Alabama Dept of Revenue Form Nr Af2

What is the Alabama Dept Of Revenue Form NR AF2

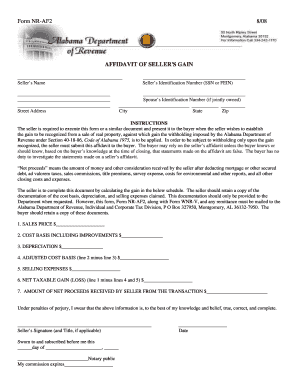

The Alabama Dept of Revenue Form NR AF2 is a specific document utilized for tax purposes within the state of Alabama. This form is primarily designed for non-residents who need to report income earned in Alabama. It plays a crucial role in ensuring compliance with state tax regulations and allows the Alabama Department of Revenue to accurately assess tax obligations for individuals who do not reside in the state but have earned income there.

How to use the Alabama Dept Of Revenue Form NR AF2

Using the Alabama Dept of Revenue Form NR AF2 involves several steps. First, individuals must ensure they meet the eligibility criteria for filing this form, typically involving non-resident status. Next, gather all necessary documentation, such as income statements and any applicable deductions. The form should be completed accurately, detailing all sources of income earned in Alabama. Once the form is filled out, it can be submitted through the appropriate channels, ensuring compliance with state deadlines.

Steps to complete the Alabama Dept Of Revenue Form NR AF2

Completing the Alabama Dept of Revenue Form NR AF2 requires careful attention to detail. Begin by downloading the form in PDF format from the Alabama Department of Revenue website. Fill in personal information, including your name, address, and Social Security number. Next, report your income from Alabama sources, ensuring you include all relevant figures. If applicable, enter any deductions or credits you may qualify for. Review the form for accuracy before signing and dating it. Finally, submit the form according to the specified submission methods.

Legal use of the Alabama Dept Of Revenue Form NR AF2

The legal use of the Alabama Dept of Revenue Form NR AF2 hinges on its adherence to state tax laws. This form must be completed and submitted by the designated deadlines to avoid penalties. It serves as a formal declaration of income and tax liability for non-residents, making it essential for compliance with Alabama tax regulations. Failure to use this form correctly can result in legal repercussions, including fines or audits by the Alabama Department of Revenue.

Key elements of the Alabama Dept Of Revenue Form NR AF2

Key elements of the Alabama Dept of Revenue Form NR AF2 include personal identification information, a detailed account of income earned in Alabama, and any deductions or credits applicable to the filer. The form also requires signatures to validate the information provided. Understanding these key components is vital for ensuring the form is completed accurately and submitted on time.

Form Submission Methods

The Alabama Dept of Revenue Form NR AF2 can be submitted through various methods, including online, by mail, or in person. For online submissions, filers can use the Alabama Department of Revenue's electronic filing system. If submitting by mail, ensure the form is sent to the correct address provided by the department. In-person submissions may be made at designated offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete alabama dept of revenue form nr af2

Effortlessly Prepare Alabama Dept Of Revenue Form Nr Af2 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, amend, and electronically sign your documents swiftly without delays. Handle Alabama Dept Of Revenue Form Nr Af2 on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Amend and Electronically Sign Alabama Dept Of Revenue Form Nr Af2 Effortlessly

- Obtain Alabama Dept Of Revenue Form Nr Af2 and click on Get Form to begin.

- Utilize the available tools to fill out your form.

- Emphasize key sections of the documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your chosen device. Edit and electronically sign Alabama Dept Of Revenue Form Nr Af2 and guarantee excellent communication throughout any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alabama dept of revenue form nr af2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the af2 form in airSlate SignNow?

The af2 form in airSlate SignNow is a digital document designed for efficient signing and management. It allows users to upload, send, and eSign documents securely and seamlessly. This form can streamline your document workflows, ensuring faster processing times.

-

How much does it cost to use the af2 form feature in airSlate SignNow?

Pricing for the af2 form feature in airSlate SignNow varies based on the subscription plan chosen. While we offer various cost-effective options, you can start with a free trial to assess the functionality of the af2 form and see how it can benefit your business.

-

What features are included with the af2 form in airSlate SignNow?

The af2 form in airSlate SignNow includes features like user-friendly templates, customizable fields, and automated notifications. These features enhance the signing experience and help you track document statuses easily. Moreover, you can integrate the af2 form with other apps to simplify your workflows.

-

Can I integrate the af2 form with other software?

Yes, airSlate SignNow allows seamless integration of the af2 form with various third-party software applications. You can connect it with CRM systems, cloud storage, and other productivity tools to streamline your document processes. These integrations empower businesses with a holistic approach to document management.

-

How does the af2 form improve business efficiency?

The af2 form in airSlate SignNow enhances business efficiency by simplifying document workflows and reducing turnaround times. With its easy-to-use interface, users can quickly send and sign documents, thus eliminating delays associated with traditional paper processes. This leads to faster decision-making and increased productivity.

-

Is the af2 form secure for sensitive documents?

Absolutely! The af2 form in airSlate SignNow employs advanced encryption and security features to protect sensitive documents. With secure access controls and audit trails, you can be assured that your data is safe and compliant with industry regulations while using the af2 form.

-

What types of documents can I create using the af2 form?

The af2 form in airSlate SignNow can be used to create a variety of documents, including contracts, agreements, and consent forms. Its versatility enables businesses to tailor documents to their specific needs while ensuring that they are legally binding and secure. This adaptability is a key benefit of using the af2 form.

Get more for Alabama Dept Of Revenue Form Nr Af2

- Fl 220 response to petition to determine parental relationship form

- Motion for contemptcontempt citation 679512075 form

- Pg 210 guardianship annual report form

- De 310 petition to determine succession to real property form

- Filing motions in jdr vbgov com city of virginia beach form

- Report of suspected dependent adultelder form

- Order after hearing on form jv 180 request to change

- Fl 350 stipulation to establish or modify child support and order form

Find out other Alabama Dept Of Revenue Form Nr Af2

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy