W9 Form

What is the W-9 Form

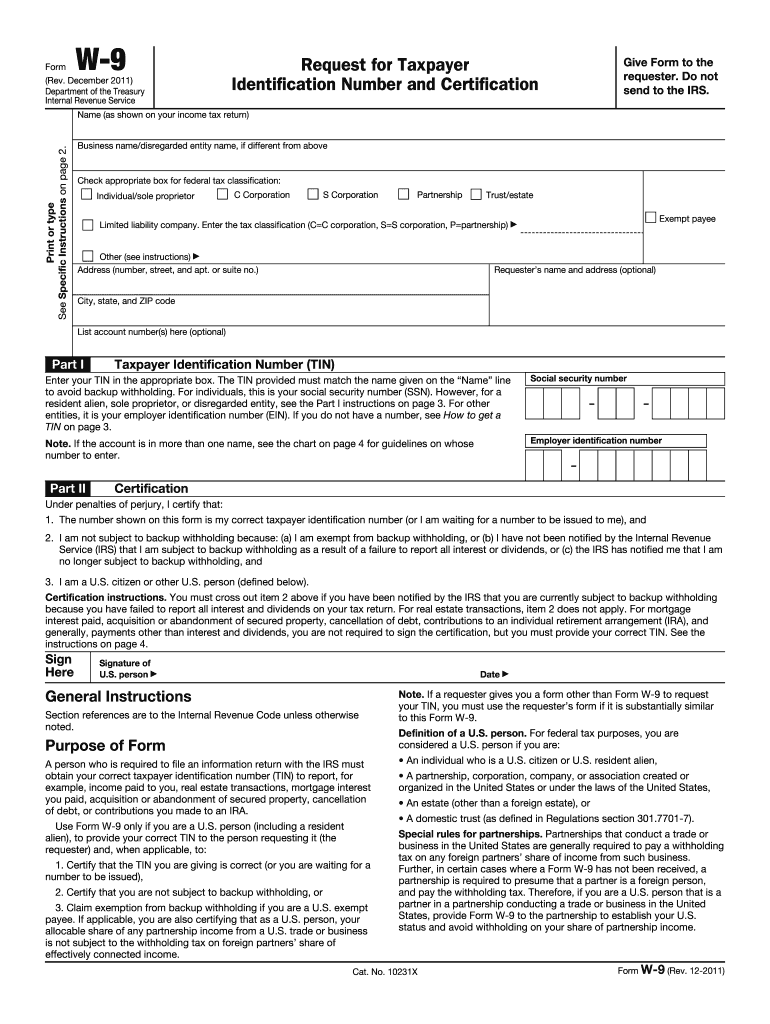

The W-9 Form, officially known as the Request for Taxpayer Identification Number and Certification, is a crucial document used in the United States for tax purposes. It is primarily utilized by businesses to obtain the Taxpayer Identification Number (TIN) of individuals or entities they are paying. This form is essential for independent contractors, freelancers, and other non-employees who receive income from a business. By providing accurate information on the W-9, the recipient ensures proper reporting to the IRS, facilitating tax compliance for both parties involved.

Steps to Complete the W-9 Form

Completing the W-9 Form involves several straightforward steps to ensure accuracy and compliance. Begin by entering your name as it appears on your tax return in the first box. If you are completing the form for a business entity, include the business name in the second box. Next, select the appropriate federal tax classification, such as individual/sole proprietor, corporation, or partnership. Then, provide your address, including city, state, and ZIP code. The final step is to enter your TIN, which can be your Social Security Number (SSN) or Employer Identification Number (EIN), and sign and date the form to certify its accuracy.

Legal Use of the W-9 Form

The W-9 Form serves a vital legal function by providing a means for businesses to collect necessary tax information from payees. When a business requests a W-9, it is typically for the purpose of reporting payments made to the IRS. The information provided on the W-9 must be accurate, as discrepancies can lead to penalties for both the payer and the payee. Moreover, the form is protected under various privacy laws, ensuring that the sensitive information it contains is handled securely.

How to Obtain the W-9 Form

Obtaining the W-9 Form is a simple process. The form is readily available on the IRS website, where it can be downloaded and printed. Additionally, many businesses may provide their own copies of the W-9 for their contractors and vendors. It is important to ensure that you are using the most current version of the form, as updates may occur that reflect changes in tax regulations.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of the W-9 Form. It is essential to follow these guidelines to avoid issues with tax reporting. The IRS requires that the W-9 be completed accurately and submitted upon request. Businesses are responsible for maintaining the W-9 forms they receive for a minimum of four years, as these documents may be needed for audits or other tax-related inquiries. Additionally, the IRS emphasizes the importance of safeguarding the information contained within the W-9 to prevent identity theft.

Form Submission Methods

The W-9 Form can be submitted through various methods, depending on the preferences of the requesting party. Typically, the completed form can be sent via email, fax, or traditional mail. When submitting electronically, it is crucial to ensure that the transmission is secure to protect sensitive information. If submitting by mail, consider using a traceable delivery method to confirm that the form has been received. Always retain a copy of the completed W-9 for your records.

Quick guide on how to complete form w 9 rev december 2014 irsgov irs

Accomplish W9 Form seamlessly on any gadget

Digital document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without interruptions. Manage W9 Form on any gadget using airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to modify and electronically sign W9 Form effortlessly

- Locate W9 Form and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to preserve your modifications.

- Choose how you wish to submit your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from your chosen device. Modify and electronically sign W9 Form while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

What is the IRS form W-10 and how is it correctly filled out?

While you may have never heard of IRS Form W-10, you will if you’re currently paying or planning to pay someone to care for a child, dependent, or spouse? If you are, then you may qualify to claim what’s called the Child and Dependent Care credit on your federal income tax return. To claim this credit, your care provider must fill out a W-10. You may also need to fill out the form if you receive benefits from an employer sponsored dependent care plan.It’s certainly worth it to see if you qualify (and for this we recommend that you consult with a tax professional). The child and dependent care credit can be up to 35 percent of qualifying expenses, depending on adjusted gross income. For 2011, filers may use up to $3,000 of expenses paid in a year for one qualifying individual or $6,000 for two or more qualifying individuals. (When it comes time to figure your qualifying expenses, remember that they must be reduced by the amount of any dependent care benefits provided by your employer, if those benefits were deducted or excluded from your income.)Do You Qualify for the Credit?To see if you need to have your care provider fill out a W-10, first determine if you qualify for the credit for child and dependent care expenses. To qualify, the care must have been provided for one or more qualifying persons, generally a dependent child age 12 or younger when the care was provided. Certain other individuals, spouses and those who are incapable of self-care, may also be considered qualifying persons. (Note: each qualifying individual must be listed on your tax return.)Remember also that the amount you can claim as a credit is reduced as your income rises. According to the Tax Policy Center, “Families with income below $15,000 qualify for the 35 percent credit. That rate falls by 1 percentage point for each additional $2,000 of income (or part thereof) until it signNowes 20 percent for families with income of $43,000 or more.”Next, consider why the care was provided. To qualify, the person (or couple, if married and filing jointly) claiming the credit must have sought care so they could work or search for employment. Further, the individual or couple filing must be considered earned income earners. Wages, salaries, tips, other taxable employee compensation, and net earnings from self-employment all qualify individuals as having earned income. For married filers, one spouse may be considered as having earned income if they were a full-time student, or if they were unable to care for themselves.Who did you pay for care? Qualifying funds spent for care cannot be paid to a filer’s spouse, a dependent of the filer, or to the filer’s child, unless that child will signNow age 19 or older by the end of the year. (The rule for payments to the filer’s child does not change, even if the child is not the filer’s dependent.) Filers must identify care providers on their tax return.There are just a few more qualifying details. To qualify, filing status must be single, married filing jointly, head of household or qualifying widow(er) with a dependent child. The qualifying person must have lived with the person filing for over one half of the year. There are exceptions, for the birth or death of a qualifying person, and for children of divorced or separated parents.IRS Form W-10So, if you meet those criteria, then its time to make sure your care provider fills out a W-10. The form is simple to fill out, requiring only the provider’s name, address, signature and taxpayer identification number (usually their social security number). The form is only for your records; details about the provider will come when you fill out form 2441 for Child and Dependent Care Expenses.Source: The Child and Dependent Care Credit and IRS W-10 Form

-

I made around $15,000 total from four different sources of W-9 work in 2014. I am not expecting to receive 1099 forms from any of these sources. Do I have to do anything for the IRS?

Are you asking what the IRS expects, or what you can get away with? The IRS expects you to file a return and declare all your income. You could absolutely get away with not filing, IN THE SHORT TERM. The IRS will not audit you this year for this year's tax return. But the long term is a different story. The IRS tends to audit 3 years after. This allows them a greater return for their effort. They can audit for three years at once, there will be more late fees and penalties. Not filing a tax return makes the long term even longer. The IRS Has only 3 years after the filing of a tax return to open an audit.AFTER THE TAX RETURN IS FILES. if you wait to file your 2014 taxes until 2017, the IRS would have til 2020 to open an audit. If you fail to file, you never close that window.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

I recently opened a Fidelity Roth IRA and it says my account is closed and I need to submit a W-9 form. Can anyone explain how this form relates to an IRA and why I need to fill it out?

Financial institutions are required to obtain tax ID numbers when opening an account, and the fact that it's an IRA doesn't exempt them from that requirement. They shouldn't have opened it without the W-9 in the first place, but apparently they did. So now they had to close it until they get the required documentation.

Create this form in 5 minutes!

How to create an eSignature for the form w 9 rev december 2014 irsgov irs

How to create an eSignature for your Form W 9 Rev December 2014 Irsgov Irs online

How to generate an electronic signature for your Form W 9 Rev December 2014 Irsgov Irs in Google Chrome

How to generate an eSignature for putting it on the Form W 9 Rev December 2014 Irsgov Irs in Gmail

How to generate an electronic signature for the Form W 9 Rev December 2014 Irsgov Irs right from your smart phone

How to make an electronic signature for the Form W 9 Rev December 2014 Irsgov Irs on iOS devices

How to make an electronic signature for the Form W 9 Rev December 2014 Irsgov Irs on Android

People also ask

-

What is airSlate SignNow and how does it relate to IRS Gove?

airSlate SignNow is an electronic signature platform that allows businesses to send and eSign documents seamlessly. It integrates with IRS Gove requirements, ensuring that your documents are compliant and securely signed, making it an essential tool for businesses dealing with IRS documentation.

-

How much does airSlate SignNow cost for IRS Gove compliance?

The pricing for airSlate SignNow is competitive and tailored for various business needs. Plans start at an affordable rate, making it a cost-effective solution for ensuring your document workflows meet IRS Gove standards without breaking the bank.

-

What features does airSlate SignNow offer for IRS Gove applications?

airSlate SignNow includes a range of features specifically designed to facilitate IRS Gove processes, such as customizable templates, automatic reminders, and advanced security options. These features help streamline your document signature processes, making compliance with IRS Gove requirements much simpler.

-

How does airSlate SignNow enhance workflow efficiency for IRS Gove documentation?

By utilizing airSlate SignNow, businesses can boost their workflow efficiency signNowly. The platform enables quick and easy eSigning of IRS Gove documents, reducing turnaround times and errors, and allowing teams to focus on their core responsibilities without delays.

-

Is airSlate SignNow compliant with IRS Gove security standards?

Yes, airSlate SignNow is designed with compliance in mind, ensuring that it meets all necessary IRS Gove security standards. Document encryption, audit trails, and secure storage are just a few of the features that make it a trusted solution for sensitive IRS-related documents.

-

Can airSlate SignNow integrate with other software for IRS Gove-related tasks?

Absolutely! airSlate SignNow offers seamless integration with a variety of popular software tools used in managing IRS Gove tasks. This means you can easily connect your existing systems to streamline your document workflows and improve overall productivity.

-

What are the main benefits of using airSlate SignNow for IRS Gove documentation?

The primary benefits of using airSlate SignNow for IRS Gove documentation include enhanced security, improved efficiency, and substantial time savings. By automating the signing process, businesses can effortlessly meet IRS Gove requirements, while reducing costs associated with paper documentation.

Get more for W9 Form

- Gaf form

- Girl cant dance quiz answers form

- Forms fillable file

- Ocfs transportation form

- Tulare county application for a birth certificate tularehhsa form

- Fatigue severity scale 264812937 form

- Puc formal complaint form office of consumer advocate puc pa

- Northwest territorieshealth care cardrenewal for form

Find out other W9 Form

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document