Notification of Compliance Status for Boiler Tune Ups Form 2013

What is the Notification Of Compliance Status For Boiler Tune Ups Form

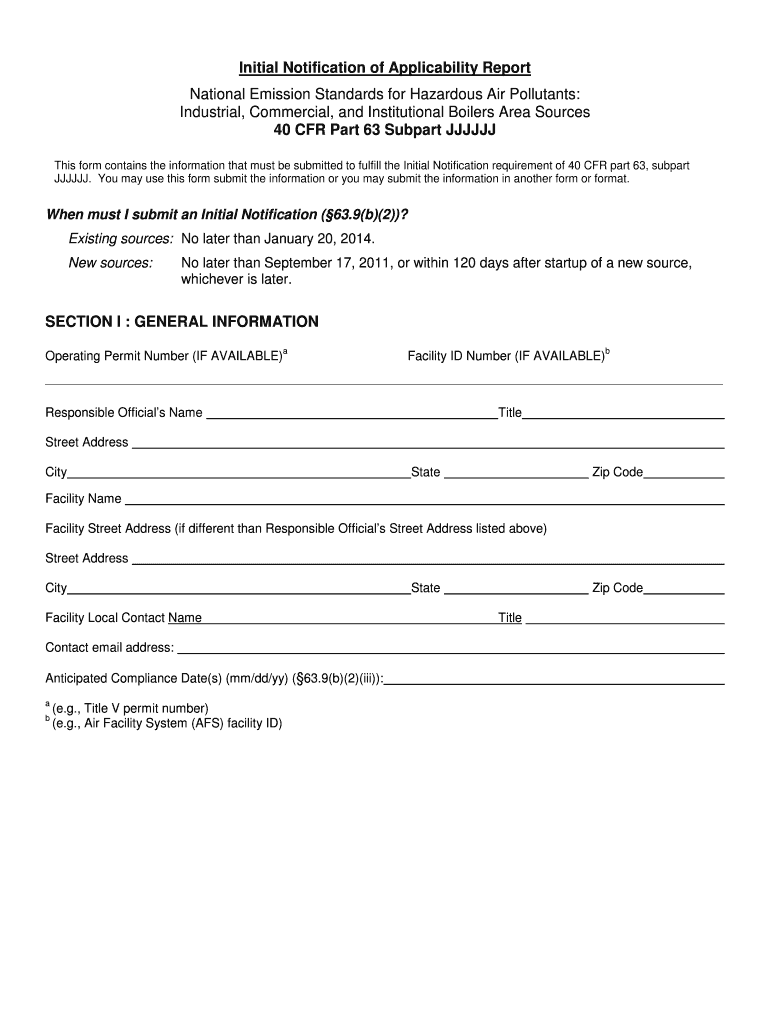

The Notification of Compliance Status for Boiler Tune Ups form is a crucial document that businesses must complete to demonstrate adherence to the regulations outlined in 40 CFR 63 Subpart JJJJJJ. This form serves as a formal declaration that a facility has conducted the necessary boiler tune-ups and is in compliance with the applicable emissions standards. It is essential for maintaining operational legitimacy and avoiding potential penalties associated with non-compliance.

How to use the Notification Of Compliance Status For Boiler Tune Ups Form

Using the Notification of Compliance Status for Boiler Tune Ups form involves several key steps. First, gather all relevant data regarding your boiler operations, including maintenance records and emissions test results. Next, fill out the form accurately, ensuring that all required fields are complete. Once the form is filled out, submit it to the appropriate regulatory agency as specified in the instructions. It is advisable to keep a copy for your records, as this may be needed for future compliance checks.

Steps to complete the Notification Of Compliance Status For Boiler Tune Ups Form

Completing the Notification of Compliance Status for Boiler Tune Ups form requires careful attention to detail. Follow these steps to ensure proper completion:

- Review the form to understand all required information.

- Collect documentation that supports your compliance status, such as boiler maintenance logs and emissions data.

- Fill in all necessary fields, ensuring accuracy in reporting your boiler tune-up activities.

- Double-check the form for any errors or omissions.

- Submit the completed form to the designated agency, either electronically or via mail, as per the guidelines.

Legal use of the Notification Of Compliance Status For Boiler Tune Ups Form

The legal use of the Notification of Compliance Status for Boiler Tune Ups form is governed by federal and state regulations. This form must be completed and submitted to demonstrate compliance with the emissions standards set forth in 40 CFR 63 Subpart JJJJJJ. It is important to ensure that the information provided is truthful and accurate, as any discrepancies can lead to legal repercussions, including fines or enforcement actions. Maintaining proper records and documentation is essential for legal protection and compliance verification.

Key elements of the Notification Of Compliance Status For Boiler Tune Ups Form

Key elements of the Notification of Compliance Status for Boiler Tune Ups form include:

- Facility identification information, including name and address.

- Details of the boiler(s) being tuned, including model and serial numbers.

- Dates of the tune-ups performed.

- Results of emissions testing, if applicable.

- Signature of the responsible official certifying the accuracy of the information.

Penalties for Non-Compliance

Failure to submit the Notification of Compliance Status for Boiler Tune Ups form or inaccuracies in the information provided can result in significant penalties. Regulatory agencies may impose fines, require corrective actions, or initiate enforcement proceedings against non-compliant facilities. It is crucial for businesses to adhere to the submission deadlines and ensure that the form is completed accurately to avoid these potential consequences.

Quick guide on how to complete notification of compliance status for boiler tune ups form

Complete Notification Of Compliance Status For Boiler Tune Ups Form effortlessly on any device

Managing documents online has gained immense popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the features required to create, edit, and eSign your documents quickly and without interruptions. Handle Notification Of Compliance Status For Boiler Tune Ups Form on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Notification Of Compliance Status For Boiler Tune Ups Form seamlessly

- Obtain Notification Of Compliance Status For Boiler Tune Ups Form and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize essential sections of your documents or redact sensitive details using tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to secure your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any preferred device. Edit and eSign Notification Of Compliance Status For Boiler Tune Ups Form and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct notification of compliance status for boiler tune ups form

FAQs

-

If a foreign citizen lives in the US on a working visa for more than a year, then what is his status? What tax form will such a person fill out when filing for taxes at the end of the tax year? Is the 1040NR the form to fill out?

In most situations, a person who is physically present in the United States for at least 183 days out of any calendar year is a US resident for tax purposes and must file Form 1040 as a tax resident. There are exceptions to this general rule, but none of them apply to people who are present in the United States in H-1B (guest worker) status. Furthermore, H-1B workers are categorically resident aliens for tax purposes and must pay taxes on the income they earn while in H-1B status as a resident alien in every year in which they earn more than the personal exemption limit. This includes both the first year and last year, even if the first or last year contains less than 183 days of residence in the United States. The short years may result in a filing as a “dual-status” alien.An H-1B worker will therefore only file Form 1040NR as his or her primary tax return in the tax year in which he or she leaves the United States permanently, and all US-connected income during that year will be taxed as if the taxpayer was a US resident, under the dual-status rules. All other tax returns during that person’s residence in the United States will be on Form 1040. The first year’s return may be under dual-status rules, with a Form 1040NR attached as a “dual status statement” as per the procedure in Chapter 6 of Publication 519 (2016), U.S. Tax Guide for Aliens. A person who resides the entire year in the United States in H-1B status may not use Form 1040NR, and is required to pay US income tax on his or her worldwide income, excepting only that income which is subject to protection under a tax treaty.See Publication 519 (2016), U.S. Tax Guide for Aliens for more information. The use of a tax professional, especially in the first and last year of H-1B status, is highly recommended as completing a dual-status return correctly is exceedingly challenging.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

-

I'm the founder of a new startup and recently I heard that when I employ someone, I need to fill out form I-9 for them. The employee needs to fill it out, but I also need to check their identity and status. Is it true that I am required to do that? Is it true that all companies, even big companies that employ thousands of people, do this?

In addition to both you and the employee filling out the form, you need to do it within a certain time period, usually the first day of work for the employee. And as mentioned, you do need to keep them on file in case of an audit. You need to examine their eligibility documents (most often their passport, or their driver's license and social security card, and the list of acceptable documents is included on the form). You just need to make sure it looks like it's the same person and that they aren't obvious fakes.You can find the forms as well as instructions on how to fill them out here: Employment Eligibility Verification | USCIS On the plus side, I-9's aren't hard or time-consuming to do. Once you get the hang of it, it only takes a few minutes.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the notification of compliance status for boiler tune ups form

How to make an electronic signature for your Notification Of Compliance Status For Boiler Tune Ups Form in the online mode

How to generate an eSignature for your Notification Of Compliance Status For Boiler Tune Ups Form in Chrome

How to generate an eSignature for signing the Notification Of Compliance Status For Boiler Tune Ups Form in Gmail

How to make an eSignature for the Notification Of Compliance Status For Boiler Tune Ups Form from your mobile device

How to create an eSignature for the Notification Of Compliance Status For Boiler Tune Ups Form on iOS

How to generate an electronic signature for the Notification Of Compliance Status For Boiler Tune Ups Form on Android

People also ask

-

What is the Notification Of Compliance Status For Boiler Tune Ups Form?

The Notification Of Compliance Status For Boiler Tune Ups Form is a crucial document that verifies compliance with local regulations regarding boiler maintenance. This form ensures that your boiler has undergone the necessary tune-ups and is operating efficiently. Using airSlate SignNow, you can easily create, send, and eSign this form to maintain compliance and keep your operations running smoothly.

-

How can airSlate SignNow help with the Notification Of Compliance Status For Boiler Tune Ups Form?

airSlate SignNow streamlines the process of managing the Notification Of Compliance Status For Boiler Tune Ups Form by providing a user-friendly platform for creating and signing documents. You can customize the form to suit your specific needs, send it to team members or clients for eSignature, and store it securely. This efficiency helps ensure you meet compliance deadlines with ease.

-

Is there a cost associated with using airSlate SignNow for the Notification Of Compliance Status For Boiler Tune Ups Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for managing the Notification Of Compliance Status For Boiler Tune Ups Form. You can choose a plan that fits your budget while benefiting from our comprehensive features. We also provide a free trial so you can explore our services before committing.

-

What features does airSlate SignNow offer for the Notification Of Compliance Status For Boiler Tune Ups Form?

airSlate SignNow provides several features to enhance your experience with the Notification Of Compliance Status For Boiler Tune Ups Form. These include customizable templates, secure eSignature capabilities, automated workflows, and real-time tracking of document status. These features ensure that your compliance documentation is handled efficiently and effectively.

-

Can I integrate airSlate SignNow with other software for the Notification Of Compliance Status For Boiler Tune Ups Form?

Absolutely! airSlate SignNow offers seamless integrations with a variety of software applications, making it easy to incorporate the Notification Of Compliance Status For Boiler Tune Ups Form into your existing workflows. Whether you use CRM systems, project management tools, or other document management platforms, our integrations will enhance your operational efficiency.

-

How does airSlate SignNow ensure the security of the Notification Of Compliance Status For Boiler Tune Ups Form?

The security of your documents, including the Notification Of Compliance Status For Boiler Tune Ups Form, is a top priority at airSlate SignNow. We implement industry-standard encryption and secure access controls to protect your data. Additionally, our platform complies with legal standards to ensure that your signed documents are valid and secure.

-

What are the benefits of using airSlate SignNow for the Notification Of Compliance Status For Boiler Tune Ups Form?

Using airSlate SignNow for the Notification Of Compliance Status For Boiler Tune Ups Form offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance management. The ability to eSign documents quickly and store them securely in the cloud saves time and resources, allowing you to focus on your core business activities.

Get more for Notification Of Compliance Status For Boiler Tune Ups Form

- Invoice rental agreement of liability hold harmless form

- Contractor lease form

- Horse lease agreement form

- Rental agreement vintage party props form

- Arai approved list speed governor form

- Cc affordable management application form

- Disputemgmt maybank service form

- Referee bstatementb education queensland education qld gov form

Find out other Notification Of Compliance Status For Boiler Tune Ups Form

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed