W 9 Form PDF Labor Ready

What is the W-9 Form?

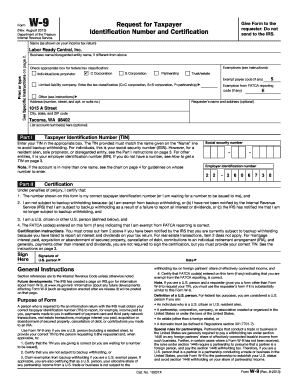

The W-9 form is an official document used in the United States by businesses and individuals to provide their taxpayer identification information. This form is essential for independent contractors, freelancers, and other non-employees who receive income from a business. The W-9 form collects information such as the name, address, and Social Security number or Employer Identification Number (EIN) of the individual or entity. This information is crucial for the payer to accurately report the payments made to the IRS.

How to Use the W-9 Form

The W-9 form is primarily used to furnish your taxpayer identification information to the entity that is paying you. When a business hires a contractor or freelancer, they will typically request a completed W-9 form to ensure they have the correct information for tax reporting. Once you fill out the form, you can submit it directly to the requester, not to the IRS. The requester will use the information provided on the W-9 to prepare the necessary tax documents, such as the 1099 form, at the end of the tax year.

Steps to Complete the W-9 Form

Completing the W-9 form involves a few straightforward steps:

- Download the form: Obtain the W-9 form from the IRS website or request it from the business that needs it.

- Fill in your information: Provide your name, business name (if applicable), and address. Indicate your taxpayer identification number, which can be your Social Security number or EIN.

- Choose your tax classification: Select the appropriate box that describes your tax status, such as individual, corporation, or partnership.

- Sign and date the form: Your signature certifies that the information provided is accurate and complete.

Legal Use of the W-9 Form

The W-9 form is a legally binding document that certifies the taxpayer identification information provided is correct. It is important for both the individual completing the form and the business requesting it to ensure the information is accurate to avoid potential legal issues. Misrepresenting information on the W-9 can lead to penalties, including fines or additional taxes owed. The form also serves as a safeguard for the payer, ensuring compliance with IRS regulations.

IRS Guidelines for the W-9 Form

The IRS provides specific guidelines regarding the use and submission of the W-9 form. It is important to keep the following points in mind:

- The W-9 form should only be submitted to the entity requesting it, not to the IRS.

- Individuals must ensure that their taxpayer identification number is accurate to avoid backup withholding.

- Keep a copy of the completed W-9 for your records, as it may be needed for future reference.

Penalties for Non-Compliance

Failure to provide a completed W-9 form when requested can result in backup withholding, where the payer must withhold a percentage of payments for tax purposes. Additionally, providing false information on the W-9 can lead to penalties, including fines and potential criminal charges. It is crucial to complete the form accurately and submit it promptly to avoid these consequences.

Quick guide on how to complete w 9 form pdf labor ready

Easily Prepare W 9 Form PDF Labor Ready on Any Device

Managing documents online has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle W 9 Form PDF Labor Ready on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Simplest Way to Modify and eSign W 9 Form PDF Labor Ready Effortlessly

- Locate W 9 Form PDF Labor Ready and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select how you wish to send your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, annoying form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign W 9 Form PDF Labor Ready and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 9 form pdf labor ready

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W 9 form and why do I need it?

A W 9 form is a tax document used in the United States by individuals and businesses to provide their taxpayer identification number to other entities, often for tax purposes. It's essential for freelancers, contractors, and other self-employed individuals to fill out a W 9 form when working with clients to ensure proper tax reporting.

-

How can airSlate SignNow help me with W 9 forms?

airSlate SignNow makes it easy to create, send, and eSign W 9 forms electronically. With our platform, you can streamline the process of collecting signatures and ensure your W 9 forms are stored securely and accessed effortlessly whenever needed.

-

Is there any cost associated with using airSlate SignNow for W 9 forms?

Yes, airSlate SignNow offers several pricing plans to cater to your needs, starting with a free trial to explore our features. This cost-effective solution includes features like eSigning and document storage, making it a great choice for managing W 9 forms.

-

Can I integrate airSlate SignNow with other applications for managing W 9 forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Microsoft Office, and more, allowing you to manage your W 9 forms efficiently. This integration enables easy access to your documents and helps streamline your workflow.

-

What are the benefits of using airSlate SignNow for eSigning W 9 forms?

Using airSlate SignNow for eSigning W 9 forms accelerates the signing process and eliminates the need for printing and scanning. It ensures that your W 9 forms are signed securely and quickly, allowing for faster processing and reducing administrative burdens.

-

Is my information secure when using airSlate SignNow for W 9 forms?

Yes, airSlate SignNow prioritizes the security of your documents and information. Our platform utilizes powerful encryption technology and complies with industry standards to ensure that your W 9 forms and personal data remain safe and confidential.

-

How do I send a W 9 form for signatures using airSlate SignNow?

To send a W 9 form for signatures using airSlate SignNow, simply upload the document, add the recipients' email addresses, and customize your message. Once sent, recipients will receive an email prompting them to eSign the W 9 form, making the process simple and efficient.

Get more for W 9 Form PDF Labor Ready

- Location stated above fid state nv form

- Specifications for electronic filing of forms 1097 1098 1099

- Research credit claims audit techniques guide rccatg form

- Annexi format of statutory auditors certificate s

- Resident dj contract template form

- Reseller contract template form

- Residential build contract template form

- Research assistant contract template form

Find out other W 9 Form PDF Labor Ready

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe

- Electronic signature Illinois Landlord tenant lease agreement Mobile

- Electronic signature Hawaii lease agreement Mobile

- How To Electronic signature Kansas lease agreement

- Electronic signature Michigan Landlord tenant lease agreement Now

- How Can I Electronic signature North Carolina Landlord tenant lease agreement

- Can I Electronic signature Vermont lease agreement

- Can I Electronic signature Michigan Lease agreement for house

- How To Electronic signature Wisconsin Landlord tenant lease agreement