Forms & Instructions 540 2EZ California Resident Income Tax Return 2024-2026

Understanding the 2024 California 540 2EZ Form

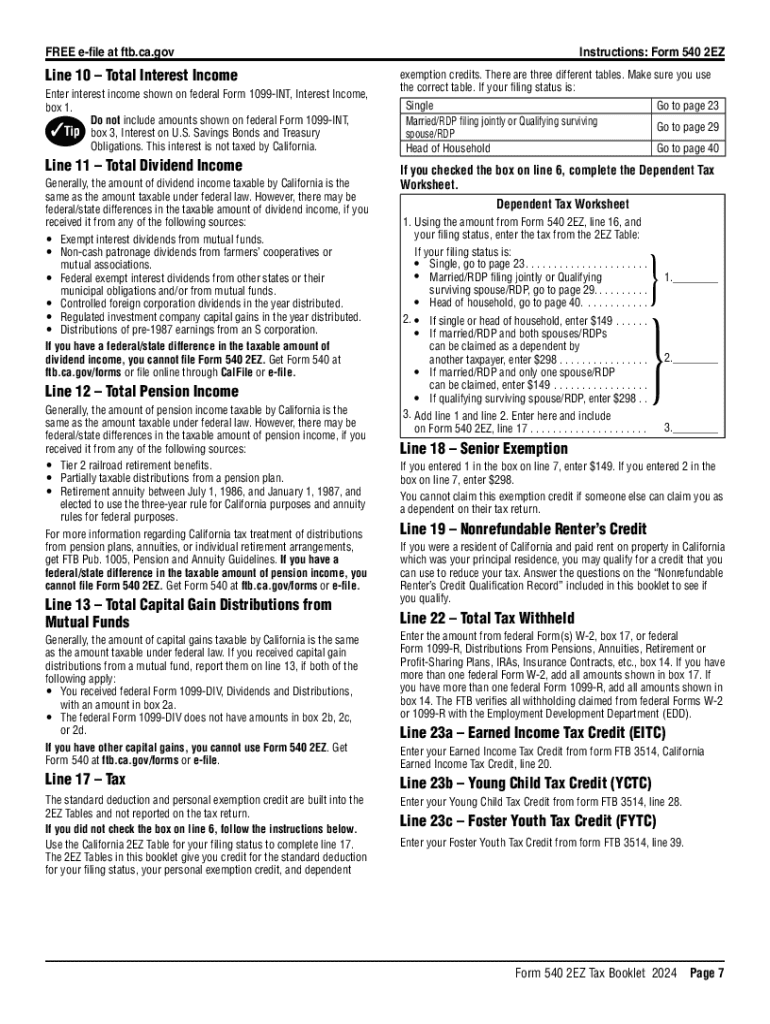

The 2024 California 540 2EZ form is a simplified tax return designed for California residents who meet specific criteria. This form allows eligible taxpayers to file their state income taxes efficiently, focusing on straightforward income and deductions. It is particularly beneficial for individuals with uncomplicated tax situations, such as single filers or married couples filing jointly, who do not have dependents and earn below a certain income threshold.

The 540 2EZ form streamlines the filing process by minimizing the number of calculations and forms required, making it accessible for those who may not have extensive tax knowledge. It is essential to ensure that you qualify for this form to avoid complications during the filing process.

Steps to Complete the 2024 California 540 2EZ Form

Completing the 2024 California 540 2EZ form involves several straightforward steps:

- Gather necessary documents, including your W-2s, 1099s, and any other income statements.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your income, ensuring you include all sources, such as wages, salaries, and interest.

- Claim any applicable deductions and credits, which can help reduce your taxable income.

- Calculate your total tax liability and determine if you owe additional taxes or are due a refund.

- Review your completed form for accuracy before submission.

Following these steps will help ensure that your tax return is filed correctly and efficiently.

Eligibility Criteria for the 2024 California 540 2EZ Form

To use the 2024 California 540 2EZ form, you must meet specific eligibility requirements:

- You must be a California resident for the entire tax year.

- Your filing status should be single or married filing jointly.

- Your total income must be below the threshold set for the tax year, which is subject to change annually.

- You should not claim any dependents.

- Your income should not include business income, capital gains, or rental income.

Confirming your eligibility before starting the form will help streamline the filing process and ensure compliance with state tax regulations.

Obtaining the 2024 California 540 2EZ Form

The 2024 California 540 2EZ form can be obtained through several convenient methods:

- Visit the California Franchise Tax Board's official website to download a printable version.

- Request a paper copy by contacting the Franchise Tax Board directly.

- Access the form through tax preparation software that supports California state tax filings.

Having the correct version of the form is crucial to ensure compliance with the latest tax regulations.

Form Submission Methods for the 2024 California 540 2EZ Form

There are multiple methods to submit the 2024 California 540 2EZ form:

- Online submission through the California Franchise Tax Board's e-file system, which is the fastest method.

- Mailing a paper copy of the completed form to the appropriate address provided in the instructions.

- In-person submission at designated tax offices, although this option may vary based on location.

Choosing the right submission method can help expedite the processing of your tax return and any potential refunds.

Create this form in 5 minutes or less

Find and fill out the correct forms ampamp instructions 540 2ez california resident income tax return

Create this form in 5 minutes!

How to create an eSignature for the forms ampamp instructions 540 2ez california resident income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 California 540 2EZ form?

The 2024 California 540 2EZ form is a simplified tax return designed for eligible California residents. It allows taxpayers to report their income and claim deductions in a straightforward manner. Using this form can help streamline the filing process and ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the 2024 California 540 2EZ form?

airSlate SignNow provides an efficient platform for electronically signing and sending the 2024 California 540 2EZ form. Our solution simplifies document management, allowing users to complete their tax forms quickly and securely. This ensures that your tax documents are processed without unnecessary delays.

-

Is there a cost associated with using airSlate SignNow for the 2024 California 540 2EZ form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage your documents, including the 2024 California 540 2EZ form, without breaking the bank. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for the 2024 California 540 2EZ form?

airSlate SignNow includes features such as eSignature capabilities, document templates, and secure cloud storage for the 2024 California 540 2EZ form. These tools enhance the user experience by making it easier to prepare, sign, and store important tax documents. Additionally, our platform is user-friendly and accessible from any device.

-

Can I integrate airSlate SignNow with other software for the 2024 California 540 2EZ form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the 2024 California 540 2EZ form alongside your existing tools. This flexibility allows you to streamline your workflow and enhance productivity by connecting with accounting software, CRMs, and more.

-

What are the benefits of using airSlate SignNow for tax documents like the 2024 California 540 2EZ form?

Using airSlate SignNow for tax documents such as the 2024 California 540 2EZ form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, minimizing the risk of loss or fraud. Additionally, the ease of use allows you to focus on your business rather than administrative tasks.

-

Is airSlate SignNow compliant with California tax regulations for the 2024 California 540 2EZ form?

Yes, airSlate SignNow is designed to comply with California tax regulations, ensuring that your use of the 2024 California 540 2EZ form meets all legal requirements. Our platform adheres to industry standards for security and data protection, giving you peace of mind when handling sensitive tax information.

Get more for Forms & Instructions 540 2EZ California Resident Income Tax Return

- City of fort smith form

- Written employment and education verification bformb

- Registered tow truck operator impounded vehicle hearing request file this request with the districtmunicipal court in the form

- Sublet room contract template form

- Sublet contract template form

- Sublet switzerland contract template form

- Sublett contract template form

- Submissive contract template form

Find out other Forms & Instructions 540 2EZ California Resident Income Tax Return

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form