Specifications for Electronic Filing of Forms 1097, 1098, 1099 2011

Understanding the Specifications for Electronic Filing of Forms 1097, 1098, 1099

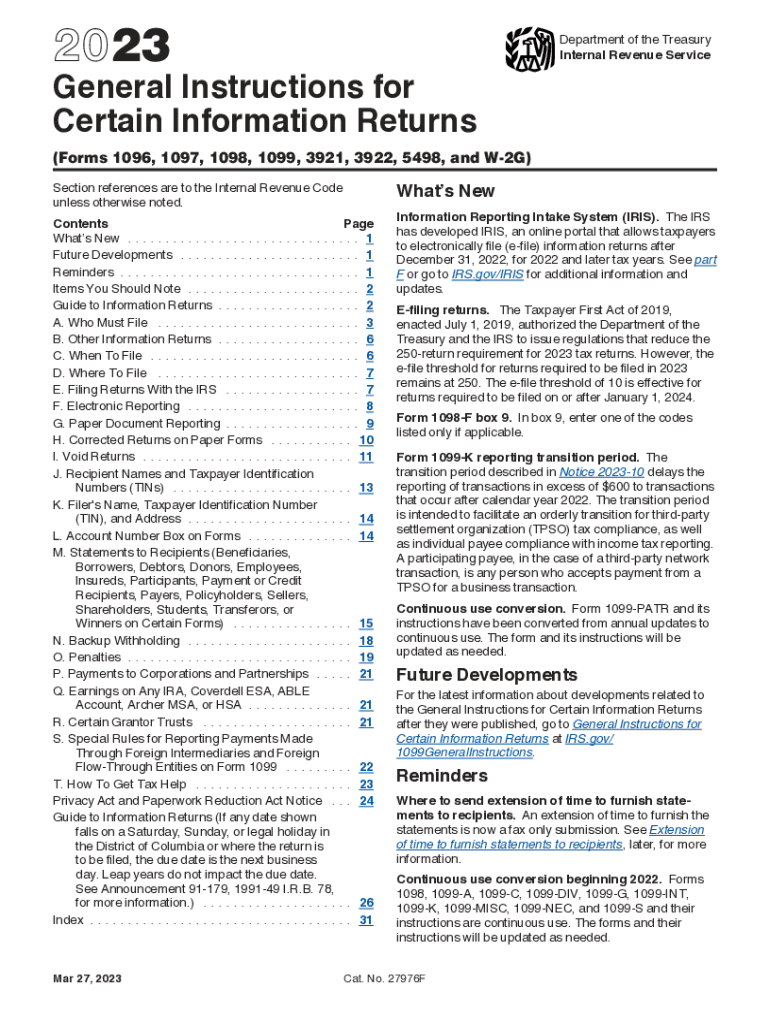

The Specifications for Electronic Filing of Forms 1097, 1098, and 1099 provide essential guidelines for businesses and individuals required to report various types of income and payments to the Internal Revenue Service (IRS). These forms are crucial for tax compliance, covering a range of reporting requirements such as interest income, mortgage interest, and miscellaneous income. By adhering to these specifications, filers can ensure accurate reporting and avoid potential penalties.

Steps to Complete the Specifications for Electronic Filing of Forms 1097, 1098, 1099

Completing the electronic filing process for Forms 1097, 1098, and 1099 involves several key steps:

- Gather necessary information, including taxpayer identification numbers (TINs), amounts to report, and relevant dates.

- Choose the appropriate form based on the type of income being reported.

- Ensure compliance with the IRS specifications, including formatting and data requirements.

- Utilize compatible software for electronic filing, which can simplify the process and reduce errors.

- Review all entries for accuracy before submission to avoid delays or penalties.

IRS Guidelines for Electronic Filing

The IRS has established specific guidelines for the electronic filing of Forms 1097, 1098, and 1099. These guidelines include:

- Mandatory electronic filing for businesses that file more than two forms.

- Requirements for file format, including XML or flat file formats.

- Deadlines for submission, which typically fall on January thirty-first for most forms.

- Instructions for correcting errors after submission, which may involve filing a corrected form.

Filing Deadlines and Important Dates

Timely filing is crucial for compliance with IRS regulations. Key deadlines include:

- January thirty-first: Deadline for submitting Forms 1097, 1098, and 1099 to recipients.

- March fifteenth: Deadline for electronic filing of Forms 1097, 1098, and 1099 with the IRS for most filers.

- Extended deadlines may apply for certain filers who request an extension.

Required Documents for Filing

To successfully file Forms 1097, 1098, and 1099 electronically, certain documents are necessary:

- Taxpayer identification numbers (TINs) for both the payer and recipient.

- Records of payments made throughout the tax year.

- Any supporting documentation related to the income being reported.

Penalties for Non-Compliance

Failure to comply with the specifications for electronic filing can result in significant penalties. These may include:

- Fines for late filing, which can increase based on the duration of the delay.

- Additional penalties for incorrect information or failure to provide necessary forms to recipients.

- Increased scrutiny from the IRS, leading to audits or further investigations.

Quick guide on how to complete specifications for electronic filing of forms 1097 1098 1099

Effortlessly prepare Specifications For Electronic Filing Of Forms 1097, 1098, 1099 on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without setbacks. Manage Specifications For Electronic Filing Of Forms 1097, 1098, 1099 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Specifications For Electronic Filing Of Forms 1097, 1098, 1099 seamlessly

- Find Specifications For Electronic Filing Of Forms 1097, 1098, 1099 and click Get Form to begin.

- Make use of the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to deliver your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassles of missing or misplaced documents, tedious search for forms, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Specifications For Electronic Filing Of Forms 1097, 1098, 1099 to ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct specifications for electronic filing of forms 1097 1098 1099

Create this form in 5 minutes!

How to create an eSignature for the specifications for electronic filing of forms 1097 1098 1099

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Specifications For Electronic Filing Of Forms 1097, 1098, 1099?

The Specifications For Electronic Filing Of Forms 1097, 1098, 1099 outline the necessary requirements for filing these forms electronically with the IRS. These specifications ensure compliance with federal regulations and help businesses avoid penalties. Understanding these specifications is crucial for smooth and efficient electronic filing.

-

How does airSlate SignNow facilitate the electronic filing of Forms 1097, 1098, 1099?

airSlate SignNow simplifies the electronic filing process by providing a user-friendly platform that complies with the Specifications For Electronic Filing Of Forms 1097, 1098, 1099. Users can easily create, send, and eSign documents while ensuring that all forms meet IRS guidelines. This efficiency helps businesses save time and reduce errors during the filing process.

-

What features does airSlate SignNow offer for electronic filing?

airSlate SignNow includes features like customizable templates, eSignature capabilities, and secure document storage, all designed to assist with the Specifications For Electronic Filing Of Forms 1097, 1098, 1099. Additionally, the platform offers integration with popular accounting software, enabling seamless data transfer and organization. These features enhance productivity and accuracy in form filing.

-

What is the pricing structure for using airSlate SignNow for electronic filing?

airSlate SignNow offers a variety of pricing plans to accommodate businesses of different sizes and needs. Each plan includes access to features tailored for compliance with the Specifications For Electronic Filing Of Forms 1097, 1098, 1099. To find the best plan for your business, you can explore their website and assess your specific requirements.

-

Can airSlate SignNow integrate with other software for filing forms?

Yes, airSlate SignNow can seamlessly integrate with various accounting and tax preparation software to enhance the electronic filing process. These integrations ensure that all data adheres to the Specifications For Electronic Filing Of Forms 1097, 1098, 1099, providing a streamlined experience for users. This flexibility allows businesses to choose tools that best fit their operational needs.

-

What are the benefits of using airSlate SignNow for electronic filing?

Using airSlate SignNow for electronic filing provides several benefits, including improved accuracy, reduced time spent on paperwork, and enhanced compliance with the Specifications For Electronic Filing Of Forms 1097, 1098, 1099. The user-friendly interface allows for quick onboarding and minimizes learning curves. These advantages help businesses focus more on their core operations and less on administrative tasks.

-

Is there customer support available for questions related to electronic filing?

Absolutely! airSlate SignNow provides comprehensive customer support to assist users with any queries about the electronic filing of Forms 1097, 1098, 1099. Their support team is knowledgeable about the Specifications For Electronic Filing Of Forms 1097, 1098, 1099 and can guide you through any challenges you may face during the filing process.

Get more for Specifications For Electronic Filing Of Forms 1097, 1098, 1099

- Redlined revised investment management agreement for qdias a0285529x9e0d7 a0291558 doc 12204a0291558 1font8 form

- Www plainsite orgattorneyspo box 1156oreilly automotive inc attorney plainsite org form

- Dealer credit application form

- Bellco dispute form

- Kubota commercial credit application 572028344 form

- Credit union dispute form

- Commercial credit application mcdaniels acura porsche form

- Debit card dispute form docx

Find out other Specifications For Electronic Filing Of Forms 1097, 1098, 1099

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document