62a500 Form

What is the 62a500?

The Kentucky personal property tax form, known as the 62a500, is a crucial document used by individuals and businesses to report tangible personal property for tax purposes. This form is essential for accurately assessing property tax obligations in Kentucky. It encompasses various types of personal property, including machinery, equipment, and inventory. Understanding the 62a500 is vital for ensuring compliance with state tax laws and avoiding potential penalties.

How to complete the 62a500

Filling out the Kentucky personal property tax form 62a500 involves several key steps. First, gather all necessary information regarding your personal property, including descriptions, values, and acquisition dates. Next, carefully fill out each section of the form, ensuring that all details are accurate and complete. Pay special attention to the valuation of your property, as this will directly affect your tax liability. After completing the form, review it for any errors or omissions before submission.

Filing Deadlines / Important Dates

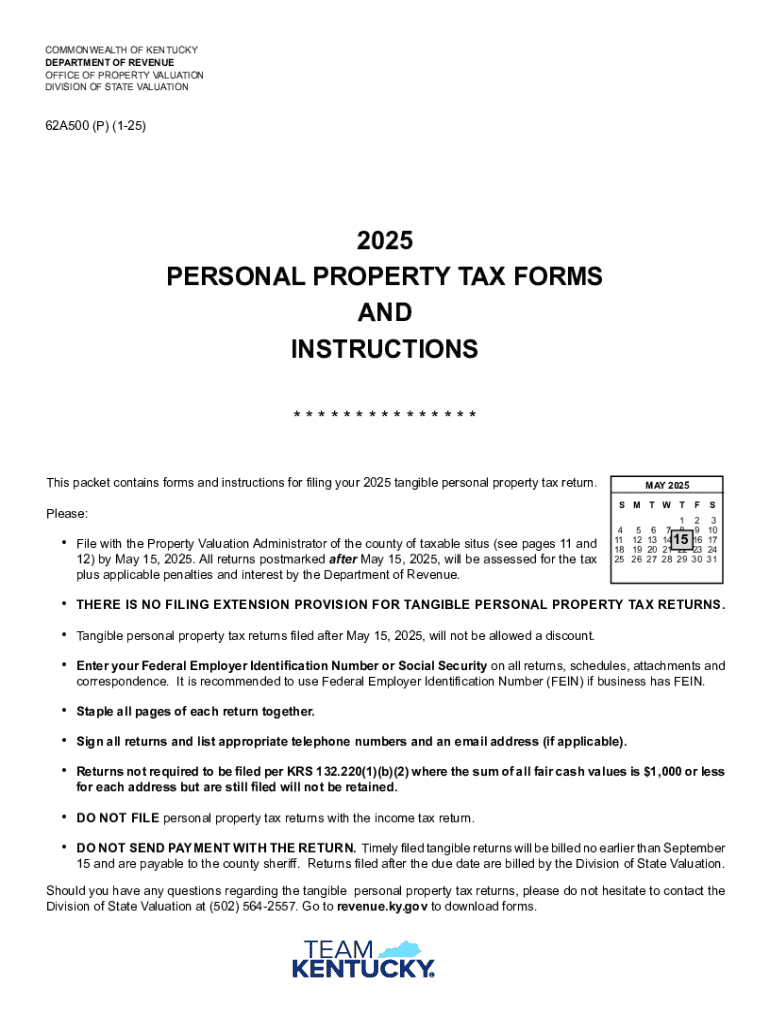

Timely submission of the 62a500 is essential to avoid penalties. The deadline for filing the Kentucky personal property tax form typically falls on May 15 each year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important to stay informed about any changes to these dates, as they can vary from year to year. Mark your calendar to ensure that you meet all filing requirements on time.

Form Submission Methods

The 62a500 can be submitted through various methods, providing flexibility for taxpayers. You can file the form online through the Kentucky Department of Revenue's website, which offers a streamlined process for electronic submission. Alternatively, you may choose to mail a paper copy of the completed form to your local property valuation administrator. In-person submissions are also accepted at designated offices. Be sure to keep a copy of your submission for your records, regardless of the method chosen.

Required Documents

When completing the Kentucky personal property tax form 62a500, certain documents may be required to substantiate your claims. These may include purchase invoices, receipts, or appraisals for your personal property. Having these documents ready will facilitate the completion of the form and ensure that you provide accurate information. Additionally, maintaining organized records can help in case of audits or inquiries from the tax authorities.

Key elements of the 62a500

The 62a500 form consists of several key sections that must be completed accurately. These include the taxpayer's name, address, and identification number, as well as detailed descriptions of the personal property being reported. Each item must be listed with its corresponding value, which is essential for calculating the total tax owed. Understanding these key elements will help ensure that the form is filled out correctly and in compliance with state regulations.

Legal use of the 62a500

The legal use of the Kentucky personal property tax form 62a500 is governed by state tax laws. Filing this form is mandatory for individuals and businesses that own tangible personal property in Kentucky. Failure to file can result in penalties, including fines and interest on unpaid taxes. It is important to understand your legal obligations regarding this form to avoid any issues with the Kentucky Department of Revenue.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 62a500

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kentucky personal property tax form?

The Kentucky personal property tax form is a document required by the state of Kentucky for reporting personal property owned by individuals and businesses. This form helps ensure that property is accurately assessed for tax purposes. Completing this form is essential for compliance with state tax laws.

-

How can airSlate SignNow help with the Kentucky personal property tax form?

airSlate SignNow provides an efficient platform for electronically signing and sending the Kentucky personal property tax form. Our solution simplifies the process, allowing users to complete and submit their forms quickly and securely. This saves time and reduces the hassle of traditional paperwork.

-

Is there a cost associated with using airSlate SignNow for the Kentucky personal property tax form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for individuals and businesses. Our plans are designed to be cost-effective, ensuring that you can manage your Kentucky personal property tax form without breaking the bank. You can choose a plan that best fits your usage requirements.

-

What features does airSlate SignNow offer for managing the Kentucky personal property tax form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of the Kentucky personal property tax form. These features streamline the process, making it easier to fill out and submit your forms accurately. Additionally, our platform ensures that your documents are stored securely.

-

Can I integrate airSlate SignNow with other software for the Kentucky personal property tax form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage your Kentucky personal property tax form alongside your other business tools. This integration capability enhances workflow efficiency and ensures that all your documents are easily accessible.

-

What are the benefits of using airSlate SignNow for the Kentucky personal property tax form?

Using airSlate SignNow for the Kentucky personal property tax form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and sign documents from anywhere, making it convenient for busy professionals. Additionally, the electronic process minimizes the risk of errors and delays.

-

How secure is airSlate SignNow when handling the Kentucky personal property tax form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your Kentucky personal property tax form and other sensitive documents. Our platform complies with industry standards, ensuring that your information remains confidential and secure throughout the signing process.

Get more for 62a500

- Maryland limited liability company llc formation package maryland

- Maryland llc 497310120 form

- Md llc form

- Maryland pllc form

- Maryland disclaimer 497310123 form

- Maryland notice lien 497310125 form

- Quitclaim deed from individual to husband and wife maryland form

- Warranty deed from individual to husband and wife maryland form

Find out other 62a500

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer