8697 Form December

What is the 8697 Form December

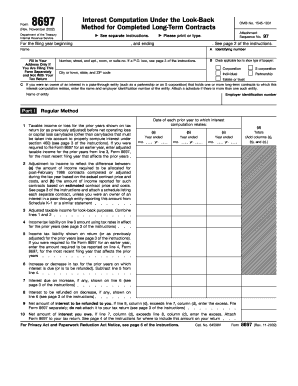

The 8697 Form December is a specific document used in the United States for tax-related purposes. This form is primarily utilized by taxpayers to report information relevant to their tax situation, particularly in December. It is important for individuals and businesses to understand the purpose of this form to ensure compliance with tax regulations.

How to use the 8697 Form December

Using the 8697 Form December involves several steps to ensure accurate completion. Taxpayers should first gather all necessary financial documents, including income statements and deductions. Once the required information is collected, individuals can fill out the form either digitally or on paper. It is essential to follow the instructions carefully to avoid errors that could lead to complications with the IRS.

Steps to complete the 8697 Form December

Completing the 8697 Form December includes the following steps:

- Gather all relevant financial documents, such as W-2s and 1099s.

- Access the form either online or through a physical copy.

- Fill in the required fields accurately, ensuring all figures are correct.

- Review the completed form for any mistakes or omissions.

- Submit the form according to the guidelines provided, either electronically or via mail.

Legal use of the 8697 Form December

The legal use of the 8697 Form December is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted within the designated time frame. Compliance with tax laws is critical, as failure to do so can result in penalties. Understanding the legal implications of this form helps ensure that taxpayers fulfill their obligations effectively.

Filing Deadlines / Important Dates

Filing deadlines for the 8697 Form December are crucial for compliance. Typically, forms must be submitted by the end of the tax year, but specific dates may vary based on individual circumstances. Taxpayers should be aware of these deadlines to avoid late fees or penalties. Keeping track of important dates ensures timely submission and adherence to IRS requirements.

Form Submission Methods (Online / Mail / In-Person)

The 8697 Form December can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission: Many taxpayers prefer to file electronically through IRS-approved software.

- Mail: The form can be printed and mailed to the appropriate IRS address.

- In-person: Some individuals may choose to deliver the form directly to a local IRS office.

Required Documents

To complete the 8697 Form December accurately, several documents are typically required. These may include:

- Income statements, such as W-2s and 1099s.

- Documentation of any deductions or credits being claimed.

- Previous tax returns for reference.

Having these documents ready can streamline the process and minimize the risk of errors.

Quick guide on how to complete 8697 form december

Accomplish 8697 Form December seamlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can locate the appropriate form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage 8697 Form December on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign 8697 Form December effortlessly

- Locate 8697 Form December and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click the Done button to save your modifications.

- Decide how you would like to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your chosen device. Edit and eSign 8697 Form December and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8697 form december

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8697 Form December and how can airSlate SignNow help?

The 8697 Form December is a specific document required for certain tax-related processes. Using airSlate SignNow, you can easily fill out, send, and electronically sign the 8697 Form December, ensuring a smooth and efficient workflow.

-

Is there a cost associated with using airSlate SignNow for the 8697 Form December?

Yes, airSlate SignNow offers a variety of pricing plans tailored to different needs. Our cost-effective solutions allow you to efficiently manage your 8697 Form December and other documents without breaking the bank.

-

What features does airSlate SignNow provide for managing the 8697 Form December?

airSlate SignNow includes powerful features like document templates, real-time tracking, and customized workflows. These tools streamline the process of handling the 8697 Form December, making it easier for you to manage your documents.

-

Can I integrate airSlate SignNow with other applications while working with the 8697 Form December?

Absolutely! airSlate SignNow offers seamless integrations with various applications, including CRM and accounting software. This allows you to efficiently process the 8697 Form December alongside your existing tools.

-

How does airSlate SignNow ensure the security of my 8697 Form December?

Security is a top priority for airSlate SignNow. We use advanced encryption methods and comply with industry standards to ensure that your 8697 Form December and other sensitive documents are fully protected.

-

What are the benefits of using airSlate SignNow for the 8697 Form December?

Using airSlate SignNow for the 8697 Form December streamlines the signing process, speeds up document turnaround, and enhances collaboration. These benefits help you save time and improve overall productivity.

-

Can I access my 8697 Form December documents on mobile devices?

Yes, airSlate SignNow offers mobile accessibility, allowing you to manage your 8697 Form December documents on the go. Whether you're in the office or away, you can access and sign documents anytime, anywhere.

Get more for 8697 Form December

- Application for immediate retirement under the civil service form

- Srsp 32 bj forms

- Mice cockroaches and rats affidavit of compliance af 6 violations form

- Chromosome mitosis meiosis review form

- California state teachers retirement system direct deposit form

- Scientific notation super teacher worksheets form

- Pdftax form

- House lease contract template form

Find out other 8697 Form December

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form