Bdmpc Loan Requirements Form

What are the bdmpc loan requirements?

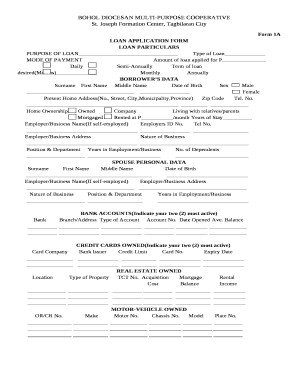

The bdmpc loan requirements are essential criteria that applicants must meet to qualify for a loan from the Bohol Diocesan Multi-Purpose Cooperative (BDMPC). These requirements typically include proof of identity, income verification, and membership status within the cooperative. Applicants may need to provide documentation such as a valid government-issued ID, recent pay stubs or bank statements, and proof of membership in the BDMPC. Understanding these requirements is crucial for a smooth application process.

How to obtain the bdmpc loan requirements

To obtain the bdmpc loan requirements, individuals should visit the official BDMPC website or contact the cooperative directly. The website often contains detailed information about the necessary documentation and eligibility criteria. Additionally, prospective borrowers can reach out to the BDMPC contact number for personalized assistance. This step ensures that applicants have the most accurate and up-to-date information regarding the loan application process.

Steps to complete the bdmpc loan requirements

Completing the bdmpc loan requirements involves several key steps. First, ensure that you meet the eligibility criteria by reviewing the requirements outlined by the BDMPC. Next, gather all necessary documents, including identification and proof of income. Once your documentation is ready, fill out the loan application form accurately. After submission, monitor your application status and be prepared to provide any additional information if requested by the cooperative.

Key elements of the bdmpc loan requirements

Key elements of the bdmpc loan requirements include the applicant's financial stability, membership duration with BDMPC, and the purpose of the loan. Financial stability is assessed through income verification, while membership duration may influence the loan amount and terms. Additionally, applicants must clearly state the purpose of the loan, whether for personal use, business expansion, or educational expenses, as this can affect approval decisions.

Eligibility criteria for the bdmpc loan

Eligibility criteria for the bdmpc loan typically include being a registered member of the BDMPC, meeting minimum income requirements, and having a good credit history. Members may also need to demonstrate their ability to repay the loan through stable income sources. It is essential for applicants to review these criteria carefully to ensure they qualify before applying for a loan.

Application process and approval time for the bdmpc loan

The application process for the bdmpc loan begins with gathering the required documents and completing the application form. Once submitted, the BDMPC will review the application, which may take several days to weeks, depending on the volume of applications and the complexity of individual cases. Applicants should remain in contact with the cooperative to receive updates on their application status and any additional steps needed for approval.

Quick guide on how to complete bdmpc loan requirements

Effortlessly Prepare Bdmpc Loan Requirements on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Bdmpc Loan Requirements on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Bdmpc Loan Requirements with Ease

- Find Bdmpc Loan Requirements and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from the device of your choice. Modify and electronically sign Bdmpc Loan Requirements while ensuring effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bdmpc loan requirements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the main bdmpc loan requirements?

The primary bdmpc loan requirements typically include being a registered business, having a good credit score, and providing necessary financial documentation. It's essential to ensure that you meet these criteria before applying, as they help facilitate a smoother approval process. Additionally, maintaining a consistent cash flow can increase your chances of meeting the bdmpc loan requirements.

-

How can airSlate SignNow assist with meeting bdmpc loan requirements?

airSlate SignNow can streamline the documentation process required to meet bdmpc loan requirements. By allowing you to easily send, sign, and manage your financial documents online, it helps ensure that all paperwork is organized and compliant. This efficiency can save you time and mitigate errors that could delay your loan application.

-

Are there any costs associated with using airSlate SignNow for bdmpc loan documentation?

Yes, while airSlate SignNow offers pricing plans tailored to different business needs, the costs are designed to be affordable and cost-effective. Understanding the bdmpc loan requirements is crucial as some plans may have features that specifically aid in meeting these requirements. Consider the potential cost savings through improved efficiency when using our platform.

-

What features does airSlate SignNow offer for handling bdmpc loan requirements?

airSlate SignNow provides a range of features specifically designed to handle bdmpc loan requirements, such as eSigning, document templates, and secure cloud storage. These features simplify the document preparation and signing process, ensuring that all necessary forms are completed correctly. This helps you stay compliant while expediting the loan application process.

-

How does airSlate SignNow enhance security for bdmpc loan documents?

To protect your sensitive information related to bdmpc loan requirements, airSlate SignNow employs advanced security measures such as encryption and secure access controls. This ensures that only authorized users can access your documents. By using our platform, you can confidently manage your loan documentation without concerns about data bsignNowes.

-

Can I integrate airSlate SignNow with other financial tools to assist with bdmpc loan requirements?

Absolutely! airSlate SignNow offers integrations with various financial tools and software that can help you streamline compliance with bdmpc loan requirements. This interoperability can enhance your overall productivity while ensuring that all documents remain synchronized across platforms, making the application process hassle-free.

-

What are the benefits of using airSlate SignNow for bdmpc loan purposes?

Using airSlate SignNow for bdmpc loan requirements comes with numerous benefits, including speed, efficiency, and enhanced organization of your documents. It allows you to quickly send and receive signed documents, eliminating the delay often associated with traditional paper processes. This agility can be crucial when navigating the necessary steps for loan approval.

Get more for Bdmpc Loan Requirements

Find out other Bdmpc Loan Requirements

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form