Prepare California Adjustment Instruction Form

What is the Prepare California Adjustment Instruction Form

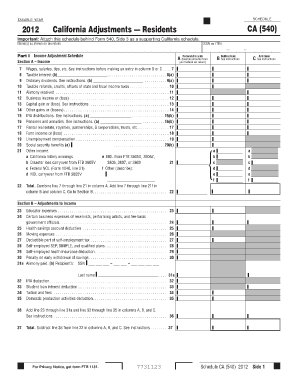

The Prepare California Adjustment Instruction Form is a crucial document used by taxpayers in California to report adjustments to their income or tax liability. This form is typically utilized when individuals need to amend their state tax returns or correct errors in previous submissions. It serves as a formal request to the California Franchise Tax Board (FTB) to review and adjust tax calculations based on updated information or changes in circumstances.

How to use the Prepare California Adjustment Instruction Form

Using the Prepare California Adjustment Instruction Form involves several key steps. First, gather all relevant financial documents, including previous tax returns and any supporting documentation that justifies the adjustments. Next, accurately fill out the form, ensuring that all information is complete and correct. After completing the form, review it thoroughly to avoid any mistakes. Finally, submit the form to the California FTB through the designated submission method, whether online, by mail, or in person.

Steps to complete the Prepare California Adjustment Instruction Form

Completing the Prepare California Adjustment Instruction Form requires careful attention to detail. Follow these steps:

- Gather necessary documents, including prior tax returns and any relevant financial records.

- Fill out the form with accurate information, including your name, address, and Social Security number.

- Detail the specific adjustments you are requesting and provide explanations for each adjustment.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Prepare California Adjustment Instruction Form

The legal use of the Prepare California Adjustment Instruction Form is governed by state tax laws and regulations. It is essential to ensure that the form is filled out correctly and submitted within the appropriate time frame to avoid penalties. The form must be used in compliance with California tax laws, and any adjustments made should be supported by adequate documentation to substantiate the claims made.

Filing Deadlines / Important Dates

Filing deadlines for the Prepare California Adjustment Instruction Form are critical to ensure compliance with state tax regulations. Generally, taxpayers should submit the form within a specific period following the original tax return due date. It is advisable to check the California FTB website for the most current deadlines and any changes that may affect the filing process. Missing these deadlines could result in penalties or delays in processing adjustments.

Required Documents

When completing the Prepare California Adjustment Instruction Form, several documents are typically required to support your adjustments. These may include:

- Copies of previous tax returns.

- W-2 forms or 1099 statements.

- Documentation of any deductions or credits claimed.

- Any correspondence from the California FTB regarding previous filings.

Form Submission Methods (Online / Mail / In-Person)

The Prepare California Adjustment Instruction Form can be submitted through various methods. Taxpayers may choose to file online using the California FTB’s e-filing system, which offers a convenient and efficient way to submit forms. Alternatively, the form can be mailed to the appropriate address provided by the FTB or delivered in person at designated tax offices. Each method has its own processing times, so it is important to select the one that best meets your needs.

Quick guide on how to complete prepare california adjustment instruction form

Effortlessly Prepare Prepare California Adjustment Instruction Form on Any Device

The management of online documents has gained traction among organizations and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Prepare California Adjustment Instruction Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Prepare California Adjustment Instruction Form with ease

- Find Prepare California Adjustment Instruction Form and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from any device you prefer. Modify and eSign Prepare California Adjustment Instruction Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the prepare california adjustment instruction form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California Adjustment Instruction Form?

The California Adjustment Instruction Form is a document used to report adjustments to your income tax return. To effectively prepare the California Adjustment Instruction Form, you need to ensure you have all relevant financial documents and calculations on hand. This form helps in correcting any discrepancies in your previously filed tax returns.

-

How can I prepare the California Adjustment Instruction Form electronically?

You can easily prepare the California Adjustment Instruction Form electronically using airSlate SignNow. Our platform provides a user-friendly interface to input data and manage documents. By utilizing airSlate SignNow, you can streamline the preparation process and stay organized.

-

Is there a cost associated with preparing the California Adjustment Instruction Form using airSlate SignNow?

Yes, airSlate SignNow offers competitive pricing for preparing the California Adjustment Instruction Form. We have various subscription plans that cater to individual needs and business requirements, ensuring you only pay for the features you use. Check our pricing page to find the best plan for you.

-

What features does airSlate SignNow offer for preparing the California Adjustment Instruction Form?

airSlate SignNow provides several features to help you prepare the California Adjustment Instruction Form efficiently. These features include customizable templates, e-signature capabilities, and document tracking. With these tools, you can ensure your forms are completed accurately and securely.

-

Are there integrations available to assist in preparing the California Adjustment Instruction Form?

Yes, airSlate SignNow integrates with various applications to streamline the preparation of the California Adjustment Instruction Form. You can connect with CRM systems, cloud storage services, and other productivity tools to enhance your workflow. This integration capability makes document management seamless and efficient.

-

What are the benefits of using airSlate SignNow for the California Adjustment Instruction Form?

Using airSlate SignNow to prepare the California Adjustment Instruction Form offers several benefits. Not only does our platform save you time with its intuitive interface, but it also increases accuracy by reducing manual errors. Additionally, you can electronically sign and send documents securely, ensuring your information is protected.

-

Is it safe to prepare the California Adjustment Instruction Form with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the safety and privacy of your documents. We implement advanced security measures, such as encryption and secure access, to protect the information you use while preparing the California Adjustment Instruction Form. Your data's safety is our top priority.

Get more for Prepare California Adjustment Instruction Form

- Ebook monthly bill payment tracker 5ih8x7rtolls cf form

- Child care enrollment cfs 0062 form

- Post traumatic stress disorder ptsd intake form nvlsp online

- Omega psi phi membership selection process form

- Parent teacher conference report form

- Student disclosure and approval of participation sit study form

- Alaska native executive leadership program financial form

- For enrollment services division only registrar gsu edu form

Find out other Prepare California Adjustment Instruction Form

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now