IRA Designation of Beneficiary Trading Direct Form

What is the IRA Designation Of Beneficiary Trading Direct

The IRA Designation of Beneficiary Trading Direct form is a crucial document that allows individuals to specify who will inherit their Individual Retirement Account (IRA) assets upon their passing. This form is essential for ensuring that the account holder's wishes are honored and that the assets are transferred smoothly to the designated beneficiaries. By clearly outlining the beneficiaries, account holders can avoid potential disputes and complications that may arise during the estate settlement process.

Steps to complete the IRA Designation Of Beneficiary Trading Direct

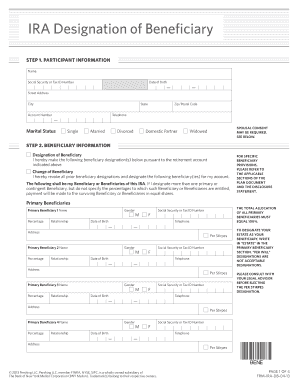

Completing the IRA Designation of Beneficiary Trading Direct form involves several important steps. First, individuals should gather necessary personal information, including their Social Security number and details about their IRA account. Next, they need to identify and provide information about the beneficiaries, which may include family members, friends, or charitable organizations. After filling out the required fields, it is important to review the form for accuracy before signing. Finally, the completed form should be submitted to the financial institution managing the IRA to ensure it is officially recorded.

Legal use of the IRA Designation Of Beneficiary Trading Direct

The legal use of the IRA Designation of Beneficiary Trading Direct form is governed by federal and state laws. It is essential that the form complies with the Employee Retirement Income Security Act (ERISA) and relevant state regulations to ensure its validity. Proper execution of the form, including signatures from both the account holder and witnesses if required, is necessary for the document to be legally binding. Additionally, it is advisable to keep a copy of the completed form for personal records and to inform beneficiaries of their designation.

Key elements of the IRA Designation Of Beneficiary Trading Direct

Several key elements must be included in the IRA Designation of Beneficiary Trading Direct form. These include the account holder's full name, Social Security number, and contact information. Beneficiary details should encompass their names, Social Security numbers, and relationship to the account holder. It is also important to specify the type of beneficiary designation, such as primary or contingent beneficiaries. Clear instructions regarding the distribution of assets among multiple beneficiaries should be provided, if applicable.

Examples of using the IRA Designation Of Beneficiary Trading Direct

Examples of using the IRA Designation of Beneficiary Trading Direct form can illustrate its importance. For instance, an individual may designate their spouse as the primary beneficiary, ensuring that they inherit the IRA assets directly. Alternatively, a person might choose to name multiple beneficiaries, such as children, specifying the percentage each will receive. In cases where a beneficiary predeceases the account holder, having a contingent beneficiary named on the form can ensure that the assets are still distributed according to the account holder's wishes.

Who Issues the Form

The IRA Designation of Beneficiary Trading Direct form is typically issued by the financial institution that manages the IRA account. This may include banks, brokerage firms, or other retirement plan providers. Each institution may have its own version of the form, so it is important for account holders to obtain the correct document directly from their IRA custodian to ensure compliance with specific requirements and regulations.

Quick guide on how to complete ira designation of beneficiary trading direct

Complete IRA Designation Of Beneficiary Trading Direct effortlessly on any device

Web-based document management has gained increased popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all necessary tools to create, edit, and eSign your documents swiftly without any delays. Manage IRA Designation Of Beneficiary Trading Direct on any platform using the airSlate SignNow Android or iOS applications and streamline any document-centered task today.

The easiest way to edit and eSign IRA Designation Of Beneficiary Trading Direct without hassle

- Locate IRA Designation Of Beneficiary Trading Direct and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and holds the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to finalize your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require reprinting document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Edit and eSign IRA Designation Of Beneficiary Trading Direct and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ira designation of beneficiary trading direct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRA Designation Of Beneficiary Trading Direct?

IRA Designation Of Beneficiary Trading Direct refers to the process of specifying beneficiaries for an Individual Retirement Account (IRA) while enabling direct trading. This ensures that the selected beneficiaries can access funds seamlessly, maximizing their financial benefits.

-

How does airSlate SignNow facilitate IRA Designation Of Beneficiary Trading Direct?

airSlate SignNow streamlines the process of designating beneficiaries for your IRA by providing user-friendly eSignature options. This makes it easy to manage and update beneficiary designations directly and securely within an integrated platform.

-

What are the benefits of using airSlate SignNow for IRA Designation Of Beneficiary Trading Direct?

Using airSlate SignNow for IRA Designation Of Beneficiary Trading Direct offers benefits such as enhanced security, easy document management, and efficient workflows. This ensures that your IRA designations are always up-to-date and accurately reflect your wishes.

-

Is there a cost associated with IRA Designation Of Beneficiary Trading Direct using airSlate SignNow?

Yes, airSlate SignNow operates on a subscription-based pricing model, allowing users to choose plans based on their needs. The cost-effective solution provides comprehensive tools for managing IRA Designation Of Beneficiary Trading Direct along with numerous other document management features.

-

Can I integrate airSlate SignNow with other financial tools for IRA Designation Of Beneficiary Trading Direct?

Absolutely! airSlate SignNow integrates seamlessly with various financial management tools, enhancing the process of IRA Designation Of Beneficiary Trading Direct. This integration streamlines workflows and ensures all your data remains interconnected.

-

Are there any limitations when designating beneficiaries directly via airSlate SignNow?

While airSlate SignNow simplifies the IRA Designation Of Beneficiary Trading Direct process, it's essential to check the specific regulations of your financial institution. Some institutions may have their requirements or forms, but SignNow can ensure you have access to digital signing options.

-

How secure is airSlate SignNow for handling IRA Designation Of Beneficiary Trading Direct?

Security is a top priority for airSlate SignNow. With bank-level encryption and secure authentication methods, users can confidently manage IRA Designation Of Beneficiary Trading Direct without worrying about unauthorized access.

Get more for IRA Designation Of Beneficiary Trading Direct

- Se acerca la fecha lmite de impuestos del 16 de octubre form

- Ea 120 form

- Petition neglected uncared for form

- Sale employee contract template form

- Sale for car contract template form

- Sale for real estate contract template form

- Sale for home contract template form

- Sale for used car contract template form

Find out other IRA Designation Of Beneficiary Trading Direct

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien