Invesco Ira Beneficiary Transfer Distribution Form

What is the Invesco IRA Beneficiary Transfer Distribution Form

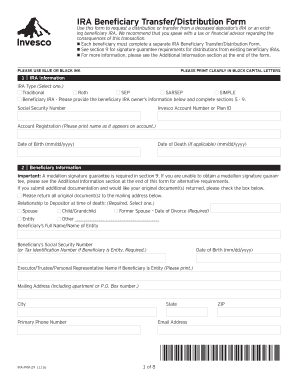

The Invesco IRA Beneficiary Transfer Distribution Form is a document used to facilitate the transfer of assets from an Invesco Individual Retirement Account (IRA) to a designated beneficiary. This form is crucial in ensuring that the distribution of funds complies with legal requirements and the specific wishes of the account holder. It outlines the details of the transfer, including the beneficiary's information and the amount to be distributed. Proper completion of this form is essential for a smooth transfer process and to avoid potential tax implications.

How to use the Invesco IRA Beneficiary Transfer Distribution Form

Using the Invesco IRA Beneficiary Transfer Distribution Form involves several straightforward steps. First, gather all necessary information about the IRA account and the beneficiary. Next, fill out the form accurately, ensuring that all required fields are completed. After filling out the form, review it for any errors or omissions. Once confirmed, submit the form as directed, either online or via mail, depending on Invesco's guidelines. It is advisable to keep a copy of the completed form for your records.

Steps to complete the Invesco IRA Beneficiary Transfer Distribution Form

Completing the Invesco IRA Beneficiary Transfer Distribution Form requires attention to detail. Follow these steps for successful completion:

- Identify the type of distribution you are requesting, such as a full or partial transfer.

- Provide your personal information, including your name, address, and account number.

- Enter the beneficiary's details, ensuring accuracy in spelling and contact information.

- Specify the amount to be transferred and any specific instructions regarding the distribution.

- Sign and date the form to validate your request.

- Submit the form according to Invesco's submission guidelines.

Legal use of the Invesco IRA Beneficiary Transfer Distribution Form

The legal use of the Invesco IRA Beneficiary Transfer Distribution Form is governed by federal regulations regarding retirement accounts. This form must be completed accurately to ensure compliance with the Internal Revenue Service (IRS) rules. It is essential to understand that improper completion can lead to delays in the transfer process or unintended tax consequences. By adhering to the legal requirements and ensuring that all necessary signatures are obtained, account holders can facilitate a smooth transfer to their beneficiaries.

Key elements of the Invesco IRA Beneficiary Transfer Distribution Form

Several key elements are essential for the Invesco IRA Beneficiary Transfer Distribution Form to be valid and effective:

- Account Holder Information: This includes the name, address, and account number of the individual requesting the transfer.

- Beneficiary Information: Accurate details about the beneficiary, including their name, relationship to the account holder, and contact information.

- Distribution Amount: Clearly specify the amount to be transferred, whether it is a full or partial distribution.

- Signatures: The form must be signed and dated by the account holder to validate the request.

Form Submission Methods

The Invesco IRA Beneficiary Transfer Distribution Form can be submitted through various methods, depending on the preferences of the account holder. Common submission methods include:

- Online Submission: Many users prefer to submit the form electronically through Invesco's secure online portal.

- Mail: Alternatively, the completed form can be printed and mailed to the designated Invesco address.

- In-Person: Some individuals may choose to deliver the form in person at an Invesco branch or office.

Quick guide on how to complete invesco ira beneficiary transfer distribution form

Effortlessly Create Invesco Ira Beneficiary Transfer Distribution Form on Any Gadget

Managing documents online has gained popularity among businesses and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, as you can obtain the correct format and securely save it online. airSlate SignNow equips you with all the resources necessary to produce, modify, and electronically sign your documents quickly without delays. Manage Invesco Ira Beneficiary Transfer Distribution Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign Invesco Ira Beneficiary Transfer Distribution Form with Ease

- Locate Invesco Ira Beneficiary Transfer Distribution Form and click Get Form to commence.

- Utilize the tools available to submit your document.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Invesco Ira Beneficiary Transfer Distribution Form and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the invesco ira beneficiary transfer distribution form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Invesco IRA beneficiary transfer distribution form?

The Invesco IRA beneficiary transfer distribution form is a critical document used to designate and transfer IRA funds to beneficiaries following the account holder's death. This form ensures that the assets are distributed according to the account holder's wishes. Having this form completed accurately helps in efficient transfer and compliance with regulations.

-

How do I obtain the Invesco IRA beneficiary transfer distribution form?

You can easily obtain the Invesco IRA beneficiary transfer distribution form through the Invesco website or by contacting their customer service directly. Many financial institutions provide downloadable forms or can mail them to you upon request. This accessibility helps ensure that you have the necessary documentation to manage your IRA efficiently.

-

What information is needed to complete the Invesco IRA beneficiary transfer distribution form?

To complete the Invesco IRA beneficiary transfer distribution form, you will need the account owner's information, the beneficiaries' details, and the specific distribution instructions. It's crucial to provide accurate information to avoid delays in processing the transfer. Furthermore, ensure you have the necessary identification and signatures as required by Invesco.

-

Are there any fees associated with processing the Invesco IRA beneficiary transfer distribution form?

Typically, there are no fees directly associated with submitting the Invesco IRA beneficiary transfer distribution form; however, it's advisable to check with your financial institution for any potential charges. Some firms might have administrative fees for processing transfers or distributions. Understanding these costs upfront can help you manage your finances better.

-

What are the benefits of using the Invesco IRA beneficiary transfer distribution form?

Utilizing the Invesco IRA beneficiary transfer distribution form ensures that your heirs receive the intended benefits from your IRA in a timely manner. This form simplifies the transfer process, minimizes confusion, and helps in compliance with tax regulations. Additionally, it can aid in avoiding probate, allowing your beneficiaries quicker access to their inheritance.

-

Can I eSign the Invesco IRA beneficiary transfer distribution form?

Yes, airSlate SignNow provides an efficient way to eSign the Invesco IRA beneficiary transfer distribution form, making the process seamless and paperless. Digital signatures are legally recognized and provide a secure method for signing important documents. Using eSignature solutions also speeds up the transfer process for both you and your beneficiaries.

-

How do I submit the completed Invesco IRA beneficiary transfer distribution form?

Once you have filled out and signed the Invesco IRA beneficiary transfer distribution form, you can submit it as instructed on the form itself. This typically involves mailing it to the designated address or submitting it electronically via your financial institution's online portal. Double-check that all required sections are complete to avoid any delays.

Get more for Invesco Ira Beneficiary Transfer Distribution Form

- Rent statement leadmarketercom form

- Technical standards for the building analyst professional bpi bpi form

- Provisional agreement for sale and purchase zero agent property form

- Landlord tenant forms

- Brinks global services low value parcel form

- National motor freight traffic association scac form

- Your order a return form is included in your parce

- Brown trucking company brown integrated logistics form

Find out other Invesco Ira Beneficiary Transfer Distribution Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form