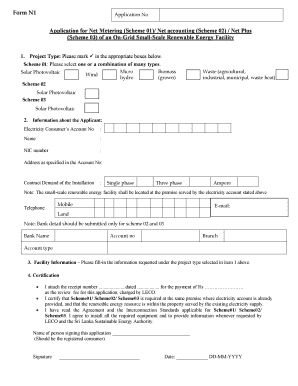

Application for Net Metering Scheme 01 Net Accounting Scheme Form

Understanding the Application for Net Metering Scheme 01 Net Accounting Scheme

The Application for Net Metering Scheme 01 Net Accounting Scheme is a formal request used by individuals and businesses to participate in net metering programs. These programs allow users to generate their own electricity, typically through solar panels, and receive credits for any excess energy they supply back to the grid. The application is essential for ensuring that participants can take advantage of financial incentives and reduce their energy costs.

Steps to Complete the Application for Net Metering Scheme 01 Net Accounting Scheme

Completing the application involves several key steps:

- Gather necessary information: Collect details about your energy consumption, the type of renewable energy system you plan to install, and any relevant permits.

- Fill out the application form: Provide accurate information in all required fields, ensuring that all data is current and truthful.

- Review your application: Double-check for any errors or omissions that could delay processing.

- Submit the application: Follow the specified submission method, whether online, by mail, or in person.

Legal Use of the Application for Net Metering Scheme 01 Net Accounting Scheme

The application must comply with local and federal regulations governing net metering. In the United States, these regulations are designed to protect both the consumer and the utility provider. Legal use ensures that the application is processed efficiently and that the participant receives the appropriate credits for energy produced. It is essential to understand the legal framework, including compliance with the ESIGN Act and UETA, which govern electronic signatures and documentation.

Required Documents for the Application for Net Metering Scheme 01 Net Accounting Scheme

When preparing to submit the application, certain documents are typically required:

- Proof of identity: This may include a government-issued ID or utility bill.

- Energy consumption history: Documentation of past energy usage to support the application.

- System specifications: Details about the renewable energy system, including manufacturer information and installation plans.

- Permits and approvals: Any local permits or approvals required for installation must be included.

Eligibility Criteria for the Application for Net Metering Scheme 01 Net Accounting Scheme

Eligibility for the net accounting scheme varies by state and utility provider. Generally, the following criteria must be met:

- Type of renewable energy system: The system must be approved for net metering, such as solar or wind.

- Installation size: There may be limits on the maximum capacity of the system eligible for net metering.

- Utility service area: Applicants must reside within the service area of a utility that offers net metering.

Application Process & Approval Time for the Application for Net Metering Scheme 01 Net Accounting Scheme

The application process typically involves several stages:

- Submission: Once the application is submitted, it enters the review phase.

- Review period: The utility provider will review the application, which can take anywhere from a few weeks to several months, depending on the complexity and volume of applications.

- Approval notification: Once approved, the applicant will receive a notification detailing the next steps for installation and activation of the net metering system.

Quick guide on how to complete application for net metering scheme 01 net accounting scheme

Complete Application For Net Metering Scheme 01 Net Accounting Scheme effortlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Application For Net Metering Scheme 01 Net Accounting Scheme on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Application For Net Metering Scheme 01 Net Accounting Scheme effortlessly

- Find Application For Net Metering Scheme 01 Net Accounting Scheme and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and eSign Application For Net Metering Scheme 01 Net Accounting Scheme and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for net metering scheme 01 net accounting scheme

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the net accounting scheme?

The net accounting scheme is a simplified accounting method that allows businesses to report their VAT more efficiently. It enables companies to pay VAT on their sales minus any VAT they have paid on purchases, simplifying the accounting process and easing administrative burdens.

-

How does airSlate SignNow support businesses using the net accounting scheme?

airSlate SignNow streamlines the documentation process for businesses using the net accounting scheme by providing electronic signatures and easy document management. This helps ensure that all necessary receipts and invoices are accurately signed and stored, which is essential for VAT reporting.

-

Is airSlate SignNow compliant with the net accounting scheme regulations?

Yes, airSlate SignNow is designed to comply with current regulations surrounding the net accounting scheme. Our platform ensures that all eSigned documents meet legal requirements, helping businesses stay compliant with VAT reporting.

-

What are the pricing options for airSlate SignNow for users implementing the net accounting scheme?

airSlate SignNow offers various pricing plans to accommodate different business sizes and needs. Each plan includes features that support the net accounting scheme, allowing users to choose the best fit for their budget and operational requirements.

-

Can airSlate SignNow integrate with existing accounting software for the net accounting scheme?

Absolutely! airSlate SignNow integrates seamlessly with various leading accounting software, making it easier for businesses using the net accounting scheme to synchronize their documents and financial records. This integration helps maintain accurate financial reporting and simplifies the VAT submission process.

-

What features does airSlate SignNow offer that benefit businesses on the net accounting scheme?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSignatures that specifically benefit businesses following the net accounting scheme. These features enhance efficiency in document handling and enable businesses to focus on growth rather than administrative tasks.

-

How can businesses ensure the security of their documents related to the net accounting scheme when using airSlate SignNow?

airSlate SignNow is built with state-of-the-art security protocols, ensuring that all documents related to the net accounting scheme are securely stored and transmitted. With features like encryption and secure user authentication, businesses can have peace of mind knowing their sensitive financial documents are protected.

Get more for Application For Net Metering Scheme 01 Net Accounting Scheme

- End of year staff appraisal form government of belize

- Statement of claimant or other person example form

- Jrotc certificate of completion form

- Analytic geometry eoc practice questions form

- Canara hsbc oriental bank of commerce life insurance pradhan mantri jeevan jyoti bima yojana form

- Course repetition request long beach city college form

- Transcript request form suny schenectady

- Expanded adept 4 0 formative observation form updated

Find out other Application For Net Metering Scheme 01 Net Accounting Scheme

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS