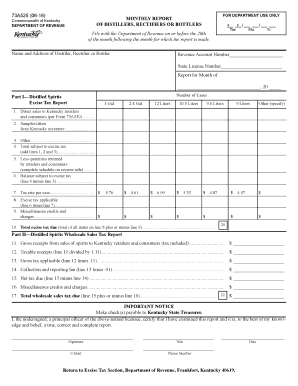

73A525 06 16 MONTHLY REPORT Commonwealth of Kentucky of Revenue Ky Form

What is the 73A525 06 16 Monthly Report Commonwealth Of Kentucky Of Revenue Ky

The 73A525 06 16 Monthly Report Commonwealth Of Kentucky Of Revenue Ky is a specific form used by businesses and organizations to report their revenue to the state of Kentucky. This form is essential for compliance with state regulations and ensures that all revenue is accurately documented for tax purposes. It serves as a financial record that helps the Commonwealth monitor economic activity and enforce tax laws effectively.

Steps to Complete the 73A525 06 16 Monthly Report Commonwealth Of Kentucky Of Revenue Ky

Completing the 73A525 06 16 Monthly Report requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including sales records and previous reports.

- Fill in the required fields accurately, ensuring that all revenue figures are correct.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate the information provided.

How to Obtain the 73A525 06 16 Monthly Report Commonwealth Of Kentucky Of Revenue Ky

The 73A525 06 16 Monthly Report can be obtained through the official Kentucky Department of Revenue website or by contacting their office directly. It is important to ensure you have the most current version of the form to avoid any compliance issues. Additionally, many businesses may have access to this form through their accounting software or tax preparation services.

Legal Use of the 73A525 06 16 Monthly Report Commonwealth Of Kentucky Of Revenue Ky

Using the 73A525 06 16 Monthly Report is a legal requirement for businesses operating in Kentucky. Failure to submit this report can result in penalties or fines. The form must be filled out completely and accurately to ensure compliance with state laws. It is advisable to keep a copy of the submitted form for your records, as it may be required for future reference or audits.

Key Elements of the 73A525 06 16 Monthly Report Commonwealth Of Kentucky Of Revenue Ky

Key elements of the 73A525 06 16 Monthly Report include:

- Business identification details, including name and address.

- Accurate revenue figures for the reporting period.

- Signature of the authorized representative.

- Date of submission.

Filing Deadlines / Important Dates

It is crucial to adhere to the filing deadlines for the 73A525 06 16 Monthly Report to avoid penalties. Typically, the report is due on the last day of the month following the reporting period. Keeping track of these deadlines ensures compliance and helps maintain good standing with the Kentucky Department of Revenue.

Quick guide on how to complete 73a525 06 16 monthly report commonwealth of kentucky of revenue ky

Complete 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to find the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without delays. Handle 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest method to alter and eSign 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky without hassle

- Obtain 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Select pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

No more misplaced or lost documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Alter and eSign 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky and ensure outstanding communication at any phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 73a525 06 16 monthly report commonwealth of kentucky of revenue ky

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky.?

The 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky. is a required document that businesses need to submit for compliance with state revenue regulations. This report helps track financial transactions and revenue collections, ensuring transparency and accountability.

-

How can airSlate SignNow assist with the 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky.?

airSlate SignNow simplifies the process of completing and submitting the 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky. by providing eSignature capabilities and secure document storage. You can easily fill out, sign, and send your monthly report directly through the platform.

-

What are the pricing plans for airSlate SignNow regarding the 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky.?

airSlate SignNow offers flexible pricing plans designed to accommodate various business needs. Whether you're an individual or a large organization, you can choose a plan that suits your budget while ensuring compliance with regulations, such as those associated with the 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky.

-

What features does airSlate SignNow include for handling digital documents like the 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky.?

Key features of airSlate SignNow include customizable templates, secure eSignatures, and cloud storage. These features allow you to create, edit, and store essential documents, including the 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky., efficiently and securely.

-

Is airSlate SignNow compliant with state regulations, specifically for the 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky.?

Yes, airSlate SignNow is designed to meet various compliance standards, making it suitable for documents like the 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky. The platform ensures that your documents are legally binding and securely stored.

-

Can I integrate airSlate SignNow with other software for the 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky.?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to streamline workflows related to the 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky. and other essential documents. This flexibility enhances productivity and simplifies document management.

-

What are the benefits of using airSlate SignNow for the 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky.?

Using airSlate SignNow for the 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky. offers benefits such as reduced turnaround times, enhanced accuracy, and improved compliance tracking. This user-friendly platform helps businesses stay organized and efficient when managing important reports.

Get more for 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky

- Www dnb combusiness directorycompany profilesthe lewisville volunteer fire department inc company profile form

- Employment application web form

- Vessa complaint form

- Click here piggly wiggly form

- Ymca springfield il form

- Illinois statewide forms certfiicate of good conduct letter to employer

- Ui findings example form cli109l

- Michael j curry summer internship application illinois gov form

Find out other 73A525 06 16 MONTHLY REPORT Commonwealth Of Kentucky OF Revenue Ky

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later