful if you are unable to handle your finances due to travel, health issues, or other reasons. By using airSlate SignNow, you can easily create, sign, and manage your Bank Power Of Attorney electronically, ensuring your financial matters are handled smoothly.

-

How does airSlate SignNow simplify the process of creating a Bank Power Of Attorney?

airSlate SignNow provides a user-friendly interface that allows you to create a Bank Power Of Attorney quickly and efficiently. With customizable templates, you can easily input the necessary details and ensure your document meets all legal requirements. Plus, you can eSign it securely, saving you time and hassle.

-

What are the benefits of using airSlate SignNow for my Bank Power Of Attorney?

Using airSlate SignNow for your Bank Power Of Attorney offers several benefits, including enhanced security, ease of access, and seamless collaboration. You can sign documents from anywhere, share them with relevant parties, and store everything in one secure location. This makes managing your financial affairs straightforward and efficient.

-

Are there any costs associated with creating a Bank Power Of Attorney through airSlate SignNow?

Yes, there are costs associated with using airSlate SignNow, but they are competitive and reflect the value of the service provided. Pricing plans are designed to cater to various needs, whether you're an individual or a business needing multiple Bank Power Of Attorney documents. Explore our pricing page to find a plan that suits your requirements.

-

Can I integrate airSlate SignNow with other applications for my Bank Power Of Attorney?

Absolutely! airSlate SignNow offers integrations with various applications, making it easy to incorporate your Bank Power Of Attorney into your existing workflows. Whether you use CRM systems, cloud storage solutions, or productivity tools, our platform can enhance your document management process seamlessly.

-

Is my Bank Power Of Attorney secure with airSlate SignNow?

Yes, security is a top priority for airSlate SignNow. Your Bank Power Of Attorney and all other documents are protected with advanced encryption, ensuring that your sensitive information remains confidential. We also comply with industry standards to provide you with peace of mind when managing your legal documents.

-

How can I ensure that my Bank Power Of Attorney is legally valid?

To ensure that your Bank Power Of Attorney is legally valid, make sure to follow the specific requirements of your state or region. airSlate SignNow provides guidance and templates that comply with legal standards, helping you create a document that meets all necessary criteria. Additionally, consider having it reviewed by a legal professional for added assurance.

Get more for Bank Power Of Attorney

Find out other Bank Power Of Attorney

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word