Blank Truth in Lending Form

What is the Blank Truth In Lending Form

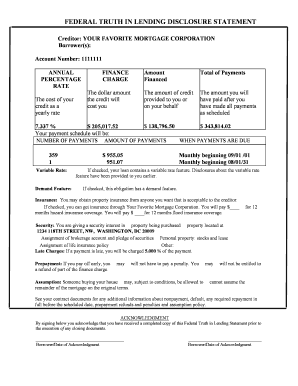

The Blank Truth In Lending Form is a standardized document used in the United States to disclose important information about the terms and costs associated with a loan. This form is designed to help borrowers understand the financial implications of their loan agreements, ensuring transparency and informed decision-making. It typically includes details such as the annual percentage rate (APR), finance charges, total payments, and the payment schedule. By providing this information, lenders comply with federal regulations aimed at protecting consumers in the lending process.

How to Use the Blank Truth In Lending Form

Using the Blank Truth In Lending Form involves several straightforward steps. First, gather all relevant information about the loan, including the loan amount, interest rate, and repayment terms. Next, fill out the form accurately, ensuring that all required fields are completed. It is essential to review the information for correctness, as inaccuracies can lead to misunderstandings. Once the form is completed, it should be provided to the borrower, who can then review the terms before signing. This process promotes clarity and helps prevent disputes regarding loan terms.

Steps to Complete the Blank Truth In Lending Form

Completing the Blank Truth In Lending Form involves a series of methodical steps:

- Gather necessary loan information, including the loan amount and interest rate.

- Fill out the borrower’s details, including name and contact information.

- Provide detailed loan terms, such as the APR and finance charges.

- Include the payment schedule, outlining the amount and frequency of payments.

- Review the completed form for accuracy and completeness.

- Present the form to the borrower for review and signature.

Key Elements of the Blank Truth In Lending Form

Several key elements must be included in the Blank Truth In Lending Form to ensure it meets regulatory requirements:

- Annual Percentage Rate (APR): This represents the total cost of borrowing expressed as a yearly interest rate.

- Finance Charges: The total amount of interest and fees charged over the life of the loan.

- Total Payments: The total amount the borrower will pay over the life of the loan, including principal and interest.

- Payment Schedule: A detailed outline of when payments are due and the amount of each payment.

- Prepayment Penalties: Information regarding any fees for paying off the loan early.

Legal Use of the Blank Truth In Lending Form

The Blank Truth In Lending Form is legally binding when completed and signed correctly. It must comply with the Truth in Lending Act (TILA), which mandates that lenders provide clear and conspicuous disclosures about loan terms. To ensure legal validity, the form should be filled out accurately, and both parties should retain copies for their records. This adherence to legal standards helps protect consumers and promotes fair lending practices.

Examples of Using the Blank Truth In Lending Form

Common scenarios for using the Blank Truth In Lending Form include:

- Personal loans for home improvements, where borrowers need to understand the total costs involved.

- Auto loans, allowing buyers to assess the financial impact of their financing options.

- Mortgage applications, ensuring that potential homeowners are aware of their long-term financial commitments.

In each case, the form serves as a crucial tool for transparency and informed decision-making.

Quick guide on how to complete blank truth in lending form

Effortlessly Prepare Blank Truth In Lending Form on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly and without hassle. Manage Blank Truth In Lending Form on any platform with airSlate SignNow's Android or iOS applications and enhance your document-centric workflow today.

How to Edit and Electronically Sign Blank Truth In Lending Form with Ease

- Obtain Blank Truth In Lending Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Blank Truth In Lending Form to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the blank truth in lending form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a lending form template and how can it benefit my business?

A lending form template is a pre-designed document that streamlines the loan application process. By using this template, businesses can ensure consistent formatting and necessary fields, which leads to quicker processing times. This efficiency not only improves customer experience but also reduces the risk of errors in documentation.

-

Can I customize the lending form template to fit my branding?

Yes, with airSlate SignNow, you can easily customize the lending form template to align with your company’s branding. You can add your logo, choose specific colors, and adjust formatting options. This customization helps maintain your brand's identity and provides a professional appearance to your documents.

-

What features are included with the lending form template?

The lending form template comes equipped with essential features such as customizable fields, e-signature capabilities, and automated workflow processes. These features simplify the loan application process and enhance efficiency. Additionally, users can track the status of documents in real-time.

-

How does the lending form template integrate with other software?

The lending form template offered by airSlate SignNow integrates seamlessly with various CRMs and third-party applications. You can connect it with tools like Salesforce, Google Drive, and others to streamline your operations. This integration allows for improved data management and helps maintain a smooth workflow.

-

Is there a free trial available for the lending form template?

Yes, airSlate SignNow offers a free trial for users to explore the features of the lending form template. This trial allows you to assess its functionalities and how it fits your business needs without any commitment. It’s a great way to experience the benefits firsthand before making a purchase.

-

What are the pricing options for using the lending form template?

The pricing for the lending form template varies based on the subscription plan chosen. airSlate SignNow provides flexible pricing tiers to accommodate different business sizes and needs. You will find affordable options that ensure you get the best value while benefiting from comprehensive features.

-

Can multiple users collaborate on the lending form template?

Absolutely! The lending form template allows multiple users to collaborate in real-time. This collaborative feature ensures that team members can work together efficiently, making necessary edits and providing input to enhance the loan application process. It fosters teamwork and improves overall productivity.

Get more for Blank Truth In Lending Form

- Motion to correct error indiana form

- Cornell notes unit 5 ecology chapter 13 the principles form

- International remittance form icbc com

- Fax number 860 255 3534 tunxis community college tunxis form

- Affidavitfinal pmd consumer complaint form

- Lawn care maintenance contract template form

- Lawn care service contract template form

- Lawn cutt contract template form

Find out other Blank Truth In Lending Form

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors