Federal IRS Income Tax Form for Tax Year 11 1231 You Can Efile This Tax Form for Tax Year Jan

Understanding the Federal IRS Income Tax Form for Tax Year 11 1231

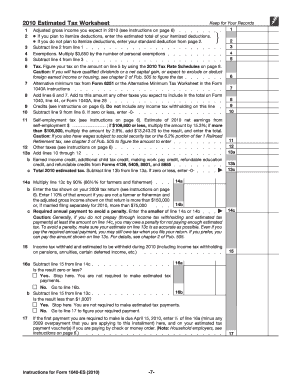

The Federal IRS Income Tax Form for Tax Year 11 1231 is a crucial document for individuals and businesses filing their taxes for the specified year. This form is used to report income, deductions, and credits to the Internal Revenue Service (IRS). It is essential for ensuring compliance with U.S. tax laws and accurately calculating tax liabilities. Understanding the purpose and requirements of this form can help taxpayers navigate their filing obligations effectively.

Steps to Complete the Federal IRS Income Tax Form for Tax Year 11 1231

Completing the Federal IRS Income Tax Form for Tax Year 11 1231 involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and other income statements.

- Determine your filing status, as this will affect your tax rates and deductions.

- Fill out the form accurately, ensuring that all information is correct and complete.

- Calculate your total income, deductions, and credits to arrive at your taxable income.

- Review the form for errors before submission to avoid delays or penalties.

How to Obtain the Federal IRS Income Tax Form for Tax Year 11 1231

Taxpayers can obtain the Federal IRS Income Tax Form for Tax Year 11 1231 through several methods. The form is available on the official IRS website, where users can download and print it for free. Additionally, many tax preparation software programs include this form, allowing for easier completion and electronic filing. Local libraries and post offices may also provide physical copies of the form during tax season.

Key Elements of the Federal IRS Income Tax Form for Tax Year 11 1231

The Federal IRS Income Tax Form for Tax Year 11 1231 includes several key elements that taxpayers must complete:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Section: Report all sources of income, including wages, interest, and dividends.

- Deductions and Credits: Include any eligible deductions and tax credits that may reduce your tax liability.

- Signature: The form must be signed and dated to validate the information provided.

Filing Deadlines for the Federal IRS Income Tax Form for Tax Year 11 1231

It is important to be aware of the filing deadlines associated with the Federal IRS Income Tax Form for Tax Year 11 1231. Typically, the due date for filing individual income tax returns is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also consider any extensions they may need to file their returns, which can provide additional time but must be requested before the original deadline.

Legal Use of the Federal IRS Income Tax Form for Tax Year 11 1231

The Federal IRS Income Tax Form for Tax Year 11 1231 is legally binding and must be filled out truthfully. Misrepresentation or fraudulent information can lead to severe penalties, including fines and legal action. Taxpayers are encouraged to keep copies of their filed forms and any supporting documentation for their records, as these may be required in the event of an audit or inquiry from the IRS.

Quick guide on how to complete federal irs income tax form for tax year 11 1231 you can efile this tax form for tax year jan

Complete [SKS] effortlessly on any device

Online document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or cover sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Modify and electronically sign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Federal IRS Income Tax Form For Tax Year 11 1231 You Can Efile This Tax Form For Tax Year Jan

Create this form in 5 minutes!

How to create an eSignature for the federal irs income tax form for tax year 11 1231 you can efile this tax form for tax year jan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Federal IRS Income Tax Form For Tax Year 11 1231?

The Federal IRS Income Tax Form For Tax Year 11 1231 is a specific tax form required for reporting income and deductions for the tax year ending on December 31. This form is essential for individuals and businesses to ensure compliance with IRS regulations. By using airSlate SignNow, you can easily eFile this tax form for tax year Jan.

-

How can I eFile the Federal IRS Income Tax Form For Tax Year 11 1231?

You can eFile the Federal IRS Income Tax Form For Tax Year 11 1231 through airSlate SignNow's user-friendly platform. Simply upload your completed form, and our system will guide you through the eFiling process. This ensures that you submit your tax form accurately and on time.

-

What are the benefits of using airSlate SignNow for eFiling tax forms?

Using airSlate SignNow for eFiling tax forms, including the Federal IRS Income Tax Form For Tax Year 11 1231, offers numerous benefits. Our platform is cost-effective, easy to navigate, and ensures secure document handling. Additionally, you can track the status of your eFiled forms in real-time.

-

Is there a cost associated with eFiling the Federal IRS Income Tax Form For Tax Year 11 1231?

Yes, there is a nominal fee for eFiling the Federal IRS Income Tax Form For Tax Year 11 1231 through airSlate SignNow. However, this cost is competitive compared to traditional filing methods, and the convenience and efficiency provided make it a worthwhile investment for your tax needs.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software, allowing you to manage your tax forms, including the Federal IRS Income Tax Form For Tax Year 11 1231, more efficiently. This integration helps streamline your workflow and ensures that all your financial documents are in one place.

-

What features does airSlate SignNow offer for tax form management?

airSlate SignNow provides a range of features for tax form management, including document templates, eSignature capabilities, and secure storage. These features make it easy to prepare and submit the Federal IRS Income Tax Form For Tax Year 11 1231. Our platform is designed to simplify the entire process for users.

-

How secure is my information when using airSlate SignNow?

Your information is highly secure when using airSlate SignNow. We employ advanced encryption and security protocols to protect your data while you eFile the Federal IRS Income Tax Form For Tax Year 11 1231. You can trust that your sensitive information is safe with us.

Get more for Federal IRS Income Tax Form For Tax Year 11 1231 You Can Efile This Tax Form For Tax Year Jan

- Office of the state attorney larry basford 14th judicial circuit of florida form

- Worthing homes mutual exchange form

- Dietary aide skills checklist form

- Family child care homesforms and documents

- Riverside pediatrics llc form

- Gp visit card application form

- Certificate of location of government corner t108n r11w form

- Statement of counterclaim and summons defendant cct 202 form

Find out other Federal IRS Income Tax Form For Tax Year 11 1231 You Can Efile This Tax Form For Tax Year Jan

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist