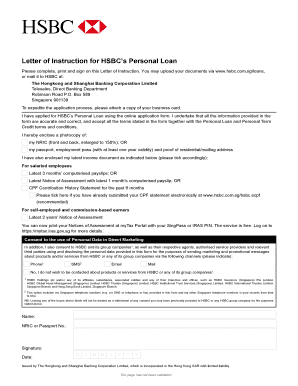

Letter of Instruction for HSBC's Personal Loan HSBC Singapore Form

Key elements of the letter for personal loan

The letter for a personal loan application, particularly with HSBC, must include several essential elements to ensure it is complete and meets the lender's requirements. These elements typically include:

- Borrower Information: Full name, address, and contact details of the applicant.

- Loan Amount Requested: Clearly state the amount of money being requested.

- Purpose of the Loan: A brief explanation of how the funds will be used.

- Employment and Income Details: Information about current employment, salary, and other income sources.

- Credit History: A brief overview of your credit history, including any existing debts.

- Signatures: The letter must be signed to authenticate the application.

Steps to complete the letter for personal loan

Completing the letter for a personal loan application involves a series of straightforward steps. Following these steps can help ensure that your application is thorough and clear:

- Gather necessary personal and financial information.

- Clearly outline the purpose of the loan and the amount requested.

- Provide details about your employment and income.

- Review your credit history and include relevant information.

- Draft the letter, ensuring all key elements are included.

- Proofread the letter for clarity and accuracy.

- Sign the letter to finalize your application.

Legal use of the letter for personal loan

The legal use of the letter for a personal loan application is crucial for ensuring that the document is recognized by the lender. To ensure legal validity, the letter must adhere to specific guidelines:

- The letter should be written in clear and concise language.

- It must include all necessary information as stipulated by the lender.

- Signatures must be obtained from all parties involved in the loan agreement.

- Compliance with local and federal regulations regarding loan applications is essential.

Eligibility criteria for personal loans

When applying for a personal loan, it is important to understand the eligibility criteria set by HSBC. Common criteria include:

- Minimum age requirement, typically eighteen years or older.

- Proof of stable income, which may include pay stubs or tax returns.

- A satisfactory credit score, which demonstrates creditworthiness.

- Residency status, confirming that the applicant is a U.S. citizen or permanent resident.

Application process and approval time

The application process for a personal loan with HSBC generally involves several key steps. Understanding this process can help manage expectations regarding approval times:

- Submit the completed letter for personal loan along with any required documentation.

- HSBC will review the application and assess the borrower's creditworthiness.

- Approval or denial will typically be communicated within a few business days.

- If approved, the borrower will receive an offer letter outlining the terms of the loan.

How to use the letter for personal loan

Using the letter for a personal loan application effectively can enhance the chances of approval. Here are some tips on how to use the letter:

- Ensure all information is accurate and up to date.

- Attach any required supporting documents, such as proof of income.

- Follow any specific submission guidelines provided by HSBC.

- Keep a copy of the letter for your records after submission.

Quick guide on how to complete letter of instruction for hsbcamp39s personal loan hsbc singapore

Complete Letter Of Instruction For HSBC's Personal Loan HSBC Singapore effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Letter Of Instruction For HSBC's Personal Loan HSBC Singapore across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Letter Of Instruction For HSBC's Personal Loan HSBC Singapore seamlessly

- Obtain Letter Of Instruction For HSBC's Personal Loan HSBC Singapore and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Select relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require you to print new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Letter Of Instruction For HSBC's Personal Loan HSBC Singapore and ensure seamless communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the letter of instruction for hsbcamp39s personal loan hsbc singapore

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a letter for personal loan, and why do I need it?

A letter for personal loan is a formal request that outlines your borrowing needs and financial situation. This document is essential as it communicates to lenders your intent and capability to repay the loan. It serves as your first step in the loan application process, establishing trust with potential lenders.

-

How does airSlate SignNow help with letters for personal loans?

airSlate SignNow streamlines the process of creating and signing letters for personal loans. With our easy-to-use platform, you can draft your letter quickly, obtain electronic signatures, and send it securely to your lender. This ensures that your application process is efficient and professional.

-

Is there a cost associated with using airSlate SignNow for my personal loan letter?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those who need to manage letters for personal loans regularly. Our plans are designed to be cost-effective, providing essential features at competitive rates. You can choose a plan that fits your budget and document volume.

-

What features does airSlate SignNow provide for creating personal loan letters?

airSlate SignNow offers a range of features to simplify the creation of a letter for personal loan. This includes customizable templates, easy document editing, and the ability to add fields for signatures, dates, or other necessary information. These tools enhance your letter's clarity and professionalism.

-

Can I integrate airSlate SignNow with other applications for my personal loan processes?

Absolutely! airSlate SignNow allows seamless integration with various applications such as Google Drive, Dropbox, and CRM tools. This means you can manage your letters for personal loans and organize your documents in one convenient location, enhancing your workflow and productivity.

-

How secure is my personal data when using airSlate SignNow for loan letters?

When using airSlate SignNow, your personal information is safeguarded with advanced security measures, including data encryption and secure access controls. We prioritize your privacy and ensure that all documents, including letters for personal loans, are securely stored and transmitted.

-

What is the benefit of using airSlate SignNow for eSigning my personal loan letter?

Using airSlate SignNow for eSigning your letter for personal loan provides numerous benefits, including speed, convenience, and legal validity. eSignatures are quick to obtain, eliminating the need for physical meetings or mail delays. Plus, they are recognized legally, ensuring your loan application is processed without hassle.

Get more for Letter Of Instruction For HSBC's Personal Loan HSBC Singapore

Find out other Letter Of Instruction For HSBC's Personal Loan HSBC Singapore

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure