Tax Illinois Form

What is the Tax Illinois

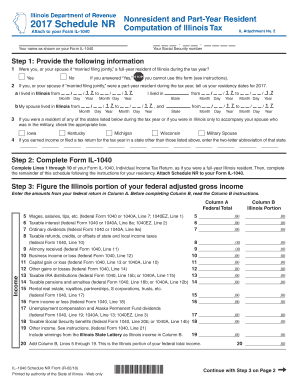

The Tax Illinois form is a crucial document used for reporting income and calculating tax obligations in the state of Illinois. It serves as a means for individuals and businesses to declare their earnings, claim deductions, and determine their tax liability. This form is essential for compliance with state tax laws and is typically required for annual income tax filings. Understanding its components and requirements is vital for accurate tax reporting.

Steps to complete the Tax Illinois

Completing the Tax Illinois form involves several key steps to ensure accuracy and compliance:

- Gather necessary documents: Collect all relevant financial records, including W-2s, 1099s, and any documentation for deductions or credits.

- Fill out personal information: Provide your name, address, and Social Security number as required on the form.

- Report income: Enter all sources of income, ensuring that you include both earned and unearned income.

- Claim deductions and credits: Identify and apply any eligible deductions or tax credits to reduce your taxable income.

- Calculate tax liability: Use the provided tax tables or software to determine the amount of tax owed or refund expected.

- Review and sign: Double-check all entries for accuracy, then sign and date the form before submission.

Legal use of the Tax Illinois

The legal use of the Tax Illinois form is governed by state tax regulations. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. It is essential to adhere to the rules set forth by the Illinois Department of Revenue to avoid penalties. Additionally, the form must be signed by the taxpayer or an authorized representative to ensure its legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Illinois form are critical for compliance. Typically, the form must be submitted by April 15 of each year for individual taxpayers. However, extensions may be available under certain circumstances. It is important to stay informed about any changes in deadlines, particularly during tax season, to avoid late fees or penalties.

Required Documents

To successfully complete the Tax Illinois form, several documents are necessary:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Records of tax credits claimed

- Previous year’s tax return for reference

Having these documents ready will streamline the process and help ensure that all information is accurately reported.

Examples of using the Tax Illinois

Examples of using the Tax Illinois form include:

- Individuals reporting wages from employment

- Freelancers declaring income from contract work

- Business owners calculating taxes on profits

- Claiming deductions for education expenses or medical costs

These scenarios illustrate the form's versatility and importance in various taxpayer situations.

Quick guide on how to complete tax illinois 100749509

Easily Prepare Tax Illinois on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent eco-conscious alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents promptly and without obstacles. Manage Tax Illinois on any platform with the airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

The Simplest Way to Modify and eSign Tax Illinois Effortlessly

- Obtain Tax Illinois and select Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize important sections of your documents or conceal sensitive information using the specialized tools provided by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a handwritten signature.

- Review the details and click on the Done button to save your updates.

- Decide how you want to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Illinois and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax illinois 100749509

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Tax Illinois?

airSlate SignNow is an electronic signature solution that allows businesses to send and eSign documents effortlessly. For those navigating Tax Illinois, it simplifies the process of signing tax-related documents, ensuring compliance and efficiency.

-

How does airSlate SignNow assist with Tax Illinois document management?

airSlate SignNow streamlines the document management process for Tax Illinois by offering secure cloud storage and easy access to signed tax documents. This helps users stay organized and ensures that all necessary documents are at their fingertips when needed.

-

What pricing plans are available for airSlate SignNow focused on Tax Illinois users?

airSlate SignNow offers various pricing tiers designed to accommodate different needs, including those related to Tax Illinois. This flexibility allows businesses of all sizes to find a suitable plan that fits their budget while gaining access to essential tax document features.

-

Are there any features in airSlate SignNow that specifically benefit Tax Illinois users?

Yes, airSlate SignNow includes features such as customizable templates, automated workflows, and in-person signing that greatly benefit users dealing with Tax Illinois documentation. These tools help streamline the eSigning process, reducing errors and saving time.

-

Can airSlate SignNow integrate with tax software relevant to Tax Illinois?

Absolutely! airSlate SignNow offers integration capabilities with various tax software solutions relevant to Tax Illinois, enhancing workflow efficiency. By synchronizing documents across platforms, users can manage their tax processes more effectively.

-

What security measures does airSlate SignNow implement for Tax Illinois documents?

airSlate SignNow prioritizes security with advanced measures such as encryption and compliance with industry regulations. This ensures that sensitive Tax Illinois documents are protected while being transmitted and stored securely.

-

How can I get support for using airSlate SignNow for Tax Illinois-related queries?

airSlate SignNow provides comprehensive customer support to assist users with any Tax Illinois-related queries. You can access resources such as a knowledge base, tutorials, and direct customer support to ensure your needs are met.

Get more for Tax Illinois

- Drainage manual county of santa clara sccgov form

- Commercial minor repair spec list form

- Preventative health care examination form ky

- Raksha tpa claim form 57337746

- Application to change a child39s name ontario ca forms ssb gov on

- Lowes accounts receivable application form

- External training request form

- Management fee contract template form

Find out other Tax Illinois

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple