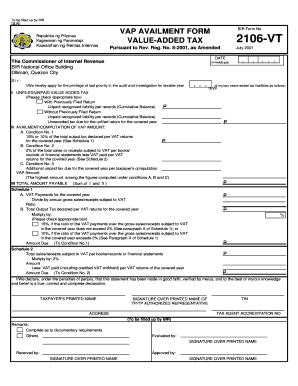

Bir Form 2107

What is the Bir Form 2107

The Bir Form 2107 is a tax-related document used primarily in the United States. It serves as a declaration of income and is essential for individuals and businesses to report their earnings accurately. This form is particularly relevant for those who are self-employed or have income from various sources. Understanding the purpose and requirements of the Bir Form 2107 is crucial for ensuring compliance with tax regulations.

How to use the Bir Form 2107

Using the Bir Form 2107 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and receipts. Next, fill out the form with precise information regarding your earnings, deductions, and any applicable credits. Once completed, review the form for accuracy before submitting it to the appropriate tax authority. Utilizing a digital platform can streamline this process, allowing for easy edits and secure submission.

Steps to complete the Bir Form 2107

Completing the Bir Form 2107 requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents, including W-2s, 1099s, and expense records.

- Enter your personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- Detail any deductions or credits you are eligible for, ensuring you have supporting documentation.

- Review the form thoroughly for any errors or omissions.

- Sign and date the form before submission.

Legal use of the Bir Form 2107

The legal use of the Bir Form 2107 is governed by tax regulations set forth by the Internal Revenue Service (IRS). To ensure that the form is legally binding, it must be filled out accurately and submitted within the specified deadlines. Digital signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. This ensures that eSigned documents hold the same legal weight as traditional paper submissions.

Key elements of the Bir Form 2107

Several key elements must be included when filling out the Bir Form 2107. These include:

- Personal Information: Name, address, and Social Security number.

- Income Details: Comprehensive reporting of all income sources.

- Deductions and Credits: Accurate documentation of any tax deductions or credits claimed.

- Signature: Required to validate the form, which can be done digitally.

Filing Deadlines / Important Dates

Filing deadlines for the Bir Form 2107 are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the following tax year. However, extensions may be available under certain circumstances. Staying informed about these dates is essential for compliance and to ensure timely processing of your tax return.

Quick guide on how to complete bir form 2107

Effortlessly Prepare Bir Form 2107 on Any Device

Digital document management has gained signNow popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Manage Bir Form 2107 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Bir Form 2107 with Ease

- Locate Bir Form 2107 and click on Get Form to begin.

- Utilize the provided tools to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred delivery method for your form—via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and eSign Bir Form 2107 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bir form 2107

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the bir form 2107 and how can airSlate SignNow help?

The bir form 2107 is a tax form used in the Philippines for income tax purposes. airSlate SignNow simplifies the process of preparing, signing, and submitting your bir form 2107 electronically. With its user-friendly interface, businesses can complete and eSign the form quickly, ensuring compliance and saving valuable time.

-

How does airSlate SignNow ensure the security of my bir form 2107?

Security is a top priority for airSlate SignNow. All documents, including your bir form 2107, are protected by bank-level encryption and secure cloud storage. This ensures that your sensitive tax information is safeguarded against unauthorized access while remaining easily accessible for your needs.

-

What are the pricing options for using airSlate SignNow to manage my bir form 2107?

airSlate SignNow offers flexible pricing plans tailored to different business needs. Users can choose from monthly or annual subscriptions based on their volume of document transactions, making it a cost-effective option for managing the bir form 2107. A free trial is also available, allowing you to explore all features before committing.

-

Can I integrate airSlate SignNow with other applications to manage my bir form 2107?

Yes, airSlate SignNow seamlessly integrates with a variety of applications such as Google Drive, Microsoft Office, and more. This integration allows for easier access and management of the bir form 2107, making document workflows efficient and effective. Enhance your productivity by combining tools that best suit your business needs.

-

What features does airSlate SignNow offer for preparing the bir form 2107?

airSlate SignNow provides robust features such as document templates, customizable fields, and automatic reminders, specifically designed for forms like the bir form 2107. These features streamline the signing process and ensure all necessary information is collected correctly and efficiently. Users can easily track the status of their documents for better management.

-

Is airSlate SignNow compliant with eSignature laws for the bir form 2107?

Absolutely! airSlate SignNow complies with electronic signature laws such as the ESIGN Act and UETA, ensuring that your eSignature on the bir form 2107 is legally binding. This compliance guarantees that your documents can be accepted by tax authorities and other parties without any issues.

-

How can I get support while using airSlate SignNow for my bir form 2107?

airSlate SignNow offers exceptional customer support through various channels including live chat, email, and a comprehensive knowledge base. Whether you're having trouble with your bir form 2107 or need guidance on features, the support team is ready to assist you. You can also find tutorials and FAQs on their website for self-help.

Get more for Bir Form 2107

- Form u 1a manufacturers data report for pressure vessels

- American legion riders application illegion form

- Snapchat law enforcement guide last updated octob form

- Himrcm screening within health program participat form

- Exchange student applicationstudy abroad form

- Heavy comsports entertainment breaking news ampamp shopping form

- Application for certified accounting technician cat status form

- Application for foreign outward remittance dear si form

Find out other Bir Form 2107

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document