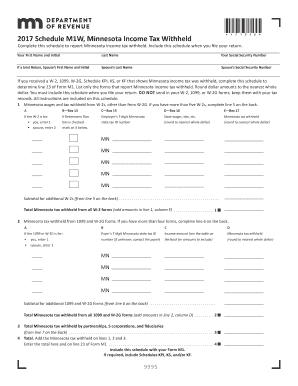

M1W, Minnesota Income Tax Withheld Form

What is the M1W, Minnesota Income Tax Withheld

The M1W form, officially known as the Minnesota Income Tax Withheld, is a crucial document for individuals and businesses in Minnesota. It is used to report the state income tax that has been withheld from employees' wages and other payments. This form is essential for ensuring compliance with state tax regulations and for accurately reporting withholding amounts to the Minnesota Department of Revenue.

How to use the M1W, Minnesota Income Tax Withheld

Using the M1W form involves several steps. First, employers must gather information regarding the total amount of income tax withheld from their employees' wages. This includes wages, salaries, and other compensation. Once the necessary data is collected, employers can fill out the M1W form, ensuring that all figures are accurate. After completing the form, it must be submitted to the Minnesota Department of Revenue by the designated deadline.

Steps to complete the M1W, Minnesota Income Tax Withheld

Completing the M1W form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant payroll records for the reporting period.

- Calculate the total amount of state income tax withheld from each employee's wages.

- Fill out the M1W form, entering the total withholding amounts accurately.

- Review the completed form for any errors or omissions.

- Submit the form to the Minnesota Department of Revenue by the deadline.

Legal use of the M1W, Minnesota Income Tax Withheld

The M1W form serves a legal purpose in the context of Minnesota tax law. It is required for compliance with state regulations regarding income tax withholding. Employers must ensure that they file this form accurately and on time to avoid potential penalties. The information reported on the M1W is used by the state to verify that the correct amount of tax has been withheld from employees' earnings.

Filing Deadlines / Important Dates

Filing deadlines for the M1W form are critical for compliance. Typically, the form must be submitted quarterly, with specific deadlines set by the Minnesota Department of Revenue. It is important for employers to stay informed about these dates to ensure timely filing and avoid late fees. Common deadlines include:

- Quarterly submissions due on the last day of the month following the end of each quarter.

Form Submission Methods (Online / Mail / In-Person)

The M1W form can be submitted through various methods, providing flexibility for employers. Options include:

- Online submission through the Minnesota Department of Revenue's e-Services portal.

- Mailing a paper copy of the completed form to the appropriate state office.

- In-person submission at designated Minnesota Department of Revenue locations.

Key elements of the M1W, Minnesota Income Tax Withheld

Understanding the key elements of the M1W form is essential for accurate completion. Important components include:

- Employer identification information, including name and tax ID number.

- Total amount of state income tax withheld during the reporting period.

- Contact information for the employer.

Quick guide on how to complete 2017 m1w minnesota income tax withheld

Effortlessly Prepare M1W, Minnesota Income Tax Withheld on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the necessary forms and securely store them online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly without any hold-ups. Manage M1W, Minnesota Income Tax Withheld on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

The easiest way to alter and electronically sign M1W, Minnesota Income Tax Withheld with ease

- Find M1W, Minnesota Income Tax Withheld and click on Get Form to begin.

- Use the tools available to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending the form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign M1W, Minnesota Income Tax Withheld while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

Create this form in 5 minutes!

How to create an eSignature for the 2017 m1w minnesota income tax withheld

How to make an eSignature for the 2017 M1w Minnesota Income Tax Withheld in the online mode

How to make an eSignature for the 2017 M1w Minnesota Income Tax Withheld in Google Chrome

How to generate an electronic signature for putting it on the 2017 M1w Minnesota Income Tax Withheld in Gmail

How to make an eSignature for the 2017 M1w Minnesota Income Tax Withheld from your smartphone

How to generate an eSignature for the 2017 M1w Minnesota Income Tax Withheld on iOS

How to create an eSignature for the 2017 M1w Minnesota Income Tax Withheld on Android OS

People also ask

-

What is the M1W, Minnesota Income Tax Withheld form?

The M1W, Minnesota Income Tax Withheld form is a document used by employers to report the total amount of state income tax withheld from employee earnings. This form is essential for compliance with Minnesota tax laws, ensuring that employees receive proper credit for taxes withheld throughout the year.

-

How can airSlate SignNow help with M1W, Minnesota Income Tax Withheld management?

airSlate SignNow offers a streamlined solution for managing M1W, Minnesota Income Tax Withheld forms by allowing users to easily create, send, and obtain electronic signatures on tax documents. This simplifies the process, minimizes paperwork, and ensures that all tax forms are securely stored and easily accessible.

-

Is airSlate SignNow cost-effective for handling M1W, Minnesota Income Tax Withheld forms?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to manage M1W, Minnesota Income Tax Withheld forms. With competitive pricing plans and the elimination of paper-related expenses, businesses can save time and money while ensuring compliance with tax regulations.

-

What features does airSlate SignNow offer for M1W, Minnesota Income Tax Withheld forms?

airSlate SignNow includes features such as customizable templates, electronic signatures, and automated workflows specifically designed for M1W, Minnesota Income Tax Withheld forms. These features enhance efficiency and accuracy, making it easier for businesses to stay organized and compliant with tax requirements.

-

Can I integrate airSlate SignNow with my payroll software for M1W, Minnesota Income Tax Withheld?

Absolutely! airSlate SignNow integrates seamlessly with various payroll software solutions, making it easier to manage M1W, Minnesota Income Tax Withheld forms. This integration allows for automatic data population, reducing the risk of errors and ensuring that tax documents are always up to date.

-

What are the benefits of using airSlate SignNow for M1W, Minnesota Income Tax Withheld?

Using airSlate SignNow for M1W, Minnesota Income Tax Withheld offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. The platform's user-friendly interface and secure document management help businesses focus on their core operations while ensuring tax obligations are met.

-

Is airSlate SignNow secure for handling sensitive M1W, Minnesota Income Tax Withheld information?

Yes, airSlate SignNow prioritizes security and protects sensitive M1W, Minnesota Income Tax Withheld information through advanced encryption and secure data storage. Businesses can trust that their tax documents are safe and secure while being easily accessible when needed.

Get more for M1W, Minnesota Income Tax Withheld

- Notification of compliance status for boiler tune ups form

- Alternate w 9 form

- Nhjb 2117 p 2011 form

- Nhjb 2297 supreme form

- Nhjb 2165 p form

- Nh dra form dp2848 2006

- Cfwb 012 application for child care assistance cfwb 012 application for child care assistance form

- Homestead or property tax refund for homeowners instruction booklet rev 9 26 25 form

Find out other M1W, Minnesota Income Tax Withheld

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free